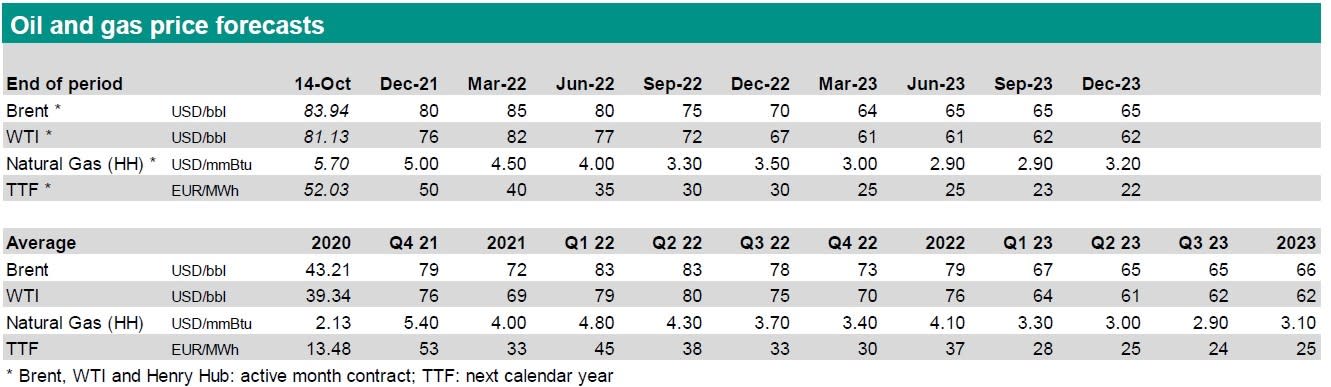

ABN Amro er sikker på, at de ekstremt høje energipriser, der både skyldes og bidrager til flaskehalsproblemerne, vil svække den økonomiske vækst, men de bliver dog ikke en trussel mod genopretningen efter pandemien. De høje energipriser er først og fremmest et kortvarigt problem, delvist selvforskyldt, fordi gaslagrene i Europa er lavere end de skulle være. De langsigtede gaskontrakter opererer med markant lavere priser end de nuværende. Men selv på længere sigt ventes gas- og oliepriser at ligge betydeligt over det normale niveau, og det gælder også el-priserne. ABN Amro venter en gaspris på EUR 30/MWh i slutningen af 2022 mod 90 euro i dag samt en oliepris på 70 dollar pr. tønde mod det halve for et år siden.

Will the energy squeeze threaten the recovery?

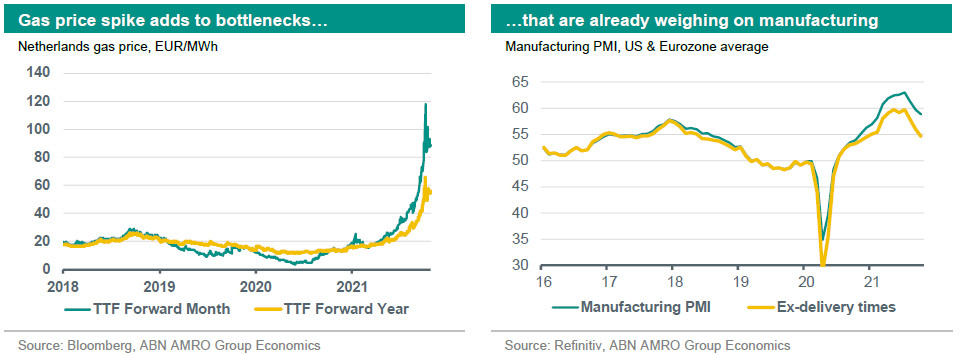

Soaring energy prices add fuel to fast-growing shortages that have already been inflationary. Consumers face both direct costs from heating bills, and price hikes as producers try to pass on their cost increases. However, government support is cushioning the blow. For producers, the risk of production outages is high in energy intensive sectors and in energy firms. Small firms are particularly vulnerable. In an economy already facing shortages, these production stops can have large knock-on effects.

We expect inflation to continue rising over the coming months. For 2022, we foresee bottlenecks slowly easing, and disinflationary forces re-emerging in the medium term

Regional updates (only in the pdf): we dive below the surface of recent inflation developments in the eurozone, while in the Netherlands, consumption and production faces new headwinds from the gas price rise

In the US, the delayed normalisation in consumption patterns means continued upside inflation risks

Growth slowed significantly in China in Q3, but policy easing should support a pickup in Q4

Global View: Will the energy squeeze threaten the recovery?

Supply chain bottlenecks have intensified further over the past month. Soaring energy prices are leaving consumers worried about upcoming energy bills as winter nears, while for firms, energy prices are yet another cost increase on top of already massive supply disruptions.

Could this render business models unprofitable and cause widespread production outages? Or, if firms pass on price hikes to consumers, could it throw the post-pandemic recovery off track?

In this month’s Global View we assess the extent to which energy price increases will spread through the economy and affect consumption and production going forward. We also look at the cushioning effect of both excess savings and government support on people’s ability to deal with these price rises.

Our take is that while in the short run a demand fallback is likely to be limited, the risks are largely with the supply side of the economy, with more inflation ahead in the coming months which could amplify demand fallbacks over the course of 2022. While this poses downside risks to our economic outlook, we continue to expect above trend growth in the eurozone and the US over the coming quarters.

Where are energy prices going?

In big picture terms, we expect upward pressure on energy prices to persist through the winter months, but for prices to fall back by the end of next year – albeit to levels significantly higher than a year ago.

For natural gas, the recent spike in prices was mostly in near-term contracts, with the month ahead contract in the Netherlands (TTF) briefly touching EUR 160/MWh, with it currently trading nearer to EUR 90/MWh. The price spike has come on the back of exceptionally low inventories heading into winter, and worries about whether supply would be sufficient in the event of a cold winter.

Longer term contracts (one year ahead) are trading at much lower levels, suggesting the market is more relaxed about supply-demand dynamics in the medium term, though at EUR 55/MWh, prices are still around 4x where they were this time last year. Once the winter is behind us, we expect year-ahead prices to ease, falling back to EUR 30/MWh by end-2022 – still double where they were this time last year, and 50% higher than our previous forecast.

We expect a similar pattern in oil and electricity prices over the coming year. Oil demand is likely to continue increasing, although we expect supply to pick up as well via increased OPEC+ production. This should help dampen prices in the course of 2022, but our forecast of USD $70/barrel (Brent) at end-2022 is still almost double the level of this time last year.

For electricity, prices are also elevated, due to shortfalls in renewables output and elevated prices of coal, gas, and carbon emissions permits (the EU ETS currently trades at around EUR 60/ton). Electricity prices at present are moving largely in line with gas prices, and there is a similar large difference between near-term contract price and the year ahead price. In tandem with gas, we expect electricity prices to ease once the winter is behind us, but to remain somewhat elevated given the high carbon price.