Gaspriserne er lettet en smule på det sidste, men risiciene på markedet er stadig store, og ABN Amro fastholder sin vurdering af, at gaspriserne vil være høje hele året. Banken tror også, at olieprisen forbliver høj. Gaslagrene i Europa er meget små, og den russiske gaseksport standsede næsten. Import af LNG-gas på skibe til Europa kan kompensere for faldet i den russiske gas, man da prisen på LNG i Asien er højere end i Europa, kan det føre til højere gaspriser i Europa. Hvis konflikten om Ukraine skærpes, kan det føre til sanktioner mod Nord Stream 2-gasledningen, og det vil forværre gasmarkedet i Europa. Der er en rimelig balance mellem olieproduktion og efterspørgsel, men nogle lande har produktionsvanskeligheder, og store pensionskasser er begyndt at trække deres investeringer ud af oliesektoren. Det kan pege på højere oliepriser inden for de næste fem år (omkring 80 dollar pr. tønde), men på længere sig venter ABN Amro en lavere oliepris på omkring 60 dollar pr. tønde.

High energy prices to stay for longer

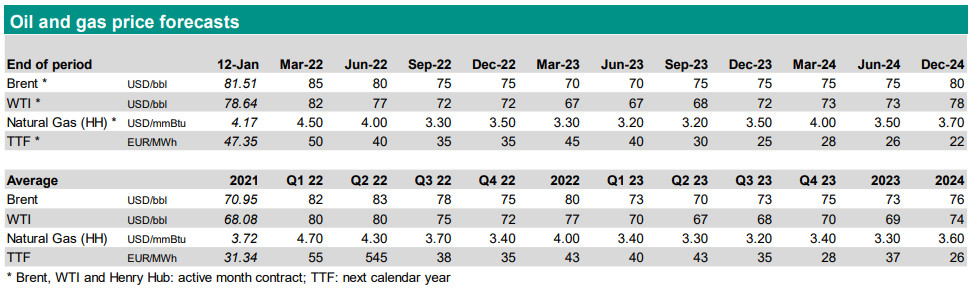

Gas prices have eased somewhat, but the near term risks will continue to dominate prices. ABN AMRO has raised our gas price forecasts: prices will remain relatively elevated for the remainder of the year. At the same time, OPEC+ will increase its oil production again with 400.000 barrels per day. That is, on paper. We see no changes with regards to our oil price forecasts in the near term. However, we do see upside price risks in the longer term.

Gas prices eased from mid-December onwards, but uncertainties remain

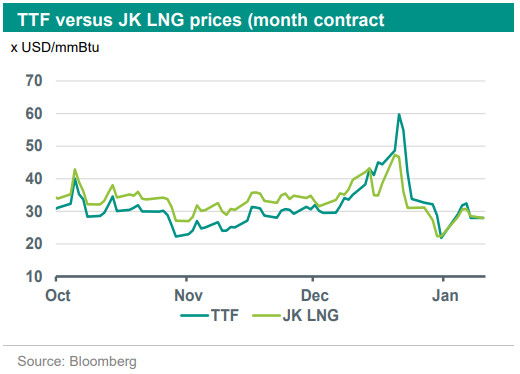

Just before the Holiday season, gas prices dropped significantly. From mid-December, the prices for Title Transfer Facility (TTF = Dutch gas benchmark) were trading higher than the prices for liquified natural gas in Asia (Japan/Korea LNG).

As a result, more LNG tankers started heading towards Europe. Some of these tankers were already heading towards Asia before they made a U-turn. Next to that, at New Year the first traded contract shifted from 2022 to 2023 (calendar year +1). This had a technical downward impact as market expectations for the gas prices for 2023 are lower than for 2022, given all the current uncertainties regarding European gas supply.

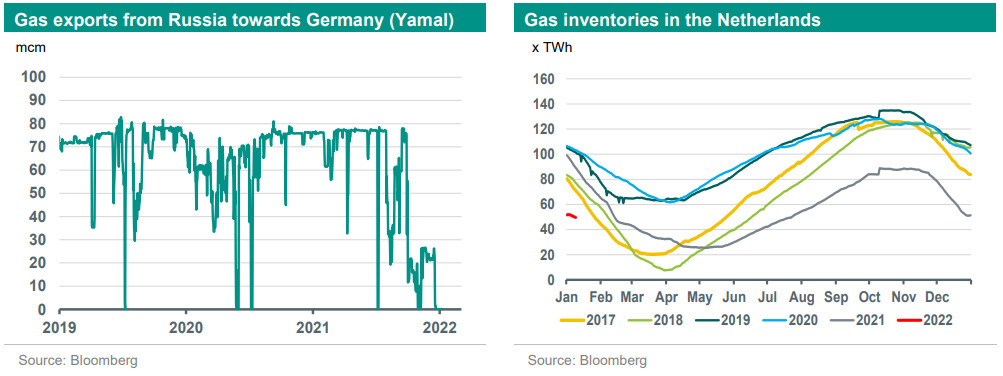

That European gas inventories are currently at very low levels for the time of the year is well known by now. On top of that, Russian gas exports towards Europe almost came to a halt (see figure on the next page of exports via the Yamal pipeline). For extra gas imports, Europe is depending on either extra natural gas from Russia or – via LNG – from countries like the US, Australia or Qatar.

On the 7th of January, Asian LNG prices were trading above the TTF prices again. The question is whether this will remain. If so, it will be interesting to see if the non-contracted LNG will continue to be shipped towards Europe, or whether the higher Asian prices would trigger another U-turn. It would mean that most of the non-contracted LNG would end up in Asia – mainly China – once more, adding more pressure to the already constrained European gas inventories.

Gas price forecasts revised upwards

The direction of gas prices will be strongly dependent on the weather conditions during the coming months. On top of that, the tense geopolitical situation with regards to Russia and Ukraine will continue to be closely monitored by the financial markets.

In case of an escalation, the chance of NordStream 2 becoming available in the course of the year would be slim. Also the risk emerges that Russia will continue to depress the gas deliveries towards Europe and will (probably) only stick to the existing – and declining number of – gas delivery contracts.

However, also without an escalation gas markets will remain tense. The low level of gas inventories and the difficulties to raise the gas imports will keep gas prices higher for longer. Not only would gas inventories be at extremely low levels at the end of this winter, it will also be difficult to replenish them before the next winter will start (2022-2023).

After the new German government indicated that possibly NordStream 2 will not become operational at all, we observed a significant jump of future gas prices in the forward curve (series of prices for gas delivery in the future). While initially only gas prices with delivery up to March 2022 were highly elevated, now prices up to and including March 2023 are trading significantly higher than the rest of the curve. This indicates that the market has limited confidence that the gas shortages will be gone before next winter.

We have lifted our TTF gas price forecasts. Especially the prices during the winter periods are revised higher significantly. For the first quarter of 2022 we expect an average price of EUR 50/MWh (was EUR 40/MWh). We assume that it will be an average winter and that there will be no escalations regarding the situation with Russia. In case of such an escalation and/or a harsh winter (in Europe and/or in Asia) gas prices can be temporarily much higher.

It is hard to predict how high prices could go in such a situation as it is unchartered territory. A scenario in which prices could be lower than in our base case is possible if we experience a significant increase in gas exports from Russia towards Europe. Please see the table at the end of this update for the latest oil and gas price forecasts.

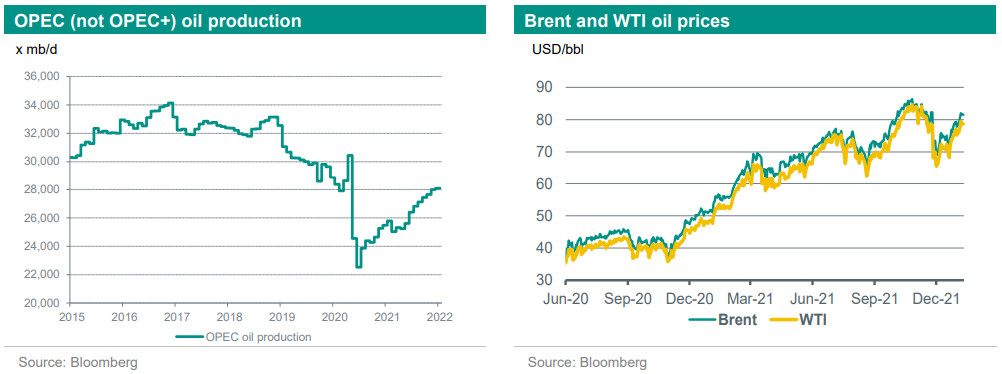

OPEC+ hold on to scheduled production increases

Last week, OPEC+ decided unanimously to raise the oil production of the group by 400.000 (400 kb/d) in February again as planned. OPEC+ production will then reach 39.1 million barrels per day (mb/d), or 2.5 mb/d more than in January 2021.

In July 2021 the group of oil producers agreed to increase production slowly but surely by 400 kb/d each month until May 2022. From May onwards, production will be even increased by 432 kb/d. If OPEC+ not only sticks to this production schedule, but is also able to actually deliver, the OPEC+ production will be back at pre-COVID levels in around November of this year.

Although the announced 400 kb/d increase of production for February was in line with market expectations, oil prices found some support. This support had to do with the announced level of OPEC+ compliance. It seems that the compliance was not only above 100%, but also rising. A compliance level above 100% indicates that some oil producers are not able to meet their obligations to raise production and meet their quotas. In November 2021 the compliance level was 120%, in December it had risen to 127%.

It was not only possible production issues in Kazakhstan that triggered some worries on the financial markets. Also in Libya local unrest resulted in lower crude production. After three weeks of blockages of pipelines by militants, the biggest Libyan production field finally became operational again. On top of that we notice that other producers, like top-producer Russia, but also Angola, Nigeria and Ecuador, also seem unable to meet the production targets. The question is whether this is a temporary blip in production increases, or whether this is the result of more structural factors.

Oil prices: range trading in 2022…

The ongoing rise of OPEC+ production in principal adds downward pressure to oil prices. Indeed, in addition to the rise in production from OPEC+ we also see that US production is slowly rebounding again. With 11.8 mb/d of production, the US is still the worlds’ largest oil producer. Nevertheless both drilling activities and oil production are still significantly lower than in early 2020. At that time, there were almost 700 operational drilling rigs versus 480 at this moment.

The US produced around 13 mb/d of oil by then. That prices are currently hovering around USD 80/bbl mainly is the result of the fact that the negative effects of the lockdowns are not as bad as feared initially. Global oil demand remains relatively strong, especially in Asia, and is still growing.

Market expectations indicate that supply and demand will be roughly in balance during 2022. also It is also generally expected that if new measures need to be taken to fight COVID19, which would result in lower oil demand, OPEC+ will actively manage their production levels again to keep this supply and demand balance in place.

We think that the fact that OPEC+ may not be able to meet their quotas in practice will not disturb the supply and demand balance too much as this will be compensated by higher non-OPEC production, e.g. from the US. On top of that, there is a possibility that the US and Iran will agree upon a new nuclear deal. If successful, sanctions on Iran will be lifted and Iranian oil production and exports will be increased again. Still, higher oil exports by Iran will be followed by a change in the production policy by OPEC+ (in which Iran does not participate).

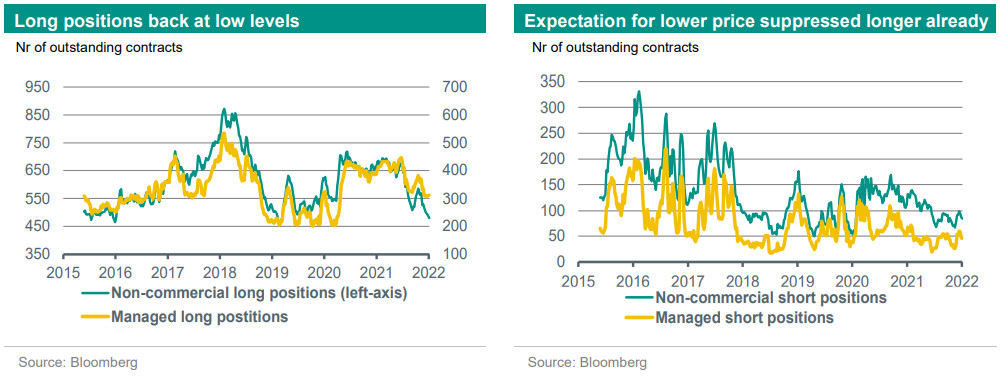

Market positioning indicates that traders have taken a cautious stance in the current markets. Whilst open short positions (speculating on lower prices) were relatively low in recent years already, investors and market speculators are currently also very cautious with regards to expected price increases (long positions).

There is a risk that upward price pressure builds if investors were to expand these long positions at some point. However, with a well balanced market there are not too many arguments to opt for a clear long or short positioning. Still we believe that there are upwards price risks in the medium term (up to 5 years).

… but upward price risks in the years thereafter

These upward price risks are triggered by several factors. Global oil demand will drop not as fast as hoped during the coming years. The rise of electric vehicles is going very fast in some regions, but the transition in the shipping- and aviation sectors still have to get started. The drop in demand of crude which is likely to materialise, is well compensated by higher demand for oil in emerging markets, especially in Asia. At the same time we see that investments in exploration for oil have fallen under pressure in recent years.

In fact, according to the International Energy Agency (IEA) investments in the oil and gas sector are currently fully in line with the Net Zero scenario for 2050, which implies significant declines in supply over the coming decades. However, to compensate for lower availability of oil and gas demand should shift towards cleaner energy solutions. This transition however is lagging due to a shortage of investments in renewable energy sources and the accompanying infrastructure.

Furthermore, we see a trend of divestments in recent years. Shareholders, like pension funds, are adding pressure to International Oil Companies (IOC’s) to withdraw from long-term and complex projects in oil and gas exploration in order to focus more on renewable energy sources. Besides the production from their own reserves, IOC’s also operate the production for national governments. Either they control the crude production or they deliver the knowledge to do so.

Slowly but surely we start to see the impact of these withdrawals. Global oil reserves have dropped to roughly 2 mb/d (early 2021 that was still around 6 mb/d). In other words, the risk of future shortages is building. A similar situation as we face today in the gas markets can no longer be ruled out for oil markets and will probably last until global demand has dropped to the same level of supply again.

Due to the expected rise in oil demand, in combination with the struggling rise in supply we see that the risk of rising oil prices in the medium term (up to five years) is rising. Our long term oil price average (> 5 years) is unchanged though at USD 60/bbl. Please see the table below for the most recent forecasts.