Den høje inflation i USA har været genstand for talrige spekulationer i flere måneder. Er den kortvarig eller vedvarende? Er den et faresignal? Vil den føre til rentestigninger? ABN Amro hæfter sig ved, at kerne-inflationen kun er steget moderat i de seneste to måneder og stiller derfor spørgsmålet, om inflationen er blevet benådet for dødsstraffen – eller om straffen er blevet udsat. Banken tror, der stadig vil komme et inflationspres fra nogle sektorer, men ellers venter banken, at kerne-inflation i løbet af 2022 vil falde til 2-procents niveauet. De amerikanske forbrugere bliver åbenbart tilbageholdende over for køb af varige forbrugsgoder, der er steget kraftigt i pris.

Inflation reprieve?

For a second straight month, US core CPI rose only modestly in September, up 0.2% m/m, following the 0.1% gain in August (headline inflation accelerated to 0.4% m/m, driven by the recent rise in oil prices). This rate of price growth is much more in keeping with historical patterns, and a far cry from the near-1% monthly price gains we were seeing earlier this year. As expected, strength was evident in shelter, with rents continuing to exhibit catch-up from last year’s lockdown period when rents were essentially frozen.

New car prices also continued to rise strongly, gaining another 1.3% m/m (8.7% y/y). The semiconductor shortage and production shutdowns continue to hold back supply of cars, although demand has also leveled off in recent months. Strength in these categories was offset by a modest fall in used car prices, with the recent rebound in wholesale prices yet to become evident. Meanwhile, the drop off in air travel continued to weigh on airfares. Medical inflation also remained subdued, with demand for elective procedures still well short of where it would have been absent the pandemic. Consumption of medical services is still around 7pp below the pre-pandemic trend as of August.

Inflation likely to rebound, albeit not dramatically

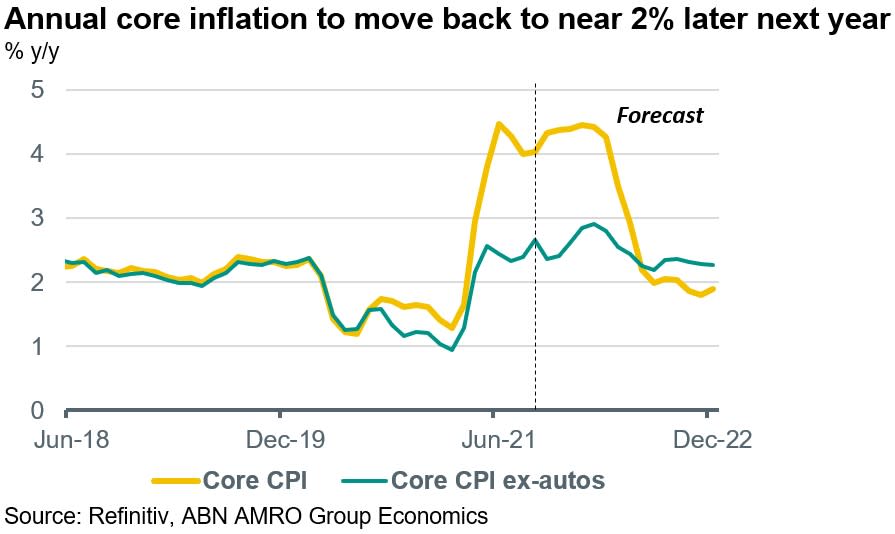

Base effects mean that annual core inflation is still relatively elevated, at 4% y/y in September, down from the peak of 4.5% in June. While we continue to think we have probably seen the peak in annual core inflation, monthly price gains are likely to pick up again in the coming months.

First, it looks as though the fall in used car prices has stalled and even gone into reverse, with wholesale prices hitting a new record in September, according to the Mannheim index. Another big recent drag – air fares – is also likely to go into reverse, given the rise in oil prices and the stabilisation in demand, following earlier falls in air passenger traffic.

Finally, the strength in wage growth and the lack of housing supply is likely to put further upward pressure on shelter inflation, which is by far the biggest component of the core CPI index. While we expect monthly inflation to pick up somewhat, however, we do not expect anything like the kind of price gains we saw earlier this year, nor do we expect this strength to last. Although supply-side bottlenecks are likely to persist into next year, demand side pressures – particularly in goods – are easing, and likely to ease further.

Consumer confidence measures suggest consumers are now being deterred by higher prices of durable goods. At the same time, the services recovery has slowed significantly, and we doubt it will regain momentum to the extent that it puts significant upward pressure on inflation in the short to medium term. As such, we continue to expect annual core inflation to move back to near 2% by the second half of 2022.