Den globale produktion stabiliseredes i september. Produktionen har i flere måneder været stigende i industrilandene og faldende i de nye økonomier. Men der er stadig kraftig modvind fra stigende omkostninger og fra meget lange leveringstider, selv om containertransporten er blevet bedre.

Manufacturing headwinds persist

Global Macro: Global manufacturing PMI stabilises in September. No signs of easing cost price pressures nor delivery times.

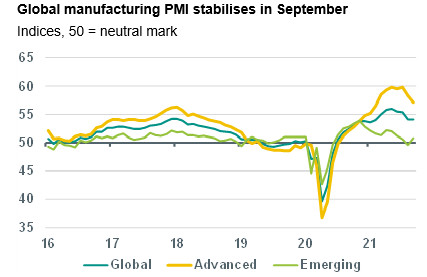

Global Macro: Global manufacturing PMI stabilises in September. Over the past few days, manufacturing PMIs for September were published for a wide range of developed markets (DMs) and emerging markets (EMs). After having dropped in the three preceding months, the global manufacturing PMI stabilised at a still relatively high level of 54.1, around two points below the cyclical peak of 56.0 reached last May.

This suggests further growth in global manufacturing is still on the cards, although momentum has fallen since the spring of this year. The global PMI sub-indices for output, new orders and exports all edged up a bit, after having dropped by around four points over the past few months.

The weakening of momentum signalled by the global manufacturing PMI over the past months was mainly driven by EMs. Although the aggregate EM index for September showed the first rise since April, to 50.8 (August: 49.6), China’s official PMI published by NBS fell below the 50 mark in September for the first time since the initial covid-19 shock in February 2020, reflecting rising headwinds to manufacturing (see our take on China’s September PMIs here).

Meanwhile, the aggregate index for DMs is still at a much higher level in September (57.1), although having fallen for a second month in a row (August: 58.3) with manufacturing PMIs coming down in the US (Markit), eurozone, Japan and the UK.

No signs of easing cost price pressures nor delivery times

The manufacturing PMIs for September also suggest that cost push pressures remain elevated. Although the global PMI subindices for input and output prices have come off a bit from their peaks reached in the spring of this year, they edged up again in September and remain at very high levels from a historic perspective. This looks partly related to the upward move in energy prices.

Meanwhile, we have seen some stabilisation in global container freight tariffs over the past few weeks, which seems to partly reflect global shipping lines’ moves to stop increasing spot freight rates. Still, these rates remain at very high levels, with the global benchmark rate around seven times higher than its trough reached in the spring of 2020.

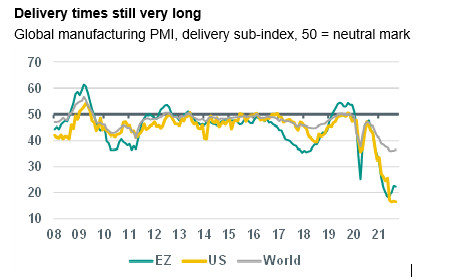

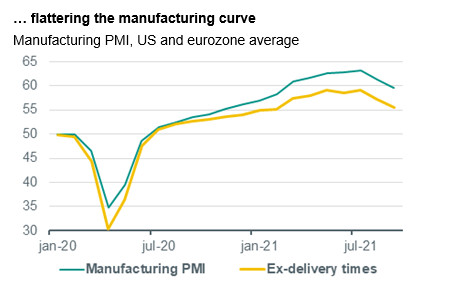

What is more, the global PMI sub-index for delivery times improved a bit in September, but at 36.5 remains at very low levels, indicating that supply chain problems (for instance with regard to the scarcity of semiconductors and the logistical problems in container transport) are far from over. In fact, the headline global PMI index is flattered to some extent by these long delivery times – also see our September Global Monthly here.