ABN Amro ser tegn på, at den kinesiske centralbank lemper pengepolitikken, og at der kommer lidt flere offentlige ivesteringer for at afhjælpe den nedtur, der skyldes Delta-varianten samt den opbremsning, der er sket af politiske grunde i f.eks. byggesektoren. Banken venter en vækstrate i år på 8,3 pct. og på 5,5 pct. næste år.

China: Some policy easing after a self-inflicted slowdown

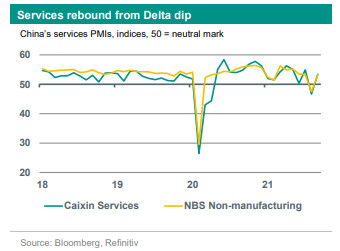

As expected, GDP growth slowed significantly in Q3, falling to 0.2% qoq sa (Q2: 1.2%) and 4.9% yoy (Q2: 7.9%). The key driver of the slowdown was the imposition of regional lockdowns and mobility restrictions following the Delta outbreak in July.

This had a significant, though short-lived, impact on activity in the services sector. With restrictions being eased, the full-vaccination rate now at 75% and export strength continuing, we expect a pick-up in quarterly growth in Q4, also assuming further piecemeal policy support.

Still, headwinds have risen in real estate (with the Evergrande crisis adding to this sector’s slowdown) and from a power crunch. These headwinds – also visible in a further slowdown of industrial production and investment – are to a large extent ‘self-inflicted’, following measures to reduce risks (real estate) and pollution (power). We leave our growth forecasts for 2021 (8.3%) and 2022 (5.5%) unchanged for now, but risks remain tilted to the downside.

Some easing of policies in the pipeline

While the growth target for 2021 of ‘above 6%’ will certainly be reached, policy inaction would raise the risk of annual growth in 2022 (our forecast: 5.5%) falling below Beijing’s preferred trajectory. The 2022 target will be announced at the annual National People’s Congress in early March 2022, although a glimpse of the government’s intentions may be spotted during the Central Economic Working Conference in December.

We still expect another 50bp RRR cut in the coming months (with the PBoC continuing to safeguard overall liquidity with special operations) and moderate fiscal support – by increasing the room for local governments to step up infrastructure spending.

On the energy front, although the government has expressed its commitment to longer-term environmental ambitions, various measures have been taken to safeguard energy provision during the winter season. Coal production has been ramped up again, electricity prices have been liberalised somewhat, and power shortages have significantly reduced. Meanwhile, authorities have stepped in to stop the rise in coal prices.