ABN Amro analyserer de seneste data for den kinesiske produktion og udmeldinger om politisk-økonomiske initiativer. Mens Kina siden sidste år har ført en hård kurs for at bekæmpe omicron – med lockdowns – så sætter Beijing nu fart på den politiske proces for at skubbe økonomien igang. PMI steg kraftigt i maj, men ligger stadig under 50, dvs., at der generelt er tilbagegang og ikke fremgang. Men økonomien blev bedre, inden lockdowns for alvor blevet ophævet. Lockdowns i Shanghai er nu ophævet. Men samtidig har regeringen taget skridt til en række økonomiske lempelser, og den stimulerer bankerne til flere udlån. Regeringen ventes at presse en stærkere vækst igennem forud for kommunistpartiets afgørende møde i november. Regeringens mål er en vækst på 5,5 pc t. i år, men ABN Amro tror dog, at væksten bliver et procentpoint lavere.

China’s PMIs rebound sharply in May, but remain below neutral mark

China Macro: PMIs confirm activity has troughed in April. Growth momentum to improve on gradual reopening and more policy support. Recent actions illustrate government’s growing sense of urgency.

China Macro: PMIs confirm activity has troughed in April

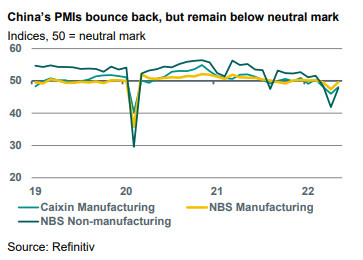

After having fallen sharply in March and April following the broadening of lockdowns, China’s Purchasing Managers’ Indices (PMIs) showed a clear rebound in May, outbeating consensus expectations.

While the sharp improvement in PMIs indicate that the worst of the pandemic-driven slump is behind us, the fact that all PMIs remain below the 50 mark separating expansion from contraction indicates that the economy is still facing serious headwinds.

On the manufacturing side, the official PMI recovered by more than two points to 49.6 (April: 47.4, consensus: 49.0), with almost all subindices (bar employment) improving substantially. Caixin’s manufacturing PMI published today shows a similar pattern, also rising by two points to 48.1 (April: 46.0, consensus: 49.0) although remaining well below the neutral mark.

On the non-manufacturing side (services and construction), the official PMI bounced back by six points to 47.8 (April: 41.9, consensus: 45.5), also still well below 50. Caixin’s services PMI will be published next Monday. The official composite PMI, a weighted average of the manufacturing and non-manufacturing PMIs, bounced back by almost six points to 48.4 (April: 42.7), although remaining clearly below the levels seen in early 2022 (around 51) before lockdowns intensified.

Growth momentum to improve on gradual reopening and more policy support

The PMI rebound in May was in line with our expectations, as we assumed activity to have troughed in April (see here), given the easing of the nationwide lockdown intensity and a gradual reopening over the past few weeks.

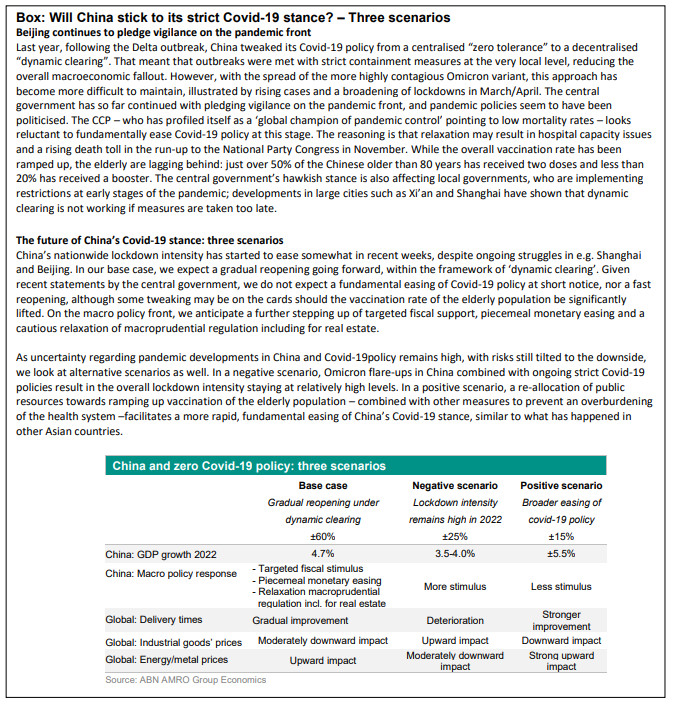

Moreover, the government has taken specific measures to ease bottlenecks in production and (truck) transport. We expect growth momentum to improve further in the second half of this year. This assumes the gradual reopening will continue – within the framework of strict ‘dynamic clearing’ Covid-19 policy – and the government will add targeted fiscal and piecemeal monetary easing, as well as a cautious relaxation of macroprudential measures including for real estate (also see our recent China update, Something’s gotta give).

That said, the government’s pledge for vigilance on the pandemic front makes the recovery vulnerable to pandemic flare-ups and prolonged lockdowns. For this reason we have also looked at alternative scenarios (see the lead article of our May Global Monthly for more background, and a box from this article below).

It has also become clear that the hardening of the trade-off between maintaining strict Covid-19 policies and safeguarding growth has impacted confidence among consumers, producers and (foreign) investors. All in all, our 2022 growth forecast of 4.7% is almost a full percentage point below Beijing’s official growth target of 5.5%.

Recent actions illustrate government’s growing sense of urgency

On the policy front, recent actions illustrate the government’s growing sense of urgency to offset the impact of the pandemic disturbances, in the run-up to the National Party Congress in November. Last week, Beijing presented a comprehensive support plan with a total of 33 measures, ranging from loan extensions and tax relief for companies and households (including specific measures to boost property and car sales) to additional support for infrastructure investment in areas such as transportation, shantytown renovation and power projects.

This urgency is also illustrated by the videoconference premier Li Keqiang held with thousands of local-government officials, and by meetings the PBoC and financial regulators had with 24 major banks to urge them to boost lending. All in all, the policy pendulum has clearly shifted back from financial derisking last year to safeguarding growth, and Beijing now seems prepared to tolerate an increase in overall leverage again – implying that overall credit will be allowed to grow faster than nominal GDP.