ABN Amro har ændret bankens basis-scenarie for eurozonen. Nu har banken ændret grundlaget for sine vurdering til recession, fordi banken er sikker på, at Europa får en recession. En række faktorer spiller ind, men det vigtigtigste er, at Rusland ikke lader gassen flyde til Europa. Vi får altså en energikrise. Det fører også til en kraftig reduktion af forbruget af gas i industrien. Forbrugerne vil mærke det i kraft af højere energipriser, der vil svække deres forbrug generelt. Derfor bliver inflationen høj i mange måneder. Der kan ventes et fald i virksomheders investeringer, ligesom indtjeningen bliver presset. ABN Amro venter minusvækst til og med 1. kvartal næste år, og inflationen vil først begynde at falde næste år.

Recession now our base case for the eurozone

We have changed our base scenario for the eurozone economy, which now includes a recession in the coming quarters. A number of factors have contributed to the changes in our scenario. Most importantly, after the annual maintenance to the Nord Steam 1 pipeline in July, gas flows from Russia clearly have not returned to the levels that would prevent an energy crisis in the eurozone.

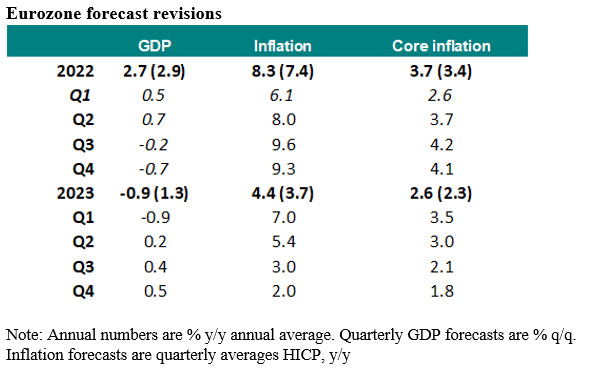

The recent jump in gas prices will probably further accelerate the already very high inflation rate in the coming months. We have raised our forecast for average inflation in 2022 to 8.3%, up from 7.4% and in 2023 to 4.4%, up from 3.7%.

As a result, households’ real disposable income will fall further. Some of the blow to household income and consumption could be limited by government support measures, but we expect these to be too limited to prevent consumption from contracting in the next few quarters. What is more, it seems that consumers have already spent most of the excess savings that they accumulated during the pandemic. Indeed, GDP growth came in higher than expected in Q2 (at 0.7% qoq). Although the details have not yet been published, private consumption probably expanded robustly in Q2 despite a sharp drop in real income, implying that consumption was largely financed by dissaving.

Another factor that should reduce consumption in the coming quarters is deteriorating labour market prospects. We think that the tightness in certain segments of the labour markets that had emerged after the pandemic will soon evaporate as labour supply will be encouraged by the high inflation rate and erosion of real income, while labour demand declines on the back of the deterioration in economic conditions. Meanwhile, fixed investment and industrial production could still expand in Q3, as backlogs due to previous disruptions in supply chains are being cleared.

However, the tightening of financial conditions and the sharply deteriorated global economic outlook should result in contraction in investment as from the final months of the year onwards. Moreover, firms will likely see their margins being squeezed, which should be an extra drag on investment and hiring going forward.

Declines in consumption and investment and the resulting contraction in GDP in the coming quarters would also be in line with recent survey indicators, such as the sharp drops in eurozone consumer confidence, business sentiment and composite PMI in recent months. All in all, we have pencilled in a modest contraction in GDP in Q3 and two consecutive more significant contractions in 2022Q4 and 2023Q1. Our annual average growth forecast drops to 2.7% in 2022 (down from 2.9% previously) and to around -1% in 2023 (down from +1.3% previously).

In such a recessionary economic environment, the ECB would probably normally stop hiking rates at an early stage or even start easing policy. However the high level of inflation is expected to encourage the central bank to continue hiking until the end of the year, as it is committed to fight against any potential rises in longer-term inflation expectations. Therefore, we continue to expect another 50bp hike in September, to be followed by two hikes of 25bp each in October and December. After that, we expect the central bank to keep rates on hold for a while. The risks to our forecast for ECB policy are skewed to more rate hikes in the 3-6 month horizon, given that the ECB’s focus is currently on inflation rather than growth.