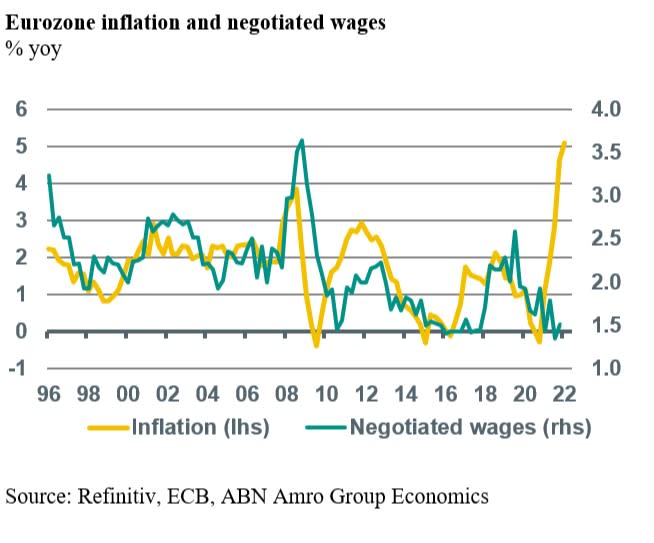

Under pandemien er reallønnen ganske enkelt brudt sammen i Europa, og samtidig er inflationen drønet i vejret som ikke set tidligere. I de seneste 30 år har der ikke været en så dramatisk diskrepans mellem inflationen og lønningerne. Normalt plejer priserne og lønningerne at følges ad parallelt, men i det seneste år er de to centrale dele af økonomien gået i hver sin retning. Mens inflationstakten er kommet op på 5-8 pct. i eurozonen, så er de forhandlede lønninger steget med kun 1,5 pct. i 4. kvartal i 2021. Familiernes realløn er altså faldet dramatisk – som ikke set i årtier. Det rammer i særdeleshed de lavere indtægtsgrupper, da det er energi og fødevarer, der er steget mest.

Uddrag fra ABN Amro:

Eurozone: Surging inflation, collapsing real wages

The largest eurozone countries all have published inflation data for February in recent days. They all reported another big jump in headline inflation. Meanwhile wage growth is still subdued and household real wages are falling rapidly. Although we expect wage growth to strengthen this year, the impact on underlying inflation should remain modest, as higher wage growth should largely be compensated by higher growth in labour productivity.

As such, inflation still remains driven by supply shocks, with domestic cost pressures still subdued. Given the hit to purchasing power from rising food and energy prices, as well a potential demand shock from the Russia-Ukraine fall-out, the long-term inflation outlook is still benign.

Inflation soaring, but still largely an energy and food price story

The largest eurozone countries all have published inflation data for February in recent days. They all reported another big jump in headline inflation. Spain’s HICP inflation rose to 7.5%, up from 6.2% in January, Italy’s increased to 6.2% from 5.1%, France’s to 4.1% from 3.3%, Germany’s to 5.5% from 5.1% and Belgium’s (national CPI) to 8.0% from 7.6%.

All statistical bureaus mentioned that food and energy price inflation continued to be the main drivers behind the further jumps in inflation. For instance, in Italy, energy price inflation jumped to 45.9% in February, up from 38.6% in January, while all Germany’s main states reported further rises in already high rates of inflation for household energy and transportation energy.

Belgium’s statistical bureau mentioned that energy price inflation came in at 61% in February, contributing 5 percentage points to the total headline inflation rate of 8%. Food price inflation also rose noticeably in February, particularly fresh food prices, with Italy reporting a rise to 6.9%, up from 5.3% in January and France a jump to 5.6% from 4.0%.

Besides food and energy price inflation, core inflation also moved higher on average, although the picture is quite mixed across countries and items. For instance, core inflation in France and Italy rose on the back of shifts in discounting in clothing and shoes a year ago. This will only have a temporary upward impact on inflation this year. However, France’s statistics bureau also mentioned that services inflation increased (to 2.2% from 2.0%) due to a rise in transport services.

This higher inflation rate of transport services probably is a second round effect of the rise in energy price inflation in previous months. The rise in transport services inflation probably has further to go and will continue to have an upward effect on services inflation in the coming months. Another factor that currently is lifting services inflation, is the ongoing normalisation of holiday and leisure related prices following the lifting of restrictions.

We expect this part of services inflation to remain elevated until around the middle of the year and subsequently fall during the rest of the year. As a result, core inflation should remain well above 2% in the first half of the year.

Based on the numbers of the individual countries, we think that eurozone inflation rose to 5.6% in February, up from 5.1% in January.

Meanwhile wage growth is still subdued, with negotiated wages rising by only 1.5% yoy in 2021Q4. This means that household real wages are falling rapidly. Although we expect wage growth to strengthen this year, the impact on underlying inflation should remain modest, as higher wage growth should largely be compensated by higher growth in labour productivity.

As such, inflation still remains driven by supply shocks, with domestic cost pressures still subdued. Given the hit to purchasing power from rising food and energy prices, as well a potential demand shock from the Russia-Ukraine fall-out, the long-term inflation outlook is still benign.