ABN Amro venter en positiv udvikling for flere europæiske obligationer. Banken venter, at de tyske obligationer vil stige i de næste måneder, men for at falde tilbage fra 2. kvartal næste år. Banken venter samtidig pæne stigninger i de græske og italienske statsobligationer, fordi de græske obligationer er blevet opjusteret i kreditværdighed, og fordi der er succes med den italienske økonomiske genopretning.

Our euro and US rates outlook

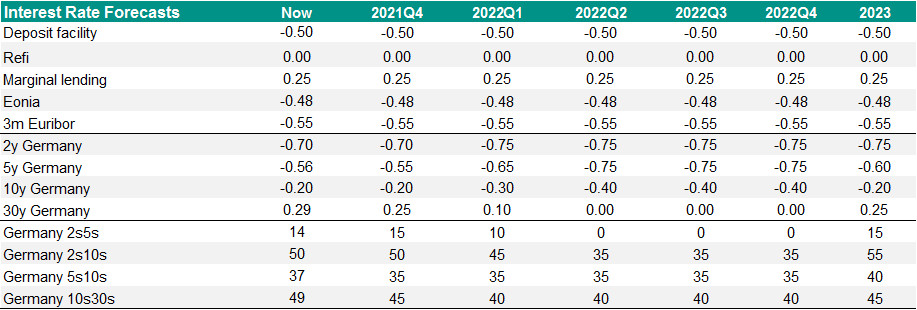

We forecast Bund yields to remain elevated for a few months, but to fall back in Q2 2022. We stick to our bullish view on Italian and Greek sovereign bonds. The US rate hike cycle priced in is in line with our base case, although we expect lift-off in 2023.

We forecast Bund yields to remain elevated for a few months, but to fall back in Q2 2022

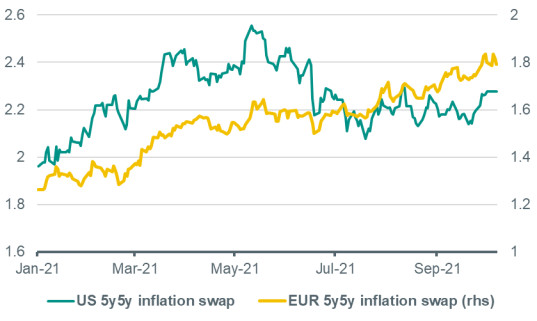

We see two main drivers for the move higher in yields over the past month. Firstly, market-based inflation expectations rose and secondly, there has been some spillover from the rise in US rates (read more about this below). Moreover, the market has started once again to price in an aggressive rate hike cycle by the ECB.

Even though we think that the spillover from the US is coming to an end, a further acceleration in eurozone inflation in the near term is likely to put a bit more upward pressure on yields. Indeed, we forecast inflation to rise a bit higher over the coming months and think headline inflation could rise to around 4% at the end of this year. Given recent developments in energy prices, the risks are tilted towards a higher peak.

Eurozone inflation expectations have risen, in % (both lhs and rhs)

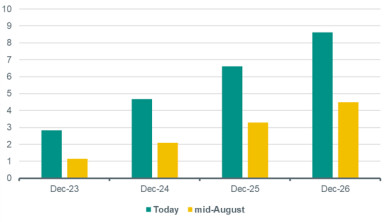

Market expects aggressive rate hike cycle by the ECB, In bp (1 rate hike = 10bp, based on Euribor futures)

On the other hand, we expect the announcement about APP in the ECB press conference planned for December to be a positive surprise for the market. This is because we expect the monthly amount of purchases under the APP to be stepped up from the EUR 20bn monthly pace. This could come in the form of an APP envelope rather than a fixed monthly amount. This would be a powerful mechanism while maintaining a lot of flexibility to increase or decrease the monthly pace of purchases according to market conditions. Either way, we expect the stock of sovereign bond holdings by the ECB to grow by more over the coming years than is currently priced in by the market.

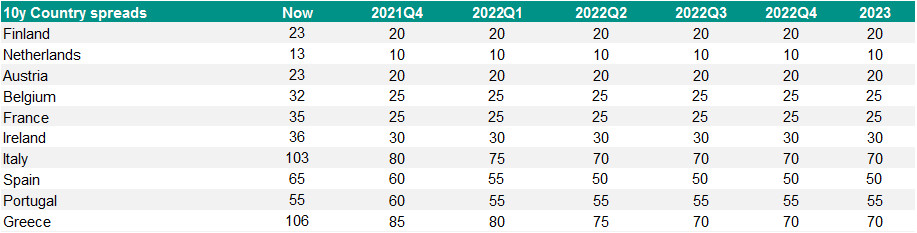

We stick to our bullish view on Italian and Greek sovereign bonds

This is because we judge that peripheral debt will remain sustainable as interest payment capacity is expected to improve further over the coming years on the back of the economic recovery, while the ECB is expected to keep yields low. More specifically, we think that Greece looks set for another rating upgrade over the coming year, which is particularly supportive for Greek sovereign debt (and also for Italian sovereign debt as the two yield spreads move largely in tandem). We think that Italy’s reform plans look ambitious and foresee a growth revolution on the back of it. Lastly, with core rates anchored at low levels in 2022, a search for yield should provide a positive backdrop for peripheral bonds.

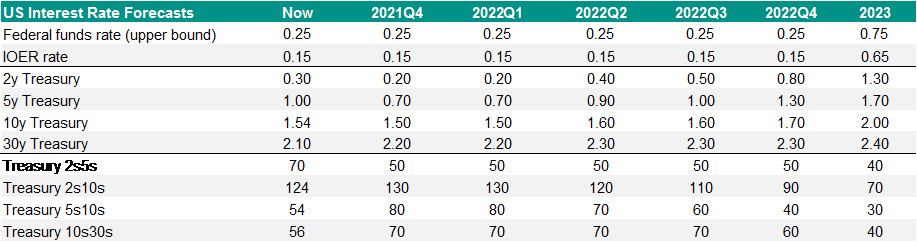

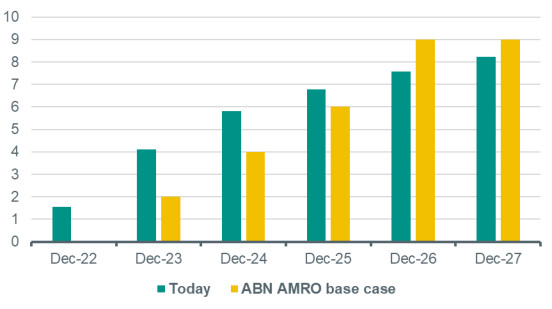

The US rate hike cycle priced in is in line with our base case, although we expect lift-off in 2023

US rates have risen on the back of a continued pricing in of rate hike expectations. Moreover, the expected rate lift-off in markets has moved forward, with the first rate hikes now expected already next year. Even though the currently priced aggressive total rate hike cycle by the Fed is in line with our expectations, we expect a rate lift-off only in the first half of 2023.

Subsequently, we expect 1 more rate hike in 2023, followed by 2 rate hikes a year (and potentially 3-4 rate hikes per year later in the cycle) until reaching the neutral level, which we think will be around 2.5% (though the exact level is of course uncertain).

We expect the rate lift-off in the first half of 2023 is because we think that the Fed will have reached its dual mandate of 2% inflation on average and full employment by the end of 2022 and we expect the Fed to wait a little while with hiking rates after fulfilling its mandate (read more about why in yesterday’s daily). Moreover, we think a gap of around 6 months between the end of tapering and the rate lift-off is realistic.

Market has priced in earlier rate lift-off than we expect In bp (1 rate hike = 25bp, based on Eurodollar futures)

Since the market started to price in earlier rate hikes by the Fed than before, the short end of the US yield curve looks elevated to us. We expect the move higher in the 2y and 5y yield to reverse, whereas the longer end of the yield curve (10y and 30y yield) looks in line with our base case. Consequently, we think longer yields will remain roughly stable for a bit and then rise gradually in line with the approaching rate hike cycle.