Den tyske industri har mistet pusten. Industriproduktionen kan ikke følge med efterspørgselen. Produktionen steg i november med kun 0,1 pct., mens ordrerne steg med 3,7 pct. Stigningen kommer især fra de øvrige eurozone-lande, og det viser, at den økonomiske vækst er stærkere uden for Tyskland. ABN Amro venter, at den økonomiske vækst i eurozonen fra og med andet kvartal vil ligge over den økonomiske trend.

German industry still struggling to keep up with demand

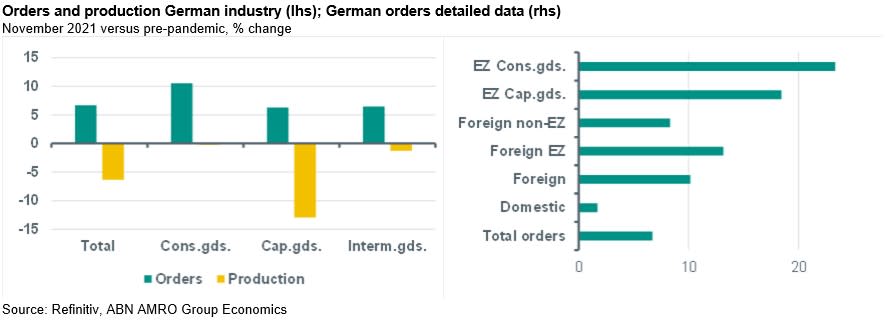

Manufacturing output in Germany rose by 0.1% mom in November, whereas new orders received by the manufacturing industry rose by 3.7% mom that month. Consequently the backlog in production, gauged by the difference between the orders and production indexes, widened again in November, after it had declined in October.

The gap between orders and production has been rising since the middle of 2020 and reached unprecedentedly high levels after the summer of 2021, as global supply bottlenecks (particularly in semiconductors and computer chips) increasingly weighed on German production.

The breakdown in main sectors shows that the production backlog is largest in capital goods and consumer goods, which is to a large extent explained by the sub-sector motor vehicles and trailers. Still, the gap between orders and production of intermediate goods shows that the problems are widespread across the German manufacturing sector.

The detailed data for Germany’s manufacturing orders shows that the largest jump in orders since the start of the pandemic has been in orders for capital goods and consumer goods from other eurozone countries. This suggests that growth in eurozone domestic demand has also been weighed somewhat by the distortions in industrial supplies from Germany.

Looking ahead, as we wrote in this publication last week (see here), global supply bottlenecks seem to have eased slightly in the final months of last year, although they remain elevated. While Omicron brings additional risks of disturbances between global industrial supply and demand, we expect pandemic related disturbances in global supply chains to fade in the course of this year, which implies that manufacturing activity in Germany will rebound and outperform Germany’s total GDP growth this year.

Also, the easing of supply constraints will likely also result in some extra growth in eurozone domestic demand. Indeed, there still is room for pent-up demand in the eurozone going forward, with private consumption as well as fixed investment in capital goods each still below pre-pandemic levels in 2021Q3. Strong growth in final domestic demand is part of our base scenario for the eurozone economy, which includes above-trend GDP growth during 2022Q2-Q4.