I USA steg indeksene for servicesektoren markant i september, mens der er set i fald i forbruget af varige – og dyre – forbrugsgoder. Forbruget af varige forbrugsgoder steg kraftigt i de første mange måneder af coronakrisen men er faldet siden begyndelsen af i år. Servicesektoren bidrager væsentligt mere til økonomien end forbruget af varige forbrugsgoder, og betydningen kan stige i en tid med flaskehalsproblemer, for de rammer ikke servicesektoren.

Will services take the baton from manufacturing?

US Macro: Services recovery regains some momentum

The ISM Services index unexpectedly rose slightly in September, to 61.9 (August: 61.7), while the Markit Services PMI – which correlates better with GDP growth – was revised upwards from the flash reading, to 54.9 from 54.4. Both suggest continued robust growth in the services sector, albeit at a slower pace than in the earlier stage of the recovery, with strength broad-based across industries.

The improvement comes as a relief considering the headwinds facing the manufacturing sector – and is consistent with the recent uptick we see in high frequency indicators such as air travel and restaurant dining.

This likely reflects the marked decline in coronavirus cases and hospitalisations over the past month in the US, with the wave of Delta variant infections having clearly peaked.

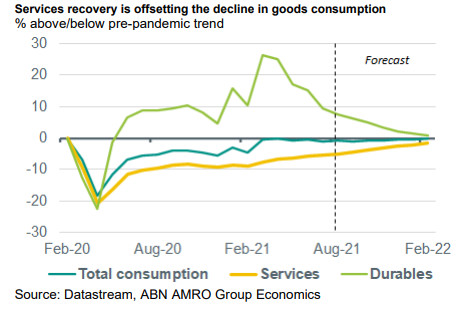

Indeed, we expect this effect to become more pronounced over the coming months, with demand likely to increasingly switch from pricier goods – where consumption has been far above the pre-pandemic trend – towards services, where consumption remains stubbornly below the pre-pandemic trend.

Services will be crucial in offsetting declining goods consumption

Durable goods consumption peaked at 26% above the pre-pandemic trend in March, and having since steadily declined, is now 7.6% above trend. We expect further declines, with the most recent Michigan consumer sentiment survey suggesting consumers are balking at high prices following the inflation we have seen in goods this year; the share of consumers saying it is a good time to buy durables fell to the lowest since 1980.

At the same time, services consumption remains around 5% below the pre-pandemic trend, with the pace of recovery dented in recent months by the spread of the Delta variant. With worries over Delta now easing, we expect the services recovery to pick up pace.

Given that services makes up a much bigger share of private consumption in the US than durable goods – at 64% vs 13% – this recovery in services should comfortably offset the decline in goods consumption. It is possible in the near term that we see outright falls in total consumption – for instance, if goods consumption falls more suddenly than we currently expect. However, we would expect this to only last one or two months at most.

A more important risk comes from supply-side bottlenecks. While the services sector is not facing anywhere near the supply-side constraints that we are seeing in manufacturing, in today’s ISM survey respondents continued to complain of shortages of both goods and labour.

The end of pandemic-related unemployment benefit top-ups, and the reopening of schools, should encourage some who had dropped out of the labour market (labour force participation is still around 2 percentage points below the pre-pandemic level).