Uddrag fra Zerohedge:

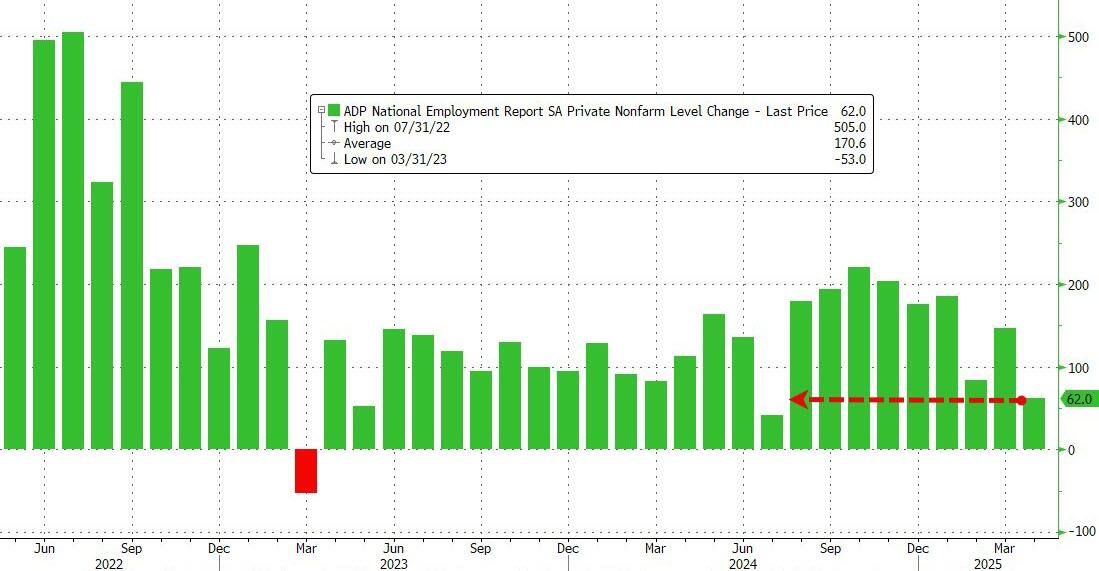

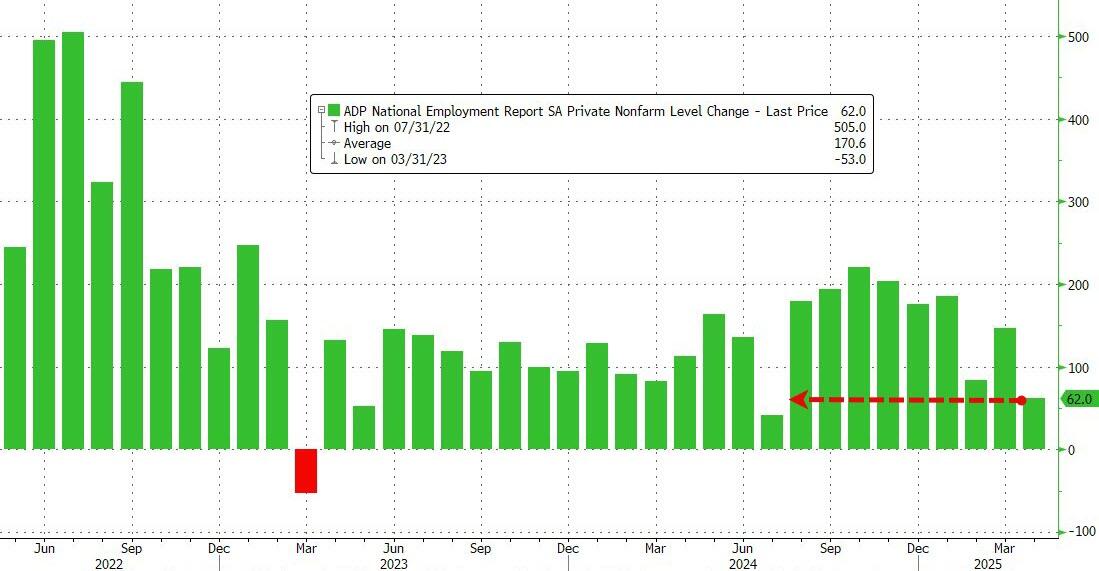

While jobless claims refuse to show even a glimmer of hope to the doomsaying ‘recession is imminent and it’s all because of Trump’ narrative, this morning’s ADP gives us a potential glimpse at what Friday’s ‘most important payrolls print ever’ will offer.

…and the picture is not pretty at all…

According to ADP, the US economy added just 62k jobs in April – the lowest since July 2024’s dip

Source: Bloomberg

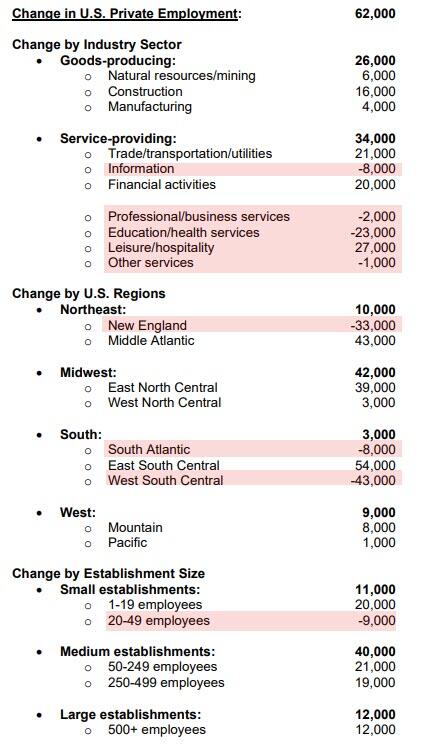

Education and health services, information, and professional and business services lost jobs, while hiring in other sectors was moderate.

“Unease is the word of the day,” says Nela Richardson Chief Economist.

“ADP Employers are trying to reconcile policy and consumer uncertainty with a run of mostly positive economic data. It can be difficult to make hiring decisions in such an environment.”

Goods-Producing jobs outperformed Service-Providing jobs…

There is more bad news –

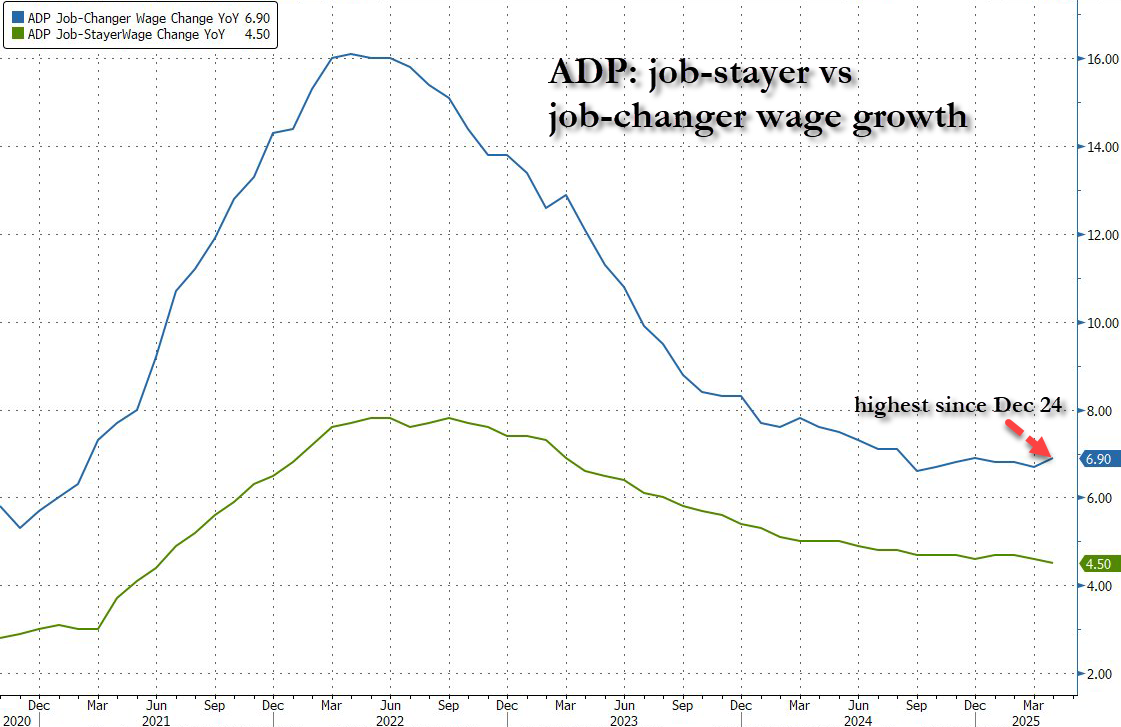

Pay for job-stayers rose 4.5 percent in April from a year earlier, a slight deceleration from March.

Year-over-year pay gains for job-changers accelerated, rising from 6.7 percent in March to 6.9 percent in April – the highest since Dec 2024.

The market is moving that way – pricing in four cuts for 2025 now.