A period of sorting and cleansing is underway

For a time, the dominant narrative suggested that AGI was only two or three years away — that “magic AI” would emerge and rapidly take off into superintelligence. As discussed on the latest All-In podcast, the GPT-5’s release, which fell short of those lofty expectations, has tempered that view. What we see instead is that progress is more incremental than revolutionary. It takes significant prompting, validation, and human oversight to generate consistent value. As the development of the tech will be more “normal”, we can apply a more normal logic to it. Some narratives of massive hype are overdone. A period of sorting and cleansing is underway. On that theme, here are some important “gap” charts as it relates to AI.

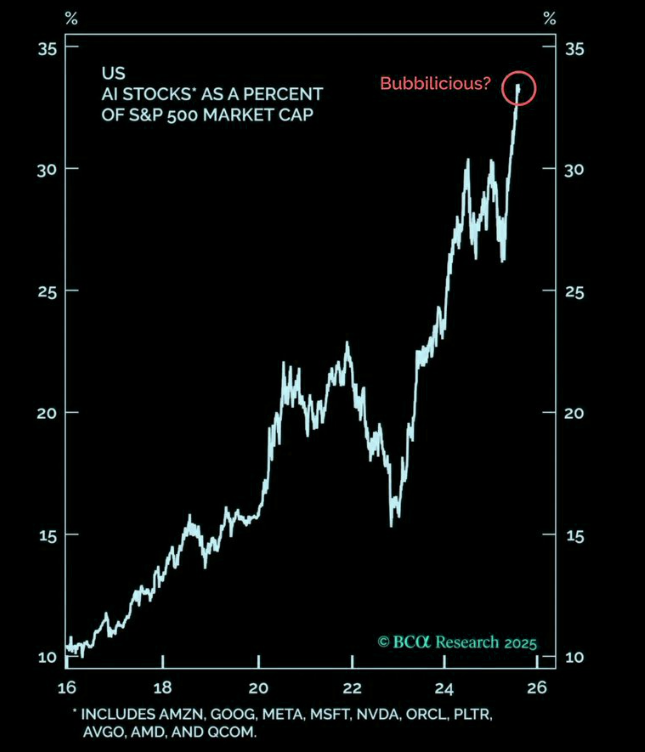

Mind the gap between AI and everything else

A little bit of a chart crime but it is BCA so we can include it…

Source: BCA

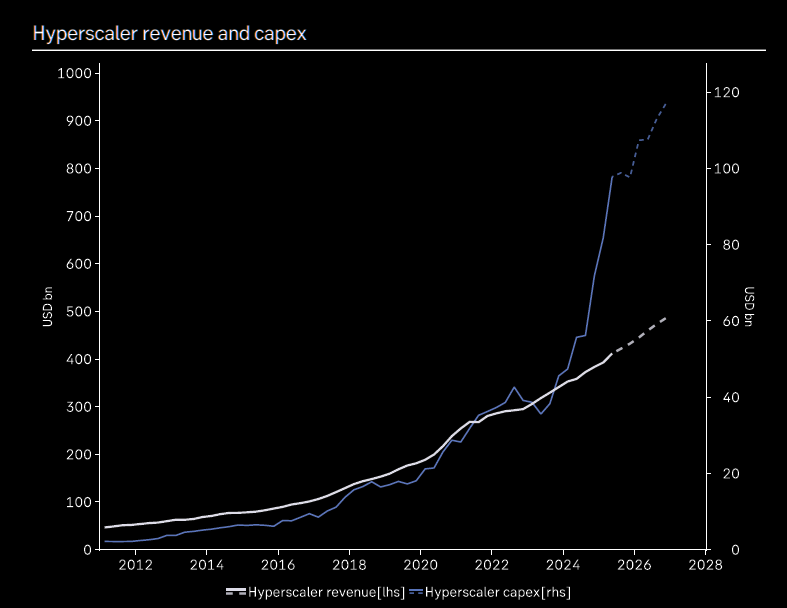

Mind this hyperscaler gap

Hyperscalers still on capex spree, but consensus estimates do not expect revenue to follow.

Source: Macrobond

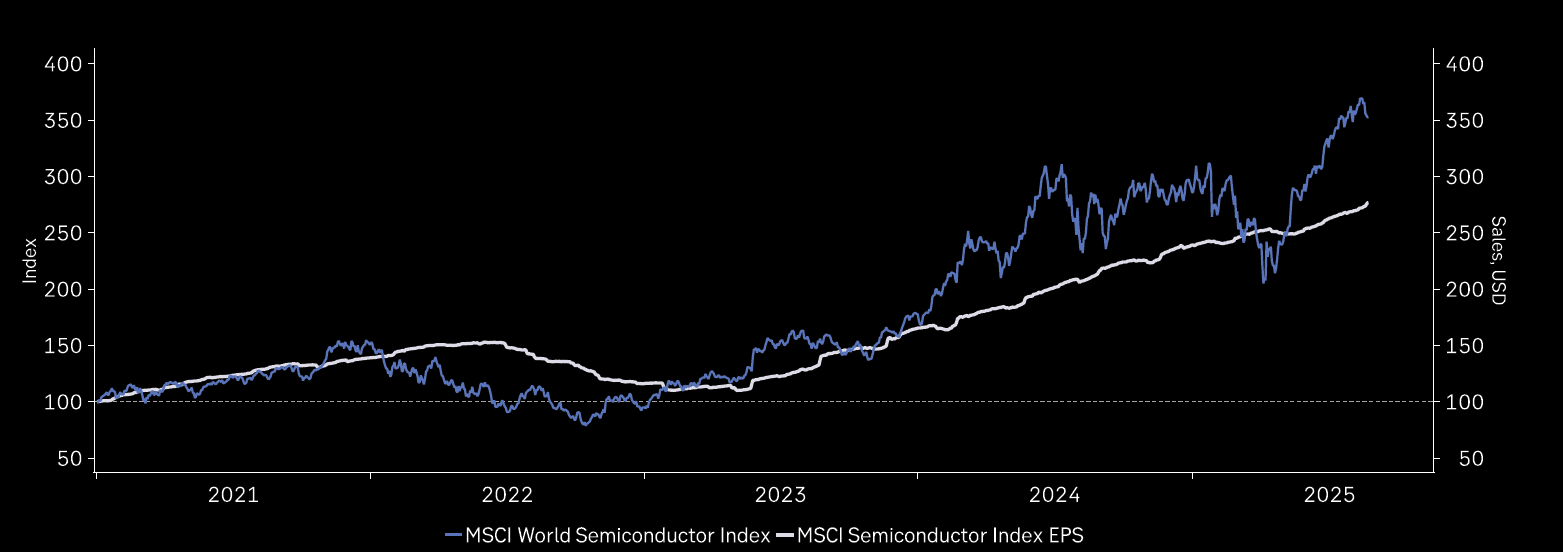

Mind the semis gap

Semiconductors trade at a historical high valuation as expectations outrun earnings.

Source: Macrobond

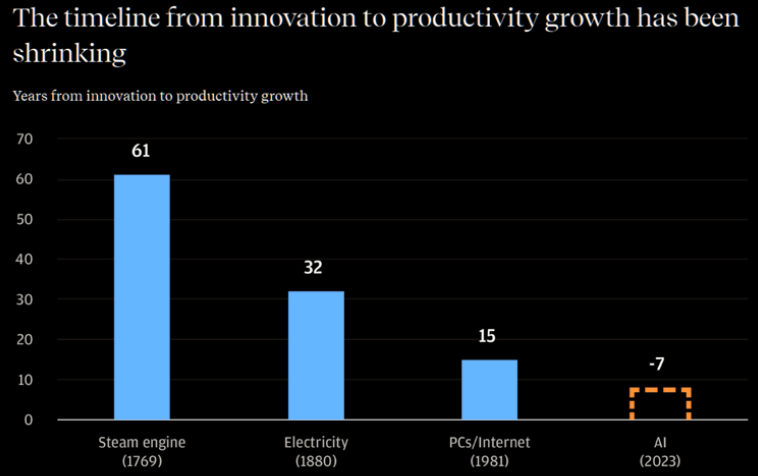

Mind the time lag gap

“As shown in the below chart, previous technological breakthroughs showed up in productivity statistics with multi-year lags. Notably, the lags shrunk over time. It took about 15 years for PCs to be reflected in productivity data, as it took time for the broader economy to adapt as organisations redesigned and optimised processes. We should expect a time lag too with GenAI, though likely much shorter.”

Source: Alpha Target

Mind the gap between valuation and revenue…

AI startups are raising at sky-high valuations, with multiples crossing 100x.

Source: CB Insights

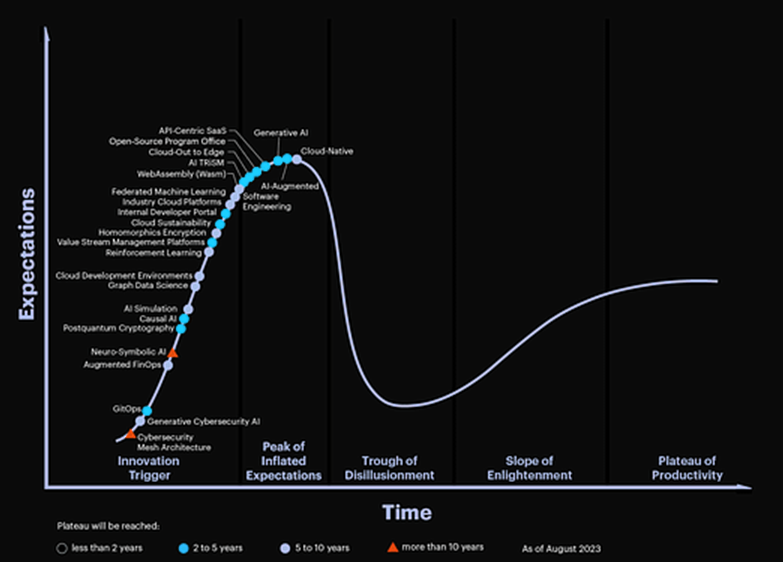

Mind the gap in the hype cycle

You need to know where you are in the Gartner emerging technologies cycle in terms of your diverse AI portfolio…

Source: Gartner

Mind the gap between the hype and the returns

MIT researchers said 95% of organizations are getting zero returns from their investments in generative AI.

Source: Gartner

That AI bubble

Not exactly a “gap” but still… Consider these two factoids and we can clearly see how the bubble talk in AI will continue to resurface every now and then.

1. There are now some 498 AI unicorns, or private AI companies, valued at $1 billion or more, with a combined value of $2.7 trillion, according to CB Insights.

2. How bad are AI startup unit economics? Here’s how the AI startup economy works right now: you, the user, pay an application-layer company $1. That company pays $5 to a foundation model provider, which then pays $7 to a hyperscaler, who finally pays $13 to a GPU maker.

Two things can be true at the same time

1. Has the market become overexcited about AI? Yes.

2. Is AI the most interesting most promising development of our time? Yes.1

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her