resume af analyse fra JP Morgan, bearbejdet til dansk, original tekst nedenfor

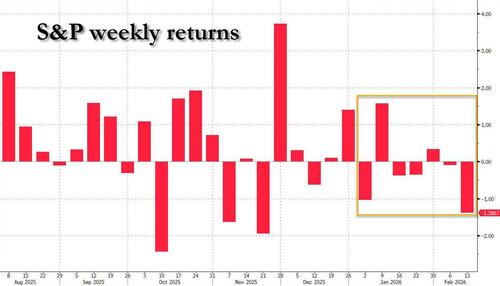

Efter en svag start på 2026 er det ikke de brede indeksbevægelser, men den ekstreme sektorrotation under overfladen, der definerer markedet. S&P 500 faldt 1,4 pct. i sidste uge – det svageste siden november – og har kun leveret positive ugeafkast i to ud af årets første syv uger. Alligevel dækker den relativt begrænsede indeksvolatilitet over en historisk høj spredning mellem sektorer og undersektorer.

Ifølge JPMorgans Market Intel-desk er vi tæt på et vendepunkt i det dominerende narrativ: frygten for, at kunstig intelligens vil gøre store dele af software-, service- og mellemmandsforretninger overflødige. Banken vurderer, at “AI Obsolescence”-fortællingen er ved at være udtømt – og positionerer sig til et modbounce ved at gå lang i en kurv af aktier, som anses for fejlprisede og relativt isolerede fra AI-disruption.

Ekstrem positionering: Semis mod Software

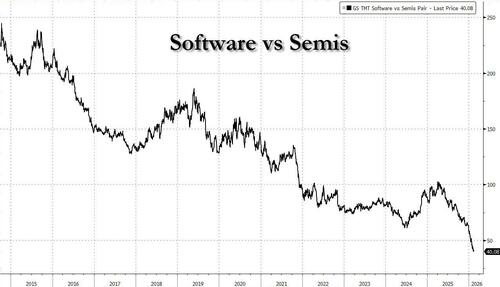

Den mest markante bevægelse i 2026 har været rotationen mellem halvlederaktier og traditionel software. Long semiconductors (SMH) mod short software (IGV) er steget knap 35 pct. år-til-dato – den mest ekstreme positioneringskløft, JPMorgans Positioning Intel-team nogensinde har målt.

Halvlederaktier handles i +4 z-score, mens software ligger omkring -3,5 z-score – en historisk divergens. Markedet har entydigt belønnet dem, der leverer “skovlene” til AI (chips og infrastruktur), mens softwareaktier er blevet solgt aggressivt på frygt for, at generativ AI vil kannibalisere forretningsmodeller baseret på licenser og abonnementsindtægter.

JPMorgan anbefaler dog ikke at shorte semis op til Nvidias regnskab, men signalerer stigende appetit på at købe software på dyk.

Spørgsmålet er, om markedet er gået for langt.

“Sell first”-mentaliteten under pres

JPM peger på tre nøglespørgsmål for den kommende periode:

Kan “sælg først”-reaktionen på AI brydes?

Kan MegaCap Tech genvinde sin strukturelle købsinteresse og løfte S&P 500 mod 7.000?

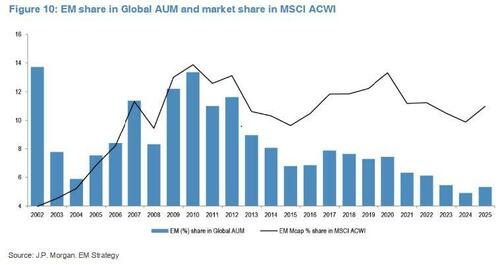

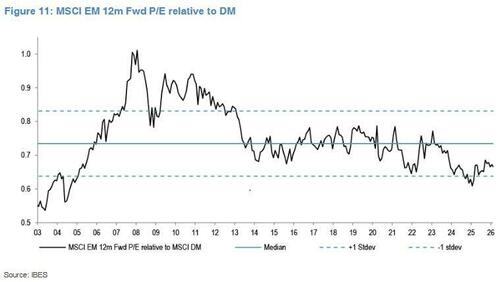

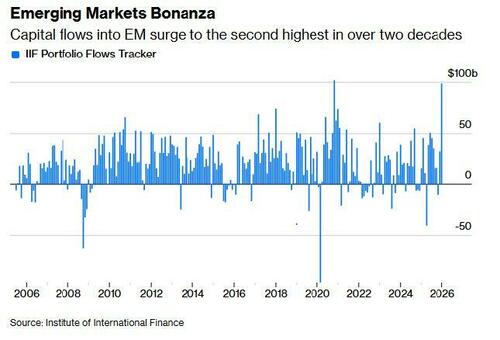

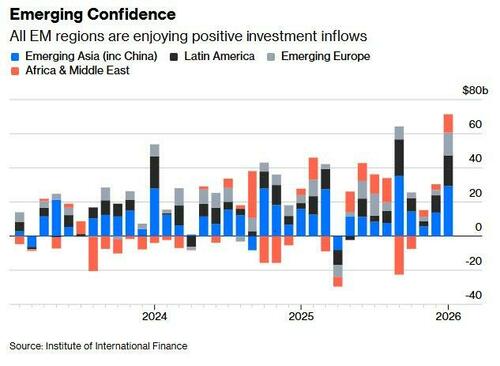

Vil kapitalstrømmen til internationale og emerging markets aftage?

En mulig katalysator kan være den igangværende India AI Impact Summit, hvor ledende aktører som Amazon, Google, Meta, Microsoft, Nvidia og OpenAI deltager. JPM vurderer, at markedet har behov for at høre direkte fra virksomhederne, at AI ikke udrydder softwareindustrien – og hvordan de konkret tilpasser sig.

AI-adoption eksploderer – men disruptiv effekt er uklar

Samtidig viser data, at AI-adoption accelererer kraftigt:

Andelen af amerikanske virksomheder med betalte AI-abonnementer er steget fra ca. 26 pct. for et år siden til 47 pct. i januar 2026.

90 pct. af organisationer forventer at øge AI-investeringer det kommende år.

Gennemsnitlig kontraktværdi for AI-løsninger ventes at stige næsten 2x over de næste 12 måneder.

Medarbejderdreven adoption er også tydelig: Over halvdelen af computerbaserede ansatte har adgang til AI via arbejdsgiver, og en betydelig andel anvender private AI-værktøjer i arbejdstiden.

Men JPM peger på en central pointe: Øget adoption er ikke ensbetydende med umiddelbar forretningsmodel-destruktion.

Software: Vanskeligt at “bevise et negativ”

Softwareanalytiker Mark Murphy fremhæver, at det er “vanskeligt at bevise et negativ” – dvs. bevise, at AI ikke vil ødelægge softwareforretninger om få år.

Problemet for sektoren er, at væksten allerede var aftagende efter COVID-årenes pull-forward og højere kapitalomkostninger. Samtidig er jobvæksten i USA gået fra 5 pct. årligt for fem år siden til nul i dag, hvilket presser sædebaserede abonnementer.

Markedets krav er blevet paradoksale: Traditionel software skal accelerere for at modbevise AI-truslen – netop i en periode med makroøkonomisk opbremsning.

JPM anbefaler en “barbell”-strategi mellem value og growth, fokus på solid fri cash flow og robuste, “sticky” indtægtsstrømme – frem for at acceptere aggressive værdiansættelser.

Finans og formueforvaltning: AI som marginløfter

Inden for finans har store banker leveret konstruktive meldinger om lånevækst, M&A- og IPO-pipelines samt omkostningsdisciplin. Alligevel faldt large cap-banker 6 pct. i sidste uge, drevet af konsensus-lange positioner og afvikling af gearing.

JPM ser dog købsanledninger i:

Forsikringsselskaber

Wealth managers

Argumentet er, at AI i disse segmenter sandsynligvis bliver en produktivitetsforbedrer – ikke en erstatning. Personlige relationer og kompleks rådgivning vurderes fortsat at være centrale.

Dog fremhæves, at yngre formuende generationer kan øge teknologipenetrationen over tid, og at AI kan løfte rådgiverproduktiviteten markant.

Logistik og life science: Overdrevet frygt?

Freight forwarding-aktier faldt tocifret efter en amerikansk AI-platform hævdede at kunne firedoble produktiviteten i transportformidling.

JPM er skeptisk over for, om AI reelt kan disintermediere branchen på kort sigt. Logistik er fortsat lavt digitaliseret og strukturelt forskellig fra fx rejsebranchen, hvor digitale platforme allerede har presset mellemled.

I life science tools og CRO-segmentet anerkendes en større nær-term risiko, men det er fortsat uklart, hvordan AI konkret vil påvirke efterspørgslen efter værktøjer og outsourcede forskningsydelser.

MegaCap Tech: Nøglen til global rotation

En vigtig dimension er den geografiske kapitalrotation. Emerging markets og internationale aktier har tiltrukket betydelige midler drevet af:

Strukturelt svagere dollar (JPM er fortsat USD-bearish)

Bedre indtjeningsudsigter i Asien (AI/memory) og Latinamerika (råvarer)

Cyklisk outperformance over defensivt

Men hvis MegaCap Tech genvinder momentum, kan kapital igen suges tilbage til USA, da de største techaktier fungerer som “asset magnets” i globale porteføljer.

JPM’s positionering: Global vækst og international eksponering

JPM fastholder fire overordnede temaer:

AI/TMT

Global Growth Reboot

Internationale investeringer

Dollar-debasement

I den aktuelle fase lægges særlig vægt på global vækst og internationale aktier, støttet af likviditet fra Kina og Japan.

Derudover anbefales:

Energi- og olieeksponering som geopolitisk hedge

Køb af volatilitet

Short momentum-faktoren

Short udvalgte squeeze-baskets

Men den centrale ændring i seneste note er vurderingen af, at AI-obsolescence-narrativet nærmer sig sin afslutning.

Konklusion: Er AI-frygten priset ind?

Markedet har bevæget sig fra eufori over AI som vækstmotor til frygt for AI som destruktiv kraft. Den ekstreme sektorpositionering antyder, at meget af den negative fortælling allerede er reflekteret i kurserne – særligt uden for chipproducenterne.

Hvis virksomhederne formår at dokumentere, at AI primært er en marginforbedrer snarere end en systemisk trussel, kan vi stå foran:

En konvergens mellem semis og software

Et comeback for MegaCap Tech

En afmatning i den aggressive internationale rotation

JPMorgan positionerer sig allerede til dette scenarie ved at opbygge lange positioner i aktier, der vurderes fejlprisede og relativt isolerede fra AI-disruption.

De kommende uger – med Nvidia-regnskab og fortsatte AI-konferencer – kan blive afgørende for, om markedets AI-frygt kulminerer eller forstærkes.

For investorer er spørgsmålet ikke længere, om AI ændrer økonomien – men om markedets prissætning af forandringen er blevet for ensidig.

Last week, the S&P fell 1.4%, its worst week since late November. It has been ugly since the start of the year: YTD, the SPX has seen positive weekly returns in only 2 of the 7 weeks and is now negative on the year.

Yet as JPM’s Market Intel desk writes this morning, and as anyone who has been trading in recent weeks knows too well, the relatively calm index moves do not reflect the unprecedented sub-sector volatility and dispersion.

The most meaningful sub-sector theme is tied to AI and the risk of obsolescence, which has roiled sub-sectors within Financials and Industrials as well as pushing the +Semis vs. -Software trade to the most extreme since the JPM Positioning Intel team has been tracking this metric.

This unprecedented negative sentiment (which we discussed earlier) has left the JPM desk wondering three questions:

- Can the ‘sell first’ mentality surrounding AI be broken?

- Can MegaCap Tech regain its ‘perpetual bid’ to aid SPX in breaching 7k?

- Do fund flows into International / EM Equities slow or reverse?

Below we excerpt from the latest JPM Market Intel note (available to pro subs), which attempts to answer these questions.

1. SHORT-CIRCUITING “SELL FIRST” AI MENTALITY & AI OBSOLESCENCE THEME

While JPM’s traders do not think that AI will eliminate all Software companies, the market may need to hear this from the companies directly as well as their mitigation strategies which points to the industry conference post-earnings, as the forum for reviving investor sentiment. JPM’s Philippe Lacroix believes that the India AI Impact Summit (Feb 16 – Feb 20) could be one such conference as it showcases C-suite and business unit CEOs from AMZN, Anthropic, GOOG, META, MSFT, NVDA, and OpenAI, among others. Could there finally be a convergence between Semis and Software? As discussed extensively here, +SMH (long semis) vs. -IGV (short software) has returned ~34.9% YTD with positioning showing Semis are +4z and Software -3.5z, the widest gap that JPM’s Positioning Intel team has ever seen. That said, the JPM Market Intel team does not advocate shorting Semis into NVDA earnings, but is increasingly warming to dip-buying Software (See below). Other sub-sectors affected are likely to see dip-buying opportunities, too (there is a deep dive on this below the US vs ROW section).

- Large Cap Banks (JP2LBK Index -6% last week): There were two major financial conferences this week and the message from large cap banks was overwhelmingly constructive (good loan growth, strong M&A and IPO pipelines, good expense discipline) but you would hardly notice it in the performance of these stocks. M&A brokers ended the week -7% as the market second guessed the strength of the pipelines. According to JPM, the -6% weekly drop reflects the nature of consensual long positioning and some definite signs of de-grossing.

- Additionally, Sector Spec Rob O’Dwyer is making dip-buying arguments for Insurance (JP2INS was -3.5% last week) and Wealth Managers (JP2RBK -3.7% last week), on the belief that AI is likely to be a margin expander and not an industry disruptor / replacement vehicle given complexity and relationship (i.e., a fallback to the old baseline that AI is only good for companies, and not disruptive).

2. MEGACAP TECH

YTD the SPW (Equal-weighted S&P 500) has outperformed SPX by 591bp with much of this explained by a -5.9% return from Mag7.

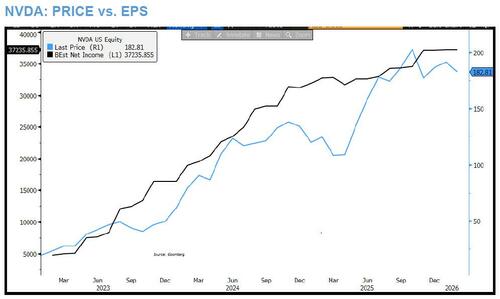

What changes this performance disparity? First, and has been the case since 2024, there needs to be a clearly stronger ROI from corporate clients given the market is punishing Mag7 for capex spend above expectations.

Next, the market needs to gain comfort with valuations which appear neutral / cheap ahead of NVDA earnings, an event which tends to cheapen the stock / group.

3. US vs. ROW:

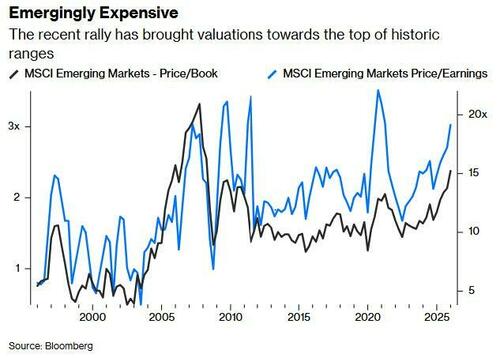

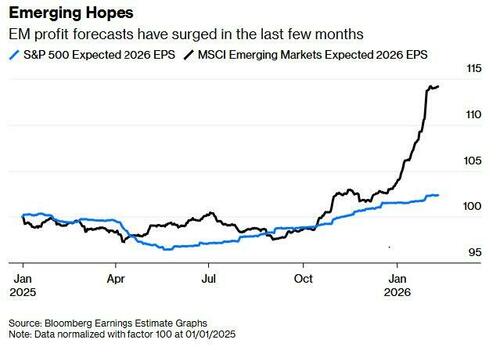

International / EM flows are being driven by (i) a structural shift in the value of the dollar; (ii) improving earnings prospects derived from AI / memory in APAC and commodity prices in Latam; and, (iii) the broadening of the rally, which is seeing Cyclicals outperform Defensives, Value over Growth, and Small-Caps over Large-caps, but is also expanding the trade ex-US.

Combine these points with below-benchmark EM allocations and there remains room to run, even if we see USD rebound (JPM maintains its bearish call on the USD). The key to the continuation of this “reverse rotation” is whether MegaCap Tech can rally since the AUM will hoover up assets from other asset classes, geographies, and sectors.

For investors playing the US performance recover, Market Intel thinks it prudent to retain an Int’l / EM allocation, even though emerging markets are now clearly at the top of historic ranges, despite a surge in expected EPS.

With these three core themes out of the way, we next take a closer look at the core premise of today’s note, i.e., AI Adoption vs Vulnerability, as several JPM traders shares their thoughts on the Obsolescence Narrative.

1. ENTERPRISE AI ADOPTION INSIGHTS (BREDA DUVERCE)

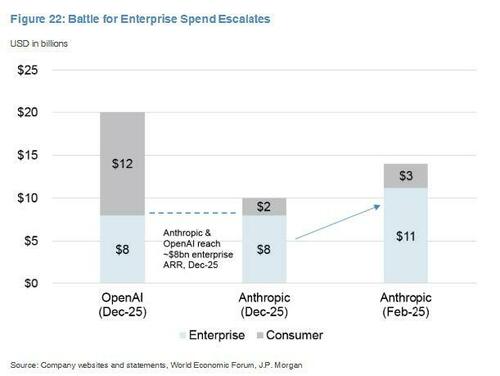

- AI adoption surging across U.S. businesses. Recent third-party data cites companies with paid AI subscriptions grew to ~47% in Jan 2026 (~26% 12 months ago). Over the next year, avg. AI contract value is projected to rise 1.9x (Ramp), and ~90% of organizations are expecting to increase AI spending (Wharton, Oct 2025).

- Pent-up employee demand for broader AI deployment. ~53% of computer-based workers in our survey receive employer-provided AI services, and of those who do not, ~38% are using personal AI services at work.

- Improved model capabilities driving adoption and use. User preference ranking data shows Google’s Gemini held the top spot overall (or tied #1) from July 2025 until this month, when Anthropic’s Claude Opus 4.6 surpassed it.

- Agentic tools gaining traction beyond coding. Claude Cowork and tools like OpenClaw are broadening agentic reach and raising SaaS disruption potential, but security and tech fragmentation factors still hinder adoption.

2. SOFTWARE (MARK MURPHY) – “Overall, our view remains to recognize the narrative shift we identified three years ago and position accordingly with a barbelled approach spanning value and growth, avoidance of overly-generous valuation frameworks, and consideration of top performers in our CIO survey work with appropriate FCF valuation support and resilient/sticky revenue streams.”

A few selected excerpts from Mark’s note:

- “We have recognized the difficulty of resolving the current debate because it is “difficult to prove a negative” (i.e., “prove that AI WON’T disrupt software companies in a few years”) and because the established software industry remains in a sluggish period of deceleration while US payroll growth has slowed from 5% five years ago to zero today. In addition, one fair criticism is that insider buying activity has largely failed to emerge, and that isn’t helping to instill confidence.”

- “We have further noted the difficulty of the current rules of the road – it is widely being stated that ‘traditional software has to accelerate, to disprove the AI-disruption thesis,’ and in many cases, the buy-side bars have magically RISEN while the stocks have dropped – while the broader software landscape, as noted above, has been consistently decelerating in the wake of the 2021 COVID pull-forward and subsequent cost-of-capital reset, while the US economy has stopped adding the jobs that usually drive software seat-based subscription volumes.”

3. WEALTH MANAGERS (ENRICO BOLZONI) – “On Tuesday, Altruist, a US tech platform for independent advisors, introduced an AI-powered Tax Planning tool for Hazel, its AI platform. The tool will help advisers create personalized tax strategies for clients based on their financial information.” Some more excepts from Enrico’s view:

- “While we believe that the market generally underestimates the importance that clients of financial advisers place on the personal relationship with their advisers, we note that different market structures across regions could lead to different levels of penetration of AI solutions, and we believe that financial advice firms will have to be proactive in adjusting their business models to cater for the needs of younger cohorts of clients, who are more likely to use technology to manage their finances, and are the recipients of the ongoing generational transfer of wealth. In a bull-case scenario, we also believe that AI could contribute to meaningfully increasing adviser productivity.”

4. AI RISKS IN LIFE SCIENCE TOOLS (CASEY WOODRING) “AI risk has also bled into the tools conversation, although this dynamic is more of a clear-cut debate in CROs in our view. Over the past two weeks we have also seen the tools group get caught up in the broader market AI sell-off, as investors weigh how pharma could use AI in drug development and manufacturing to potentially improve productivity and efficiency and thereby impact demand for tools and service providers. From our perspective, while we are not AI experts, it is more unclear to us how AI would apply to tools in its current state and over what time horizon. That said, we do acknowledge that the AI debate holds more near-term weight in the CRO space, particularly given some of the commentary we’ve heard this earnings season from the likes of MEDP, which said that internal AI-related productivity gains across pharma customers on the surface seem like a net-negative for a service company providing that same work externally.”

5. FREIGHT / LOGISTIC SERVICES (ALEXIA DOGANI) “On February 12th, the Freight Forwarding stocks (DSV, KNIN, DHL) significantly underperformed the market, down on average 10% vs. SXXP down 0.5% driven by the market’s reaction to the risk of AI disintermediating the asset light business model. This was triggered by a sell-off in US peer, CHRW, down 25% following a press release by Algorhythm Holdings highlighting that its SemiCab AI platform (an AI-driven collaborative transportation platform) can enable an individual operator to manage 2,000 loads pa, compared to a traditional broker of c. 500 delivering 4x productivity. The company noted that it is looking to expand the platform in the US and plan future international deployments, highlighting that ‘Freight is one of the largest industries in the world, yet it still operates on antiquated, labor-intensive models, by applying artificial intelligence at scale, we’re unlocking a new level of productivity, profitability, and resilience for the entire freight ecosystem.’.” Some more details from Alexia’s view:

- “The press release this afternoon highlighted that this new tool could potentially disintermediate the need for a broker / forwarder to transact and access capacity. We are skeptical on this point, especially as a forwarder is a service provider who is currently virtually integrating physical infrastructure which otherwise would be inaccessible. Freight remains very low on the digitalization curve (unlike the airline / hotel industry for instance where the travel agent business model has been structurally challenged).”

6. JAPAN IT SERVICES (MATTHEW HENDERSON) – “In Japan, large corporations are still heavily dependent on SIers, and in-house development of IT by Japanese corporations lags significantly behind that of other industrialized countries. Combined with a shortage of IT talent, Japan is already behind other countries in terms of AI adoption rates… we believe Japanese corporations are unlikely to independently accelerate their use of generative AI. As a result, we believe major structural changes are unlikely to occur in this environment, at least in the medium term. Over the long term, we see a high likelihood that companies will accelerate insourcing in response to SIers raising prices (improving margins through price hikes), as seen in overseas markets in the past. In this respect, advances in generative AI are likely to dramatically boost the productivity of IT talent, help alleviate the IT talent shortage, and support greater insourcing by companies.”

* * *

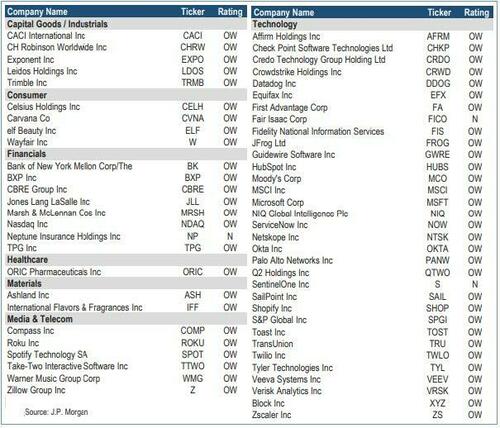

Putting it all together, the JPM market intel team reaffirms its latest monetization menu (from Feb 9), which stated a preference for core themes that JPM has written about YTD, namely (i) AI / TMT; (ii) Global Growth Reboot; (iii) International Plays; and (iv) Dollar Debasement; here, it would emphasize the Global Growth Reboot and International Plays given liquidity tailwinds coming from China and Japan. The bank also likes upside in crude and Energy Equities to hedge geopolitical risk, and likes portfolio hedges of buying vol, shorting Momentum factor, and shorting one or more of the JPMorgan Delta-One team’s squeeze baskets.

There is one notable difference in the Feb 17 note however: the bank says that while there were no changes over the past week, Market Intel thinks “we are getting closer to end of the ‘AI Obsolescence’ narrative, suggesting a dip-buying opportunity within MegaCap Tech”.

Finally, the Market Intel desk is trading the upcoming bounce by going long a basket of what it sees as the most mispriced stocks, which are “most insulated from AI disruption.” The members are listed below.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her