Få fri adgang til alle lukkede artikler på ugebrev.dk i 3 uger:

Tilmeld dig tre udgaver gratis af aktieanalysepublikationen ØU Formue, inden kampagnen udløber 31/8

Uddrag fra Bank of America:

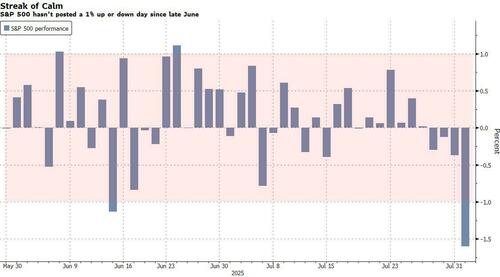

After this week’s (short but sharp) meltup by the Mag7 names following blowout earnings by META and MSFT (if not so much AMZN and AAPL), the market cap of the 7 largest tech names as a percentage of the S&P500 briefly surpassed their previous all time high of 31.8% set in January of 2025. It then, however, quickly reversed after Friday post-payrolls selloff, which saw the first 1% drop in the S&P since June 13.

So with just 7 stocks now accounting for literally a third of the S&P’s market cap, is this where the broader investing population finally calls time on the biggest and fastest rebound in history (from the April lows), or is this just the pause to a massively overbought market that refreshes?

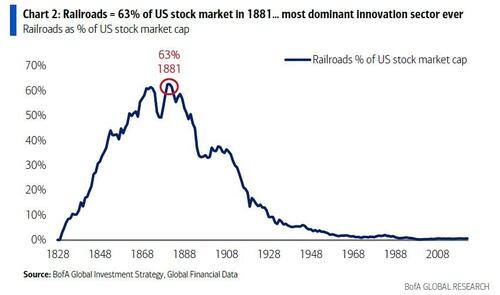

According to BofA’s Michael Hartnett, the meltup may well continue. That’s because as he notes in the zeitgeist quote to his latest Flow Show “The railroad stocks were more than 60% of market cap in the late 1880s… why can’t the Magnificent 7 get to the same level.”

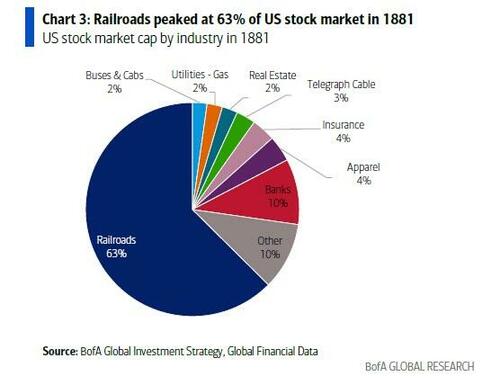

Indeed, as shown below, US railroad stocks, the dominant revolutionary monopoly at the time, peaked at 63% of US market cap in 1881…

… more than 6 times the second biggest sector at the time…

…. and they were not alone: here is a snapshot of other new paradigm concentration peaks:

- Nifty Fifty 40% of SPX (‘72),

- Japan 45% of ACWI (‘89),

- Tech 40% of SPX (‘00);

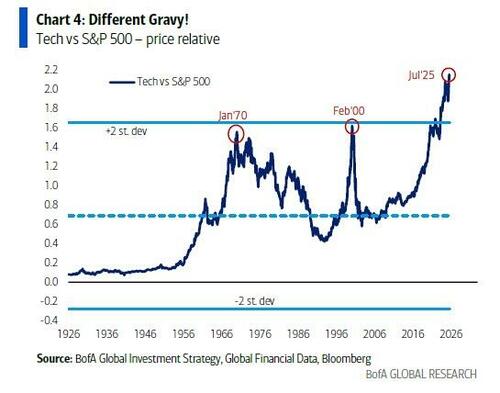

- US tech vs SPX at 100-year high in ’25,

- And Magnificent 7 stocks 32%of US market cap.

Turning to the latest Tale of the Tape, Hartnett writes that the biggest July “pain trade” was the 3% rally in US dollar (confirming what the June Fund Manager Survey already told us, see “Biggest Pain Trade Is Long The US Dollar”: Latest Fund Manager Survey Finds Everyone Is Short The Buck“), and follows the 11% decline in the first half; the catalysts for this pain trade are: i) extreme short positioning, ii) hawkish Fed, iii) RoW impacted by Trump tariff rates.

But here otherwise contrarian Hartnett joins the non-contrarian chorus and says that secular US debt & deficit dynamics remain unchanged, so shorts go back on as US dollar DXY index approaches 103 (200-day moving average). We disagree, especially since the coming recession will be far worse in Europe, Japan and China, not to mention EMs, but to each their own.

Hartnett then turns to the second biggest July “pain trade” which he finds was the 20bps flattening of US yield curve; here, too, Hartnett joins the crowd and predicts that it will flattens further (as the UST 10-year yield falls toward 4%) until the data flips Fed dovish (recall that the Fed 50bps rate cut 2 months before the election to help Kamal Harris sent yields soaring higher as the market priced in runaway inflation), but with the Fed hawkish for now, the long-end remains anchored.

A quick look next at the latest weekly fund flows where we find little loss of appetite for risk following $12bn in outflows from cash, while all other asset classes saw inflows: $19.6bn to stocks, $19.2bn to bonds, $1.9bn to crypto, $0.5bn to gold. According to Hartnett, these are the key flows to know:

- IG bonds: $10.2bn inflow… annualizing $313bn inflow (2nd highest ever);

- Global equities: $19.6bn inflow… annualizing $640bn inflow (3rd highest ever);

- US equities: $9.0bn inflow… annualizing $286bn inflow (3rd highest ever);

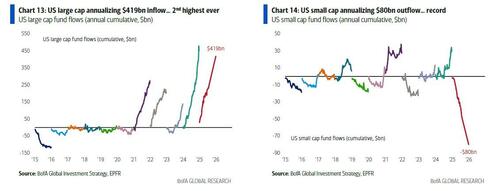

- US large cap: $14.0bn inflow… annualizing $419bn inflow (2nd highest ever);

- US small cap: $4.5bn inflow… but annualizing record $80bn outflow.

Based on this, it’s time to be loading up small caps hand over fist, especially once Powell’s replacement starts slashing rates.

Next, taking a look at foreign flows, we find that while sentiment is cooling toward US fixed income, appetite for US stocks remains at record highs:

- US Treasuries… $104bn inflows decade-to-date, $0.3bn inflows in 1H25… big slowdown in foreign buying;

- US corporate bonds… $61bn inflows decade-to-date, $3bn inflows in 1H25… big slowdown in foreign buying;

- US equities… $352bn inflows decade-to-date, $59bn inflows in 1H25… no slowdown in foreign buying.

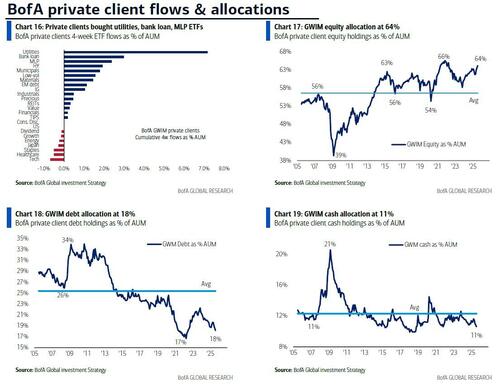

A similar picture emerges when observing the fund flows among BofA’s high net worth clients: with their AUM hitting $4.1tn (record-high), it consists 64.2% of stocks (highest since Mar’22), and 18.1% bonds (lowest since May’22), and 10.6% cash (lowest since Oct’21); A closer look at private client ETF flows shows that in the past 4 weeks private clients were buying utilities, bank loan, MLPs, selling tech, healthcare, staples.

The BofA Chief Investment Strategist then proceeds to the core of his latest note, namely the Macro, Momentum & Misfits trades.

According to Hartnett, markets are always trading the 3Ms – Macro, Momentum, and Misfit trades – which are:

- The macro trade in H1 was short dollar & steeper US yield curve – July reversal;

- H1 momo liquidity trade shifted from gold, crypto, international back to AI & Mag7;

- Misfit unloved contrarian trades remained bonds, oil, value, small cap, China.

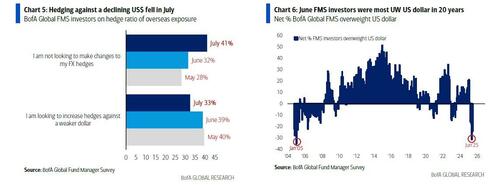

1. The Macro Trade: as we have discussed frequently in recent months, the dollar rallied on extreme short positioning, hawkish Fed, RoW impacted by Trump tariff rates; indeed, as we noted at the time, the June BofA Global FMS had investors most underweight the US$ in 20 years, one month later, the July FMS found that “short US dollar” was the #1 most crowded trade as the number hedging against falling dollar fell 40% May to 33% July.

But to Hartnett, the emotional bearishness on the US dollar masks a world that’s still long US assets (>$0.5tn inflows decade-to-date… >$60bn more inflows in ’25); and until trajectory of US debt & deficits changes, Hartnett says “investors fade US dollar DXY index (100) as it approaches 103 (200-day moving average).” Alas, since said trajectory will never change, that’s hardly the trigger to go long, especially since there is literally no other fiat currency that can replace the greenback. Of course, that doesn’t mean that there are no non-fiat alternatives. Quite a few in fact, which is why gold (+24.4% YTD), and bitcoin (+23.7%) are the two best performing asset classes YTD.

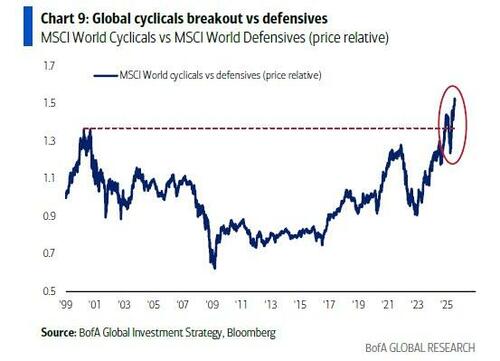

2. The Momentum Trade: The momo trade in gold, crypto, and international that defined the first half shifted back to US big tech in July on i) bullish exponential AI capex spend (soon >$400bn and 20-25% US equipment capex), ii) secular shift from humans to AI, iii) from big 68% US consumption % GDP to low 14% US investment % GDP; But in the short-term, the US big tech momo trade is now stretched, and bulls need new highs MAGS >$60, SOX >$6k, ARKQ >$100 to stay long; Hartnett says to stay long International as global investors will barbell US growth with RoW value stocks… Meanwhile, the RoW fiscal excess evident in global cyclicals breakout vs defensives…

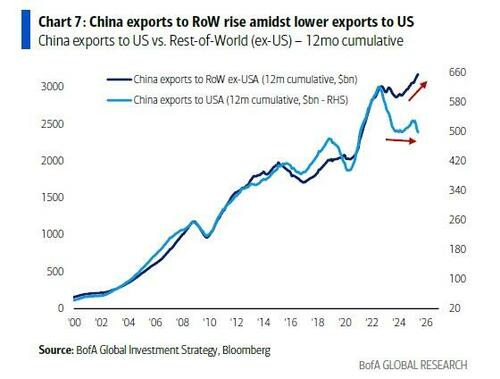

… and the big outperformance of intl small cap stocks YTD (e.g. China 35%, Europe 22%); Hartnett is also bullish on China because “no one long, China next in line for lower Trump tariff deal, exports to RoW strong, and less dependent on US.”

Hartnett also thinks that small cap action shows China credit/consumer/real estate deflation ending – no reason why H-shares can’t challenge 10k (ultimately 12k highs in 2021); And with Europe the focus of Russia/Ukraine conflict in August, Hartnett believes that “long gold/crypto is a structural trade in geopolitical world of sanctions & tariffs.”

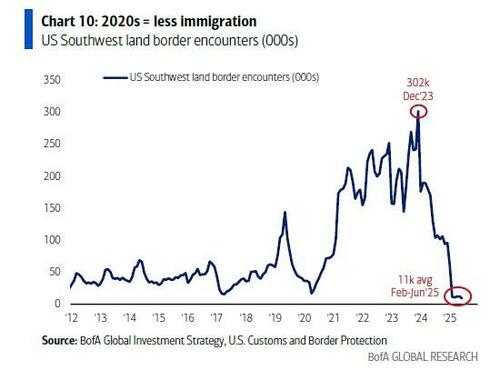

3. The Misfit Trade: As he noted last months, Hartnett reminds his readers that the 10-year rolling return from long bonds is a record low -1.3% in Jan’25, which is the same “buy humiliation” entry point as were stocks in Feb’09 (-3.4% rolling return, worst since 1939), commodities Jun’18 (-7.7%, worst since 1933), gold in Sep’22 (-1.5%, worst since 2002); but 2020s is a world of inflationary geopolitical Isolationism, government Intervention, less Immigration…

… and the possible end of Fed independence; And while Hartnett no longer sees case for a secular bull in bonds; with US Treasuries up +3% YTD, he expects further gains in H2 because:

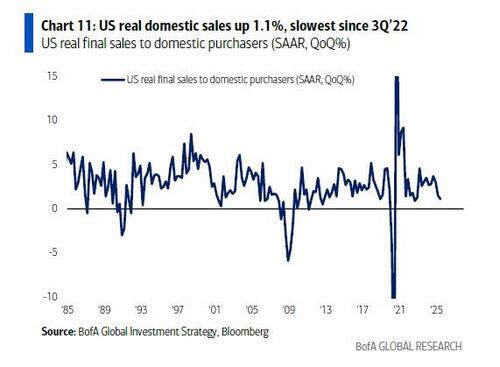

- US growth cooling (real domestic sales up 1.1% SAAR in 2Q’25, slowest since 3Q’22)

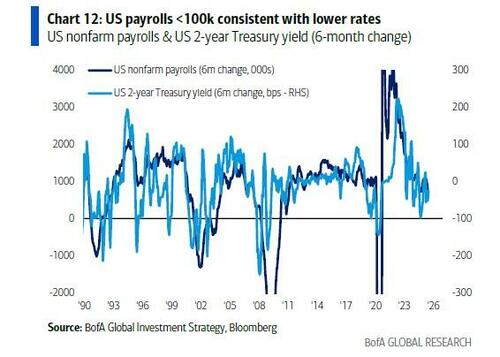

- labor market ambiguous but AI adoption starting and payrolls <100k consistent with lower rates

- Hawkish Fed tactically good for long-end; and low Trump approval rating (driven by inflation) means government intervention to lower prices (e.g. healthcare or lower tariffs);

- Pushback is rising to JGB yields (ground zero for bond vigilantes & rising Nasdaq (wealth effect), but too many interest rate sensitive sectors (RTY, REITs, XHB) discounting 5% not 4% yields

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her