Analyse fra Bank of Americas Harnett, bearbejdet til dansk:

Hvad ligger bag det dramatiske vendepunkt for amerikanske aktier?

På den ene side var den umiddelbare udløsende faktor annonceringen af gensidige toldsatser den 2. april. Det udløste en markant revurdering af USA’s rolle i den globale finansielle orden, men ifølge Hartnett er det blot den naturlige udvikling af begivenhederne de sidste fem år. Han udtrykker det således:

“2020’erne er årtiet for ‘store forandringer’, afslutningen på ‘Wall Streets’ optimistiske ‘globalisering’ – dette afspejles i den konservative 25/25/25/25-fordeling mellem kontanter/obligationer/guld/aktier, som er steget 4,7% år til dato (primært takket være guld og obligationer), mod -5,4% for den traditionelle 60/40-portefølje… og selvom 60/40 siden årtiets begyndelse har givet 4,6% årligt mod 3,8% for 25/25/25/25, er 60/40’s langsigtede merafkast på det laveste niveau i 14 år og falder hurtigt.”

En mere uudtalt årsag

Der findes naturligvis en anden, mindre omtalt grund til, at amerikanske aktier klarer sig så dårligt i forhold til resten af verden – en årsag vi opsummerede i sidste uge i følgende tweet, som fremhævede Federal Reserves mærkelige tilbagetrukkenhed under handelskrigen…

Det har ført mange til at spekulere i, at Fed i virkeligheden er en meget politisk aktør (som NEC-direktør Kevin Hassett, der sagde: “Denne Federal Reserves politik var at hæve renterne straks efter, at Trump blev valgt, for at hævde, at de udbudsside-skattelettelser ville skabe inflation. Fed-embedsmænd undlod dog at advare på tv og IMF-møder om den åbenlyse inflationsfare ved Joe Bidens massive udgifter. Og så sænkede de renten lige før valget”).

Og nu tør selv Bank of Americas strateg fremhæve det åbenlyse i sin seneste Flow Show-note:

“Fed sænkede renten med 50 bps i september, da aktiemarkedet var på rekordhøjde, og Atlanta Fed forudsagde +3% BNP-vækst. Nu nægter Fed at sænke renten efter et markedskollaps på 20%, hvor Atlanta Fed forudsiger -3% vækst.”

Fed kan ikke undgå at blive trukket ind

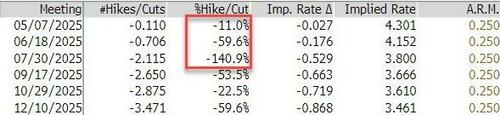

Powell kan forsøge, men vil ikke undgå at blive trukket ind i handelskrigen. Ifølge Hartnett er markedets sandsynlighed for en rentesænkning:

11% ved FOMC 7. maj

60% ved FOMC 18. juni

141% ved FOMC 30. juli

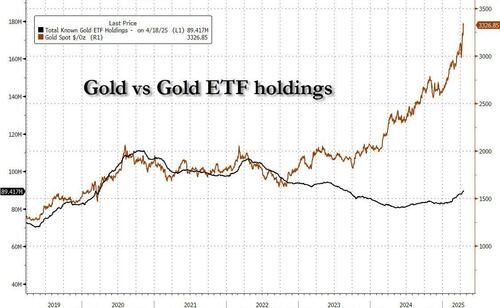

Guldpriserne som indikator

Et sted hvor Feds forestående dueagtige skifte er tydeligt, er i guldpriserne, som er eksploderet til nye rekordhøjder i de seneste uger og måneder.

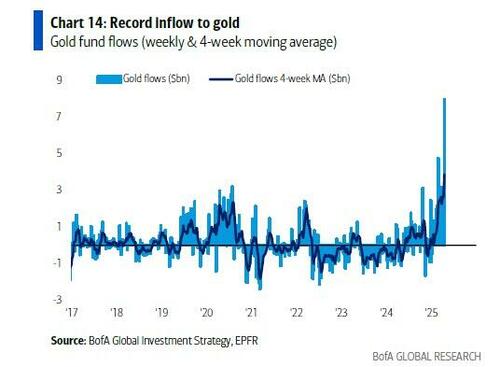

ETF-investeringerne har i årevis ignoreret udviklingen, men nu begynder de at følge trop: Hartnett rapporterer rekordstore $8 mia. i ugentlige inflows i guld – større end $7,9 mia. i aktier, trukket fra $0,3 mia. i krypto, $20,1 mia. ud af obligationer og hele $72,4 mia. ud af kontanter (største udstrømning siden jan. 2025).

Andre vigtige kapitalstrømme

IG-obligationer: største 2-ugers udstrømning siden juni 2022 ($11,1 mia. ud denne uge)

Globale aktier: $7,9 mia. ind denne uge, $250 mia. år til dato

Europæiske aktier: største inflow siden maj 2017 ($6 mia.)

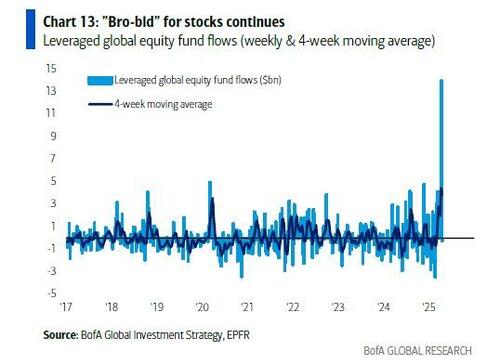

Gearing-ETFs: lille udstrømning på $0,3 mia. efter rekordstor inflow sidste uge på $14 mia.

Udenlandske strømme

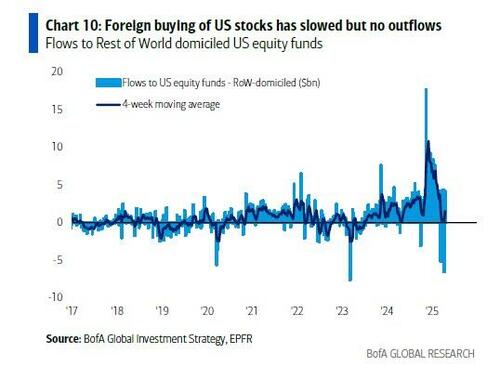

Til amerikanske aktier: $2,1 mia. inflow over de sidste tre uger – køb er aftaget siden dec. 2024, men ingen udstrømning; udlændinge ejer $16,5 mia. eller 18% af amerikanske aktier

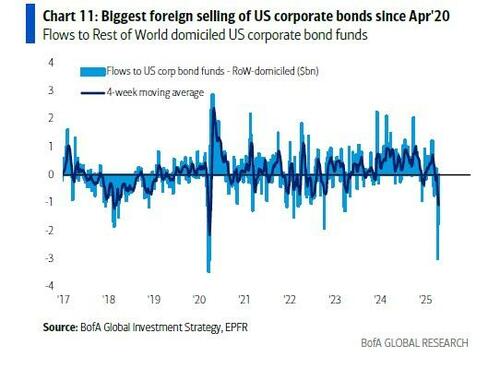

Til amerikanske erhvervsobligationer: $4,6 mia. udstrømning – største salg siden april 2020; udlændinge ejer 27%

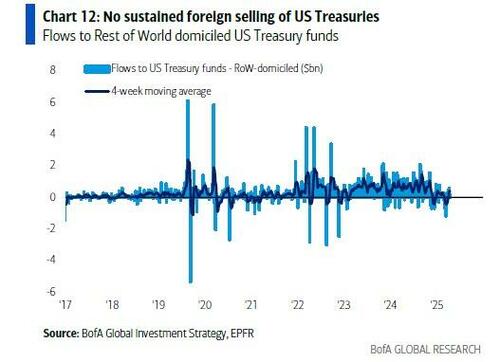

Til amerikanske statsobligationer: $1,2 mia. inflow – ingen vedvarende udstrømning; udlændinge ejer 33%

Sentiment og markedspsykologi

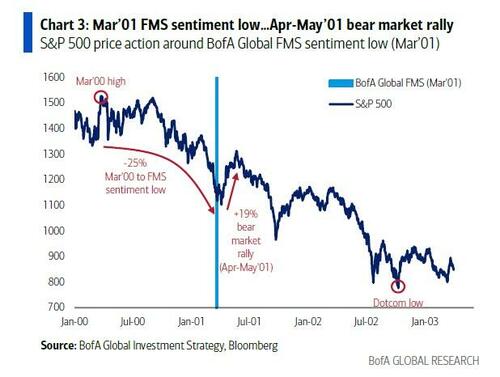

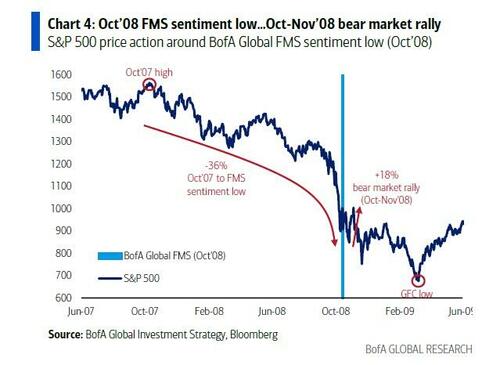

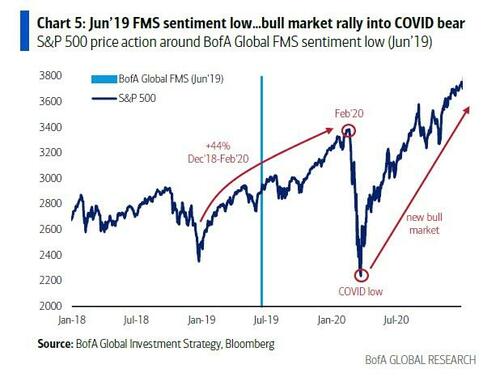

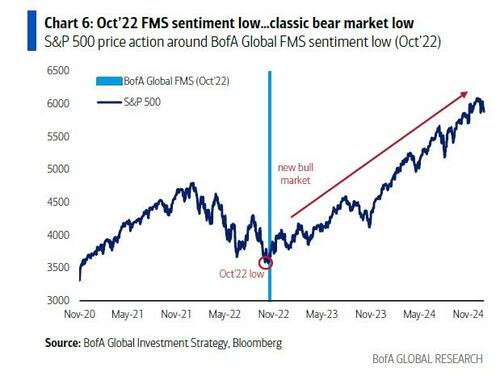

Hartnett gør grin med sin egen Fund Manager Survey fra april – den 5. mest pessimistiske i 25 år. Tidligere sentimentbunde har udløst stigninger, men Hartnett advarer:

“Politik og profit vil afgøre, om det er et bear market rally eller starten på et nyt bull market.”

Tidligere eksempler:

Marts 2001 → kort 19% bear market rally

Okt 2008 → kort 18% bear market rally

Juni 2019 → 44% bull market rally frem til COVID

Okt 2022 → klassisk bund, start på nyt bull market

Men i dag? Selvom stemningen er apokalyptisk, placerer få faktisk short-positioner.

Fremadrettet strategi

Hvis toldnedsættelser, skattelettelser og rentesænkninger udebliver, kan pessimismen blive selvopfyldende. Hartnetts forventninger til politik i resten af 2025:

Inauguration til Memorial Day (26. maj): Trump bringer de dårlige nyheder (DOGE, told)

Memorial Day til Labor Day (1. sept.): aggressivt skift til skattelettelser, deregulering og energipolitik

Labor Day til 31. dec.: bullish momentum drevet af skattelettelser, Fed-rentehævninger og fald i olie/renter/dollar

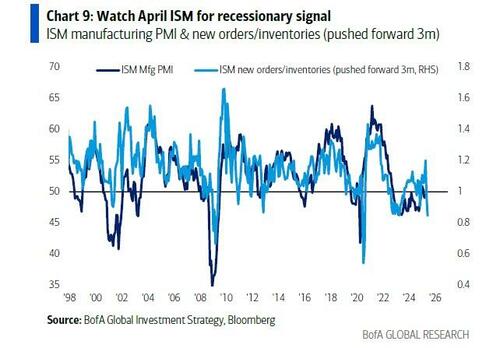

Profitter og indikatorer

Ifølge Hartnett ses klar evidens for, at forbrugere og virksomheder handler proaktivt før toldforhøjelserne 2. april – f.eks. via:

Stigende amerikansk detailsalg

Hoppende varelagre i produktion

Eksport fra Kina og Taiwan

Tegn på, at hårde data skifter til bløde:

Detailsalg i USA falder

Første ledighedstal overstiger 250k

ISM-rapporten 1. maj viser stigende lagre, faldende nye ordrer → recessionstegn

Hartnetts markedsudsigter

Q2 2025: sælg i styrke indtil Fed og Trump skifter kurs

Resten af 2025: køb obligationer (DOGE og recession), internationale aktier (slut på amerikansk dominans), guld (mod USD-svækkelse og politiske fejl)

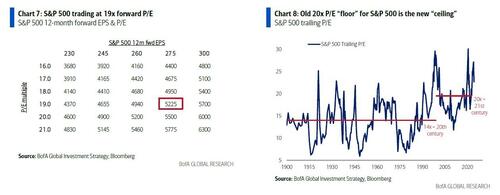

2020’erne generelt: høj inflation og renter, boom/bust-cyklus, skift fra globalisering til isolation, fred til krig, AI, ældning – derfor vil S&P 500s P/E på 20x ikke længere være gulv, men loft

Afsluttende visdom

Et citat fra afdøde Charlie Munger:

“Hvis du kun købte kvalitetsaktier, når de ramte 200-ugers glidende gennemsnit, ville du slå S&P 500 med stor margin over tid.”

Hartnetts tolkning: S&P 500’s 200-ugers gennemsnit er 4685, 50-ugers gennemsnit er 5685 – det er spændet.

What’s behind this dramatic reversal of fortune for US equities? On one hand, the proximal catalyst was the April 2 reciprocal tariff announcement (which we warned the market was dramatically underestimating back in February) which sparked a stark reassessment of the US role in the global financial order, but which Hartnett would argue is just the natural evolution of events in the past 5 years, to wit: “2020s is the decade of “big change,” end of “Wall St” bullish “globalization” – this is manifesting in the conservative 25/25/25/25 cash/bonds/gold/stocks “permanent portfolio” up 4.7% YTD (mostly thanks to gold and bonds) vs –5.4% for traditional 60/40 portfolio…and while decade-to-date 60/40 is annualizing 4.6% vs 3.8% for 25/25/25/25, the 60/40 long-run outperformance at 14-year low and plunging fast.

Of course, while mostly unspoken, there is another reason why US stocks are underperforming the rest of the world so dramatically, a reason which we summarized last week in the following tweet, highlighting the Fed’s peculiar aloofness in this time of trade wars…

… one which has led many to speculate that the Fed is truly a very political animal (such as NEC Director Kevin Hassett, who said that “the policy of this Federal Reserve was to raise rates the minute President Trump was elected last time, to say that the supply-side tax cuts that were going to be inflationary. Fed officials opted not to go on TV and at IMF meetings and warn about the terrible inflation from the obvious runaway spending from Joe Biden, and the obvious runaway spending from Joe Biden was textbook inflationary. And then they cut rates right ahead of the election”) and now even the Bank of America strategist dares to highlight the obvious in his latest Flow Show note (available to professional subs):

Fed cut 50bps in Sept when stock market at record high, Atlanta Fed was forecasting +3% US GDP growth; Fed now determined not to cut rates after 20% market plunge, Atlanta Fed forecasting -3% GDP growth

However, try as he might, Powell will not be able to avoid getting dragged into the trade war, and Hartnett points out that market probabilities for a Fed cut are 11% at May 7th FOMC, 60% at June 18th FOMC, 141% at July 30th FOMC.

One place where the Fed’s looming dovish pivot is more than obvious, is the prices of gold which has exploded higher in recent days, weeks and months to unseen record highs (not surprisingly Hartnett’s latest Flow Show is titled, well, see for yourself…

… and while ETF flows had for years ignored the move, they are finally starting to jump on the bandwagon: according to Hartnett, the latest weekly data shows a record $8.0 billion inflow into gold, even greater than the $7.9bn into stocks, offset by $0.3bn out of crypto, $20.1bn out of bonds, and a whopping $72.4bn out of cash (biggest since Jan’25).

Besides the all time high Gold ETF inflows…

… here are some other notable flows to watch:

- IG bonds: biggest 2-week outflow since Jun’22 ($11.1bn outflow this week);

- Global stocks: $7.9bn inflow this week, and huge $250bn inflow YTD;

- European stocks: biggest inflow since May’17 ($6.0bn);

- Leveraged equity ETFs: tiny $0.3bn outflow this week after record $14bn inflow last week…the “bro bid” for stocks continues

- Foreign flows to US stocks: $2.1bn inflow past 3 weeks…buying has slowed since Dec’24 (Chart 10), but no outflows; foreigners hold $16.5tn or 18% of US stocks

Foreign flows to US corporate bonds: $4.6bn outflow past 3 weeks…biggest selling since Apr’20 (Chart 11); foreigners own $4.4tn or 27% of US corporate bonds

Foreign flows to US Treasuries: $1.2bn inflow past 3 weeks…no sustained foreign selling; foreigners own $8.5tn or 33% of US Treasuries

Hartnett next joins us in mocking his own monthly Fund Manager Survey, writing that the just released April survey (full report here for pro subs) was the 5th most bearish in past 25 years and noting that price action around the past 4 prior big FMS sentiment lows (measured by growth expectations, cash levels, equity allocation) says “always a rally”… but the caveat is that Policy & Profits will determine if it is just a bear market rally or shiny new bull market, to wit:

- Mar 2001: short 19% bear market rally Apr-May 2001:

- Oct 2008: short 18% bear market rally Oct-Nov 2008:

- Jun 2019: bull market rally of 44% into the COVID bear of Mar 2020:

- Oct 2022: classic bear market low, start of new bull market.

That said, there is one reason why one should doubt the pervasive bearishness: while sentiment is apocalyptic, and everyone is ultra bearish, few are actually putting (or shorting) their money where their mouth is.

According to Hartnett, while investors are extremely “emotionally” bearish, they are not extremely “physically” bearish, i.e. institutional & private clients have not sold hard. But Hartnett warns that will change if US tariff/tax/rate cuts don’t materialize to sustain investor belief in subconscious second half of 2025 bullish policy “roadmap:”

- Inauguration Day to Memorial Day (May 26th) would see Trump frontload “bad news” of DOGE/tariffs

- Memorial Day to Labor Day (Sept 1st) would see aggressive pivot from bearish trade policy to bullish tax cut/deregulation/energy policy, and

- Labor Day to Dec’31st is all bull momentum from tax cuts, Fed cuts, and lower oil/yields/dollar.

As for profits, the BofA strategist sees unambiguous evidence of consumers & corporations frontrunning US tariff

increases on April 2nd “Liberation Day”: these include surging US retail sales, a jump in US manufacturing inventories, China/Taiwan exports. Amid this background, the best evidence that “hard” data is transitioning to “soft” in coming weeks will be i) US retail sales reverse March gains, ii) initial unemployment claims range of 200-250k past 3 years is broken to upside; and the biggest tell would be the May 1st ISM manufacturing report showing the inventory index rising from 53.4 to >55, new orders index dropping from 45.2 to <40, signaling new orders/inventories ratio (big lead indicator) dropping to recessionary levels.

As for Hartnett’s own market views, these can be summarized by the time horizon in question: the quarter, the year and the decade, to wit:

- Q2 2025: selling-into-strength until Fed cutting rates and Trump cutting tariffs, and credible pivot to tax cuts; as he noted before, the recession math says nibble SPX 5.4k, bite 5.1k if you think policy panic imminent, or wait to gorge 4.8k which prices in short/shallow recession

- 2025 long BIG: long Bonds to play DOGE & peak US deficits/debt, hedge recession, hedge topping process in stocks; long International stocks to play end of US exceptionalism, US “Magnificent 7” flipping into “Lagnificent 7, start of big Europe/Asia monetary & fiscal ease; long Gold to play US dollar bear market, hedge risk “new world order” policy mistakes (US tariffs, Fed intransigence, Trump-Powell battle, China-EU bromance, China export dumping in Europe, UK pivoting to EU, Japan stimulus checks with 5% inflation, Iran war)

- 2020s: an era of higher inflation and rates (periodically interrupted by recession/credit events), US debt and dollar debasement, booms and busts in wide equity trading range, driven by new trends in society (inequality to inclusion), policy (monetary to fiscal), trade (globalization to isolationism), capital (repudiation of US assets), geopolitics (peace to war), tech (AI), environment (energy/food security), demographics (aging)…means that 1. average S&P 500 P/E of 20x thus far this century (Charts 7-8), and 2. “floor” for S&P 500 P/E of 20x in past 5 years of monetary/fiscal excess, 50% surge in nominal GDP, AI boom/bubble…no longer tenable; 20x is the new ceiling; old bear markets in real estate, commodities, value stocks the new relative bull markets.

One final observation from the BofA Chief investment strategist, which is a quote from the late Charlie Munger:

“If all you ever did was buy high-quality stocks on the 200-week moving average, you would beat the S&P 500 by a large margin over time”

To Hartnett this translates as follows: “S&P 500 200-week MA currently 4685, 50-week MA is 5685 – that’s the range.”