Uddrag fra JP Morgan og Refinitiv:

| Time for tail hunting after the violent squeeze |

| On July 7 we outlined our “un-fundamental” logic for a possible vicious squeeze in our thematic email: What is the squeeze case for equities? (premium subs only, sign up here) We wrote: “In conclusion, the most bullish thing we can say is that we could not really come up with any convicting bullish arguments. And we know from previous experience, when stocks rally and very few can say why and it looks absurd and un-fundamental sometime those are the most vicious rallies”. Fast forward to today and the SPX is up more than 300 points since that note. The case for chasing stuff here is obviously less attractive. Our main take from here is to wait for cheap optionality to start showing up as people puke volatility as inverse panic hits markets. We are probably not there yet, but getting close. It is time to start looking at various tails, all depending on your needs. There is always a possibility of something unexpected occurring. Chart showing the SPX 2008 vs now analogy. Maybe not a likely scenario, but you should always think about tails when VIX pukes… |

Refinitiv Refinitiv |

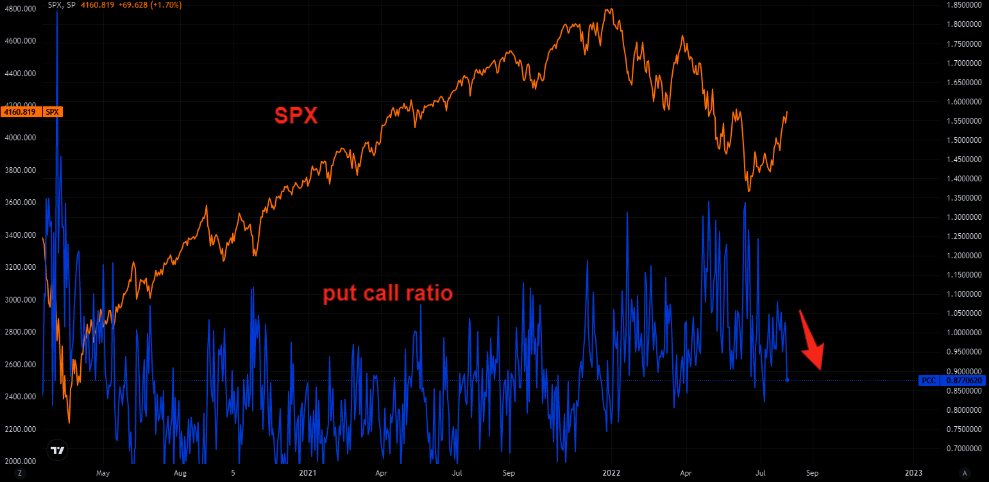

| Put puke is back |

| We are not at extreme levels, but more and more people are explaining “hedges” only cost money. We have been waiting for the inverse panic to kick in. Ideally we get VIX to low 20s and then start looking at long volatility set ups. These strategies would be both in the form of downside hedges, but also replacement strategies etc, where using relatively cheap optionality is the main driver of hedges. |

Tradingview Tradingview |

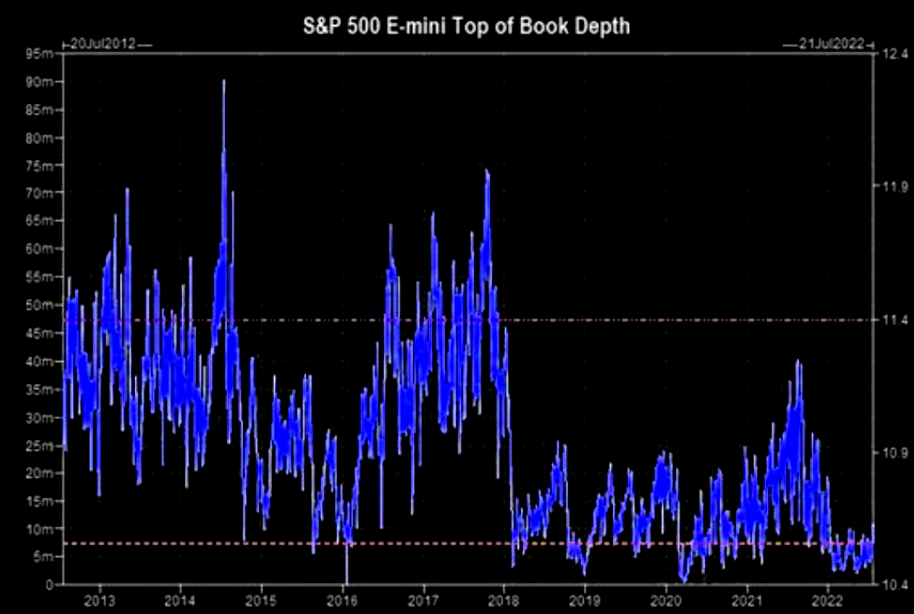

| Never forget – liquidity “pain” works both ways |

| Blame the computers for the squeeze. From early last week: “Systematics have made a “silent” come back, but things could get much more dynamic should we squeeze even higher. Recall what GS wrote on Monday: Skew over the next 1 month: FLAT = $41B to buy / DOWN BIG -$15B to sell / UP BIG +$162 BILLION TO BUY Don’t forget extremely poor liquidity tends to work both ways…. |

GS GS |

| Goldilocks doing a Victoria’s Secret: not as sexy anymore |

| Barclays summarizing the situation in markets pretty well in two short sentences: “The emerging Goldilocks narrative for equities is that bad data and peak inflation will prompt more dovish CBs. We are sceptical and would fade the rally, cognisant that bearish sentiment/positioning can extend the short squeeze” (Barclays Equity Strategy) |

| Macro Mavens: short equities |

| Chart shows Macro HF beta to equities. |

JPM JPM |

| Recall the exuberant VIX? |

| VIX refused buying much of the SPX bear. Regular readers of TME are familiar with the “exuberant” VIX, but this “out performance” is now gone as the gap between SPX and VIX is closed. Things are not as clear going forward… |

Refinitiv Refinitiv |

| Oil – haven’t seen this in a long time |

| Brent is currently trading below the 200 day moving average. We haven’t seen oil close below the longer term moving average in a very long time. We stick to our non consensus bearish oil view outlined in our thematic email in late June, Oil – last man standing? A close slightly lower and things could get rather nasty for black gold. |

Refinitiv Refinitiv |

| This demand is cratering |

| US gasoline demand ain’t looking pretty. |

MPAS MPAS |

| US buybacks robust |

| US buybacks rebounded in 2021, after a very subdued 2020. This year again, we have seen strong momentum in buyback announcements thus far. Chart shows S&P500 announced buybacks. |

JPM JPM |

| US buybacks: more to go |

| Buybacks as a share of profits are still low. |

JPM JPM |