ABN Amro vurderer, at en amerikansk rentesænkning er udskudt til 2. kvartal. Det bygger på den amerikanske centralbankchefs rapport til Kongressen. Inflationen kryber opad.

Uddrag fra ABN Amro:

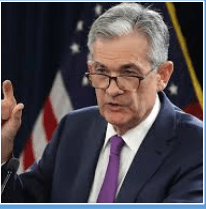

Fed View: Policy to ‘remain appropriate’, but for how long? – Chair Powell spoke in his semi-annual testimony to Congress today, broadly reiterating the stance from the last FOMC meeting press conference on 29 January. The key message continued to be that current policy ‘is likely to remain appropriate’ unless ‘developments emerge that cause a material reassessment of our outlook’ – in which case, the Fed would ‘respond accordingly’. However, in the same speech, Powell pointed to two potential sources of a ‘material reassessment’ – first, the fallout from the coronavirus outbreak in China, the disruption from which is currently causing us and many other analysts to review our own outlooks. On this, Powell said ‘we are closely monitoring the emergence of the coronavirus, which could lead to disruptions in China that spill over to the rest of the global economy.’ Second, Powell referred to the continued undershoot in inflation, which on the Fed’s preferred measure (PCE inflation) stood at 1.6% in 2019, well below the symmetric 2% target. Powell reiterated the Fed’s expectation that ‘over the next few months’ inflation will ‘move closer to 2%, as unusually low readings from early 2019 drop out of the 12-month calculation.’ While these base effects will indeed push inflation temporarily higher up to March, beyond here PCE inflation is likely to fall back down to closer to 1.5%, with if anything a risk of weaker outturns given that some of the pipeline pressures – in wage growth and housing costs – have been cooling. As such, the Fed’s expectations look overly optimistic to us.

We push our rate cut call to Q2 – With that said, the stronger tone to the recent jobs data and the signaling from Fed officials makes it unlikely that the Committee will cut at the 17-18 March FOMC meeting, and we are therefore pushing back our rate cut forecast to Q2. Ultimately, we expect weaker growth in the US, combined with soft underlying inflation, to push the Committee to cut a further 25bp. However, with the US domestic economy proving more resilient to the global slowdown in recent months, the Fed will likely be reluctant to ease until it sees clearer signs of a passthrough from weak manufacturing and exports to services and consumption.