Merrill venter, at de amerikanske aktier fortsætter opad i 2020, og cykliske aktier som forbrug, finans, teknologi vil føre an. Store selskaber har en overvægt i forhold til small cap. Samtidig vinder ikke-amerikanske aktier ind på amerikanske.

Uddrag fra Merrill:

It is a new year and new decade but our market expectations for 2020 are similar to 2019. In a nutshell, we expect U.S. equities to continue to grind higher, led by cyclical sectors like consumer discretionary, financials, industrials and technology. We maintain our high quality bias in equities, preferring large caps over small caps, and our U.S.-centric basis relative to Rest of World equities.

However, we do expect international equities to close the performance gap with the U.S. in 2020, and have tactically become more constructive on non-U.S. equities. Thematically, we favor such sectors as robotics, ecommerce, healthcare, defense and cyber security, and clean energy/waste management. The bull market in equities, in other words, rumbles on, supported by a number of variables, including monetary accommodation from the world’s top central banks, a trade truce between the U.S. and China, and reflationary fiscal measures in some of the world’s largest economies—think the U.S., Europe and China. Today’s market backdrop could not be more different from a year ago.

Then, global monetary conditions were tight, U.S.- China trade tensions were escalating, and there was little talk or support for global fiscal Chartered Financial Analyst® and CFA® are registered trademarks owned by CFA Institute. 4 of 9 January 6, 2020 – Capital Market Outlook easing. Fast forward to today, and the opposite conditions are in play—looser money, calmer trade and easing fiscal conditions. Granted, with the S&P 500 posting whopping total returns in excess of 30% last year (see accompanying “Thought of the Week”), a great deal of good news has already been priced into various assets.

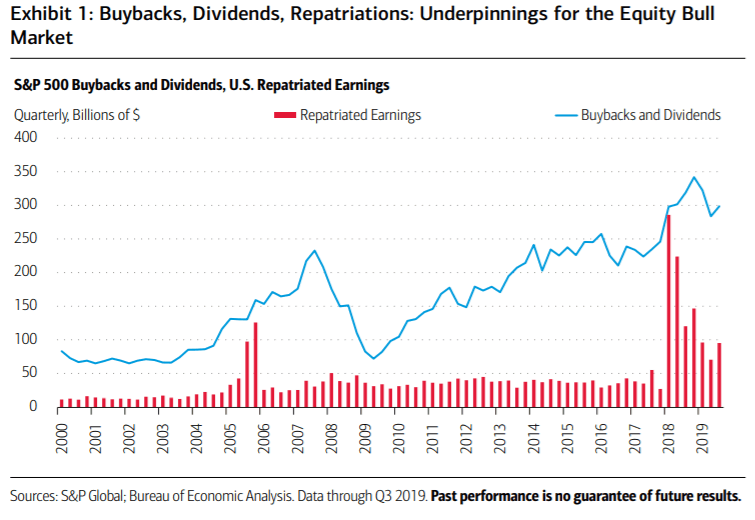

Also boosting 2019 returns: repatriated U.S. earnings and the attendant boost in buybacks and dividends. On this front, U.S. multinationals are estimated to have brought home almost $350 billion in foreign profits this year, more than double the average in the years leading up to tax reform. In total, an estimated $1.1 trillion of overseas earnings has returned to the U.S. in the two years since the U.S. changed its corporate tax code.