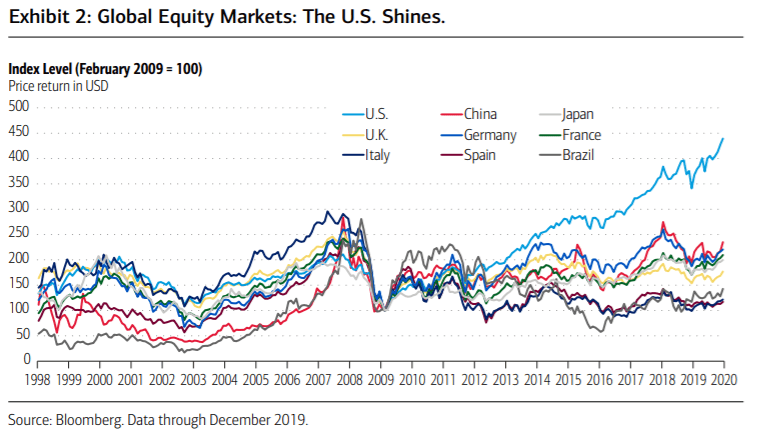

Merrill vurderer, at markederne er blevet en jungle med nationalisme, anti-globalisering, økonomisk krig mellem USA og Kina og med uro i Mellemøsten, men alligevel vil USA tiltrække investorer. Det er dér, kurserne stiger mest. I junglen er den amerikanske Silverback gorilla stadig den dominerende.

Uddrag af Merrill:

The liberal international order of the past seven decades is fading. Deglobalization is

gaining traction. Global supply chains are fracturing, as is the global internet. The United

States and China, once strategic competitors, are now ironclad foes. The Middle East is a

boiling cauldron of strife and instability. Populism, nationalism and authoritarianism—this

triad is undermining the global post-WWII order that handsomely rewarded investors

with solid long-term investment returns.

All of the above, of course, is anathema to the capital markets. Investors prefer

open borders, free trade, unfettered capital flows, competition yet cooperation, and

multilateralism. They prefer, quite naturally, the world as it used to be, not as it is: an

unruly jungle that has caused a spike in geopolitical risks over the past few years, with

the U.S.-Iran confrontation just the latest example.

But that said, and acknowledging that yes, it’s a jungle out there, it’s important for

investors to realize where America stands amid the planet’s wild habitat. In the hierarchy

of the jungle, think of the United States as a silverback—or the older, stronger and

domineering economic beast of the planet, challenged by up-starts but still top gorilla.

Betting against the U.S. corporate sector has been a losing proposition for nearly a

decade. Distracted by divisive politics and a 24/7 negative news cycle, many

investors have been blinded to the underlying strengths and pillars of the U.S. economy.

Now they are fearful of a world without a leader, a planet without a hierarchy. The jungle.

While we are not oblivious to the multiple challenges in front of America—a crumbling

physical infrastructure, burdensome entitlement expenditures, the rising cost to service

America’s debt, an unwieldy healthcare system, anti-trade and immigration sentiment—

America’s multiple strengths give it ample opportunity/ammunition to address its

weaknesses. Stay long America—the economic silverback in a jungle of a world.