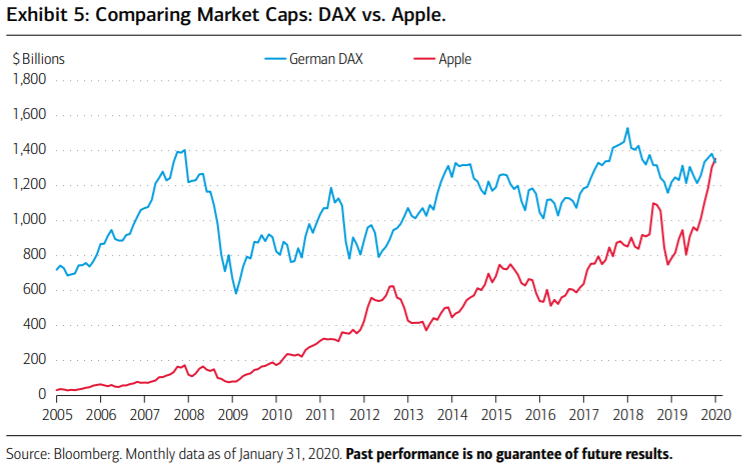

Den digitale kløft mellem USA og Europa slår kraftigt igennem i disse år, og det illustreres i, at Apple er blevet mere værd end samtlige 30 tyske DAX-selskaber. Europa er fastlåst i kampen mellem USA og Kina.

Uddrag fra Merrill:

The Transatlantic Digital Divide

It’s an open secret that the European Union currently woefully lags the United States and Asia in terms of technological capabilities, but Exhibit 5 brings the point brutally home.

The market capitalization of Apple is now greater than the 30 largest publicly traded, blue chip companies in Germany. Relative to the FAANGs4

(market cap = $3.9 trillion), Germany, along with the rest of Europe for that matter, is a digital pygmy.

The digital divide reflects many variables, namely Europe’s tepid risk-taking culture and underdeveloped venture capital markets, which stunts the growth of startups and minimizes the chances of game-changing, technological moonshots. America’s risk perceptions and preferences are more aligned with Asia than Europe. China, Japan and South Korea are formidable (and investable) technology players;

the same cannot be said

of Europe’s largest economies like Germany, France and the United Kingdom.

Owing to Europe’s underwhelming tech ecosystem, the region now finds itself

technologically stuck in the middle of the great U.S.-Sino rivalry over the next generation of wireless networks. The United Kingdom has already agreed to use the equipment of Chinese telecom giant Huawei, while other countries are leaning in the same direction, against the wishes of the U.S. The end result: an even greater digital divide between the U.S. and EU, and the rising risks of transatlantic trade tensions over technology.

As Exhibit 5 illustrates, the digital gap between the two parties is already extraordinarily large—and threatening to future transatlantic commerce and the earnings of both U.S. and European firms.