Uddrag fra Atlanta FED/Zerohedge:

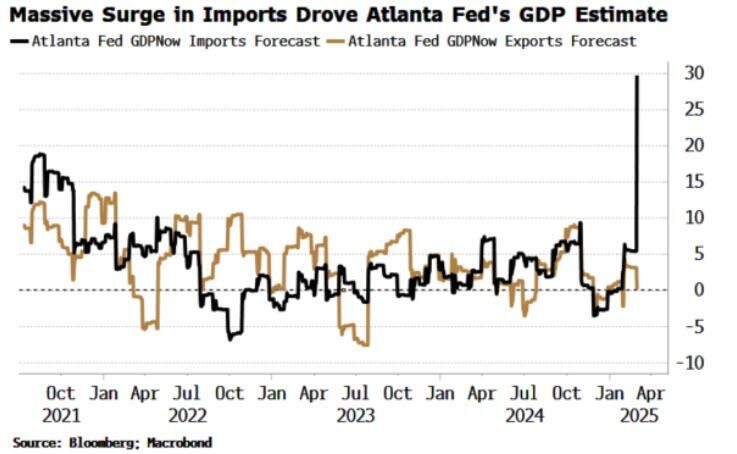

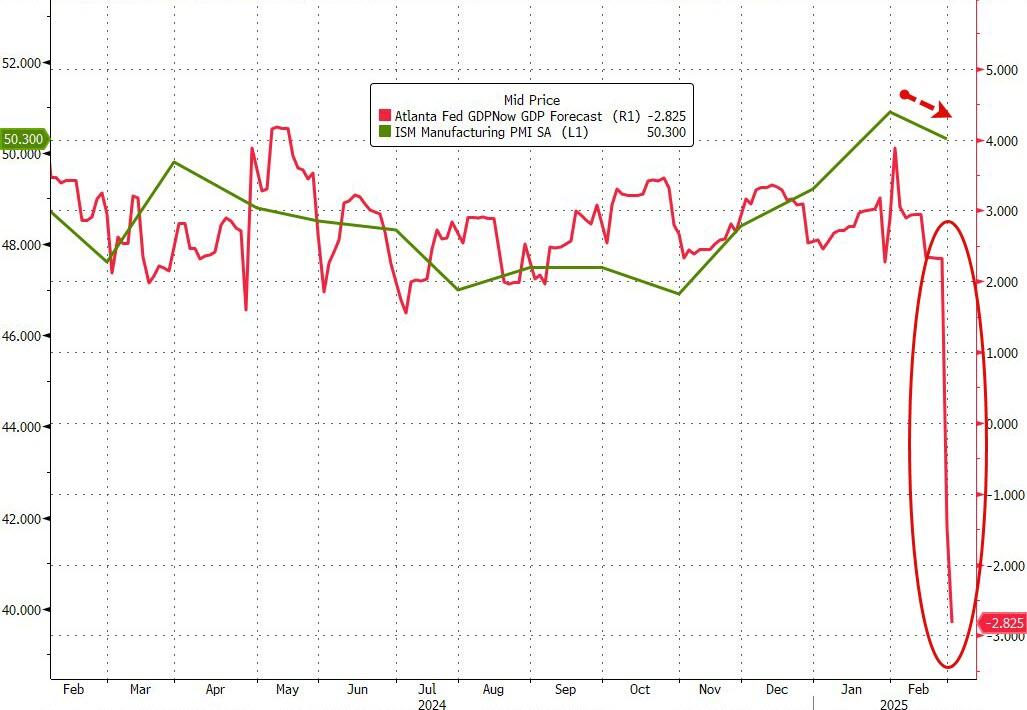

In the peace of two business days, The Atlanta Fed’s GDPNOW forecast for Q1 2025 has collapsed from +2.33% to -2.825% – a stunning 510bps plunge in growth expectations.

Today’s drop to a 2.825% contraction is the worst forecast for GDP since the COVID lockdowns in 2020…

Source: Bloomberg

Friday’s plunge was blamed on the trade deficit, as we detailed earlier:

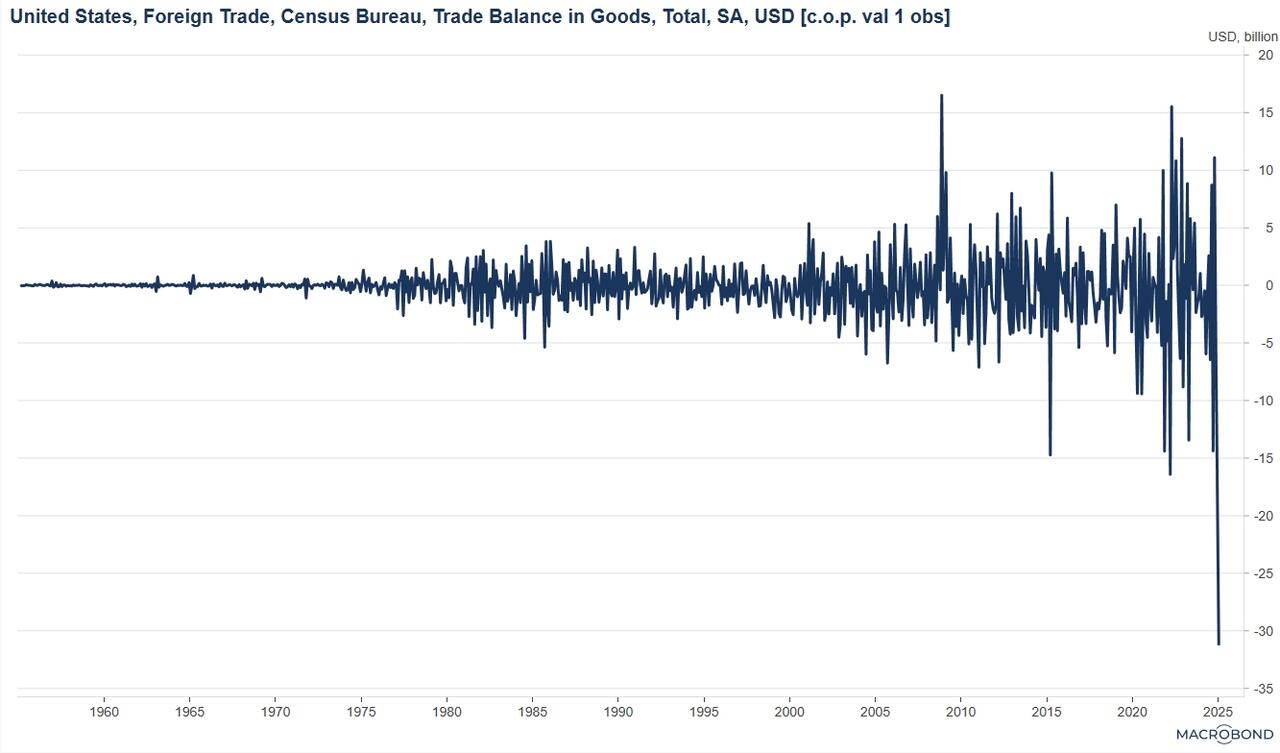

The January Goods Trade Deficit fell to a record -$153 billion versus expectations of -$116 billion.

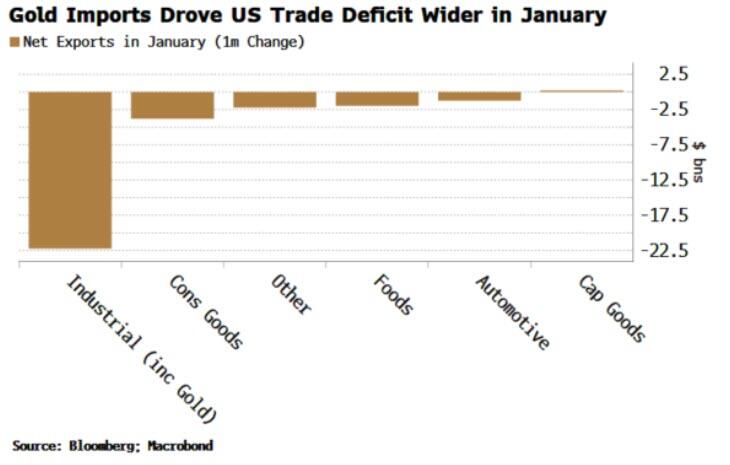

Moreover, as we share below, courtesy of MacroBond, the monthly decline of $31 billion is more than double any other instance since 1955. Imports rose by 12% while exports increased by 2%. The steep decline in the trade deficit is primarily due to US companies front-running tariffs. Approximately $22 billion of the $31 billion, or about two-thirds of the decline, came from industrial supplies. Consumer goods ($4 billion), food and beverages ($2 billion), and other goods ($2.3 billion) account for the bulk of the rest of the change. A similar large trade deficit will likely be reported for February.

The steep decline, mainly due to tariffs, will likely normalize over the coming months. The import demand will be less than typical as inventories for specific products are now bloated for those frontrunning the tariffs.

However, as we detailed here, most of the widening in the trade deficit in January was driven by a surge in gold imports.

We have discussed previously the dynamics in the gold market that has led to a jump in the amount of the metal leaving Europe and heading to the US.

It is likely to do with an ongoing squeeze in the physical metal in vaults in London and Switzerland driven by several years of EM central-bank hoarding – so nothing to do with cyclical economic growth in the US.

Today’s plunged from -1.5% to -2.8% was blamed on this morning’s blip lower in ISM Manufacturing survey:

After this morning’s releases from the US Census Bureau and the Institute for Supply Management, the nowcast of first-quarter real personal consumption expenditures growth and real private fixed investment growth fell from 1.3 percent and 3.5 percent, respectively, to 0.0 percent and 0.1 percent.

Now, to help people clarify what the fuck is going on here, the ISM Manufacturing survey (a soft survey data point being used to forecast hard data economic growth), fell from 50.9 (expansion) to 50.3 (still expansion)

So, to clarify – a 0.6ppt decline in the noisy-as-fuck ISM Manufacturing (which remains in expansion) was enough to drive The Atlanta Fed’s forecast for economic growth to its most recessionary since the COVID lockdowns?

Of course, as Treasury Seretary Bessent opined earlier, the all-too-convenient narrative is, of course, that this is all Trump (and Musk’s) fault.

In fact, as Bessent explains “We’re seeing the hangover from the excess spending in the Biden 4 years. In 6 to 12 months, it becomes Trump’s economy.”