Der er atter kommet gang i den kinesiske økonomi, udtrykt ved den såkaldte credit-puls, og det vil præge udviklingen i 2020. Da Kina står for en tredjedel af verdens økonomi, får fremgang betydning for reten af verden.

Uddrag fra Saxo Bank:

In today’s edition, we focus on the Chinese economy. The latest data released tend to confirm a cyclical rebound is at work. In last December, there have been a massive jump in imports (+17.7%) and in exports (+9%) in CNY terms. On the top of that, inflation (PPI and CPI) is finally at a turning point. We expect that the rebound in PPI will continue and that PPI will turn positive in Q1 while higher CPI is likely in the short-term due to stronger demand for pork in January ahead to the Spring Festival that will take place the last week of January. However, afterwards, we should see lower CPI will could give more room for maneuver to the PBoC.

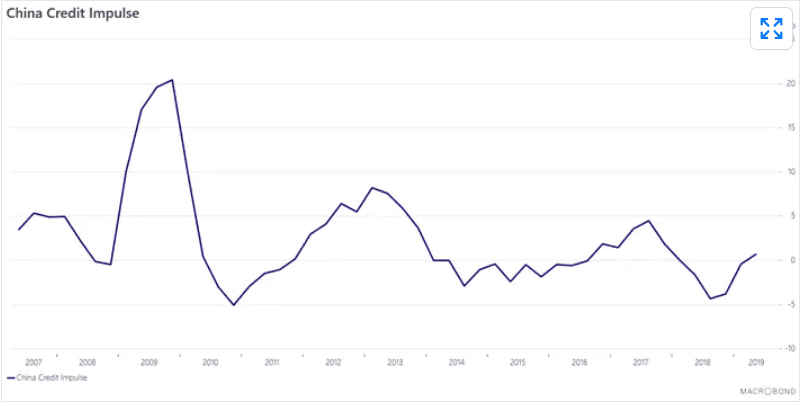

The improvement in data is consistent with our leading indicator for the Chinese economy, credit impulse, which leads the real economy by 9 to 12 months. It is back in positive territory for the first time since the end of 2017, running at 0.7% of GDP (chart below). This is certainly one of the most important macroeconomic news of the past months. As China represents about 1/3 of global growth impulse, positive credit impulse means we could see the constructive global ripple effects in the coming months.

We believe China’s growth will significantly improve in Q2 2020 on the back of positive credit push, lower political risk and more debt stimulus. The US-Chinese trade deal won’t solve all the issues, but it should help both countries to focus on stimulating domestic growth. Over the past few hours, we have had more information regarding the details of the agreement. One of the main Chinese commitments is to purchase $200bn of goods ($75bn for manufacturing goods, $50bn for energy, $40bn for agricultural goods and $35 to $40bn of services) but, as mentioned previously by our Head of Commodity Strategy, Ole Hansen, such an amount is unlikely to materialize.