Uddrag fra John Authers:

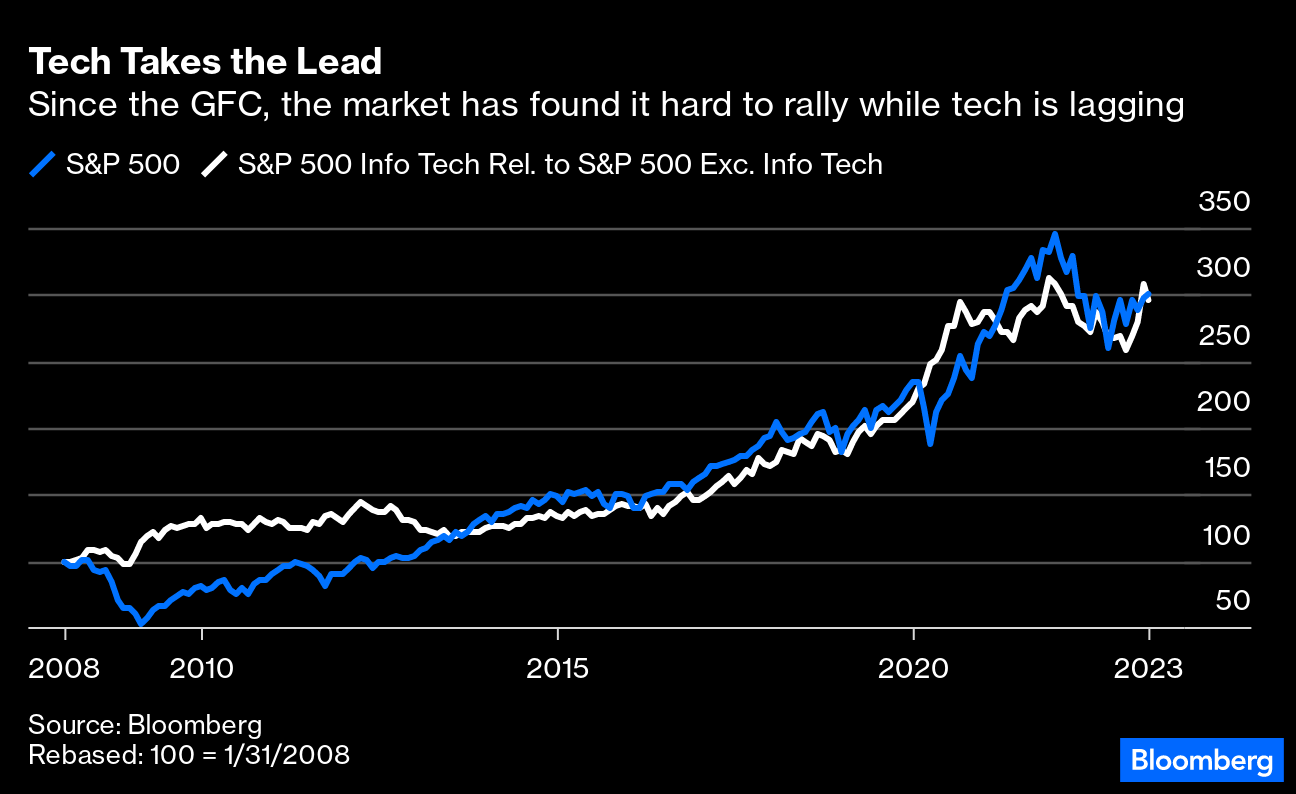

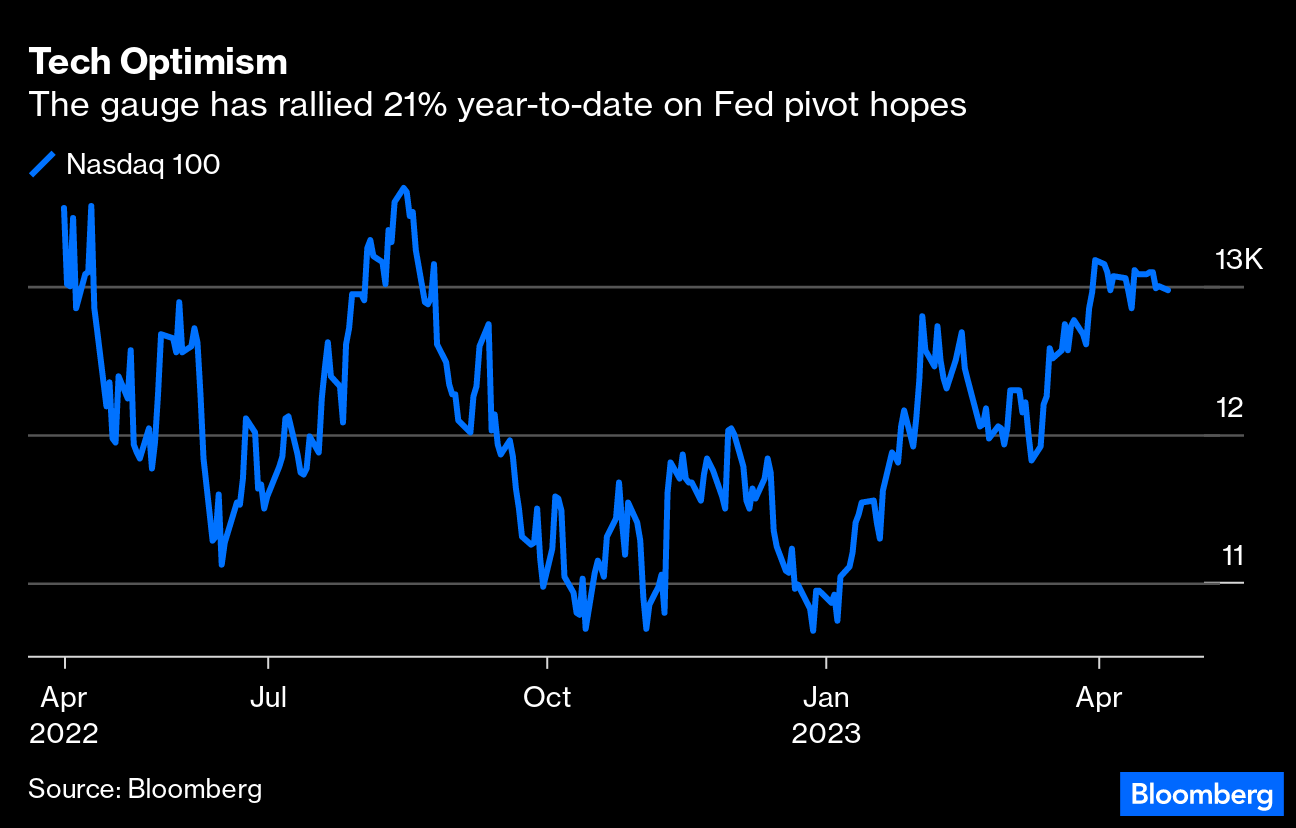

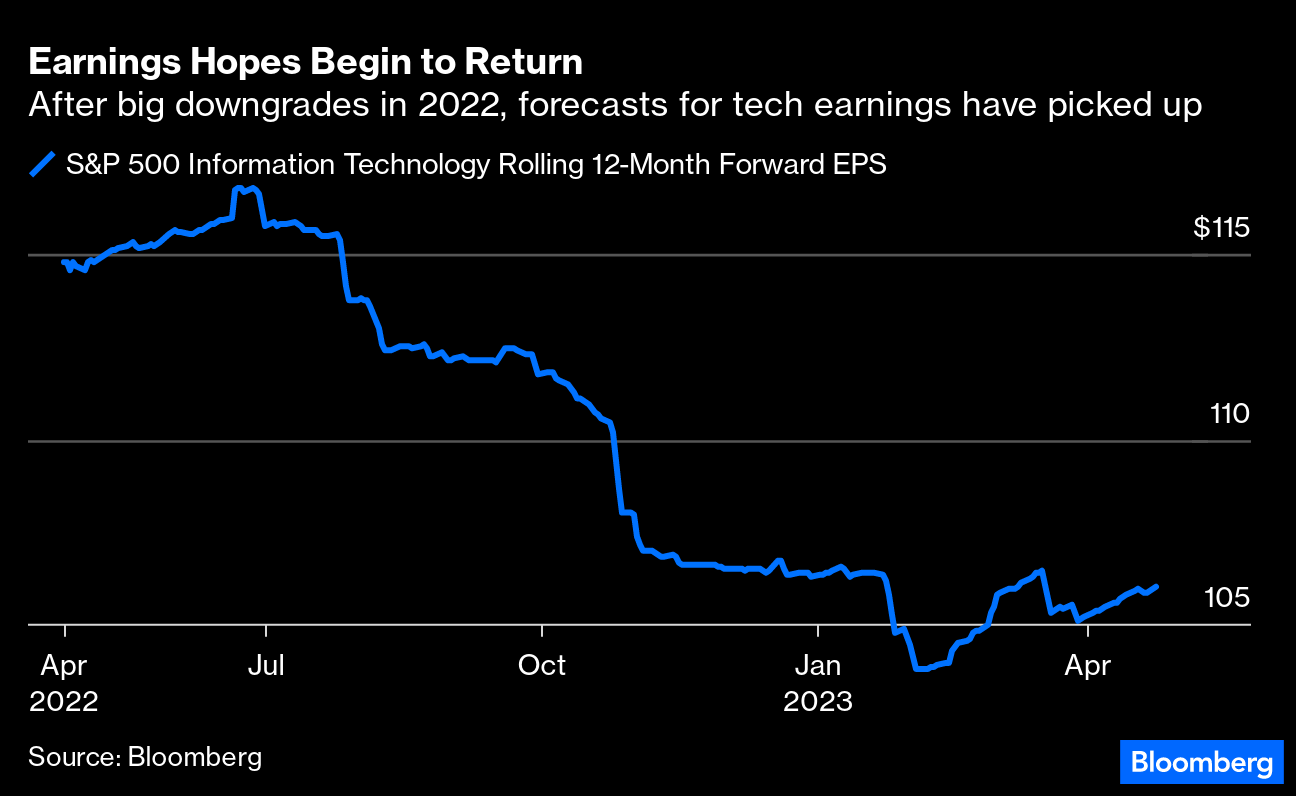

The first-quarter earnings season is well under way with roughly 20% of the S&P 500 companies having reported already. And the verdict is: So far, so good. Even if there were a few high-profile misses — notably Elon Musk’s Tesla Inc. — companies as a whole are exceeding expectations on the top and bottom lines. In absolute terms, that still isn’t great. The S&P is on track for a year-over-year earnings per share decline of 7.3% compared to the preseason forecast of down 8.1%, as Bloomberg Intelligence strategists Gina Martin Adams and Wendy Soong pointed out here. Beat rates are better than average, they added, with 77% of the reports surpassing EPS estimates versus the five-year pre-pandemic average of 73%. But this is testimony primarily to prior pessimism, rather than any corporate dynamism in the economy. So far, the equity market is treating it as though it’s no big deal. It’s been mostly calm in the first seven trading days of the earnings season, with the market showing little to no indication of concern over misses but also failing to get excited by companies’ ability to do slightly less badly than bearish expectations. T hat will probably change over the forthcoming two-week stretch. This week will be the busiest of the season, with 178 S&P 500 companies comprising 43.6% of index market cap expected to report. The next will bring in a further 164 companies, totaling 23.8% of market cap. Most heavily scrutinized will be the internet platform groups mostly known as the FANG stocks.[1] Alphabet Inc., Microsoft Corp., Amazon.com Inc., Meta Platforms Inc. and Apple Inc. between them account for almost half of the Nasdaq 100. They’ve led the equity market, in both directions, almost without a break since the Great Financial Crisis in 2008:  This year has so far continued that pattern with a very strong rally for the big tech stocks powering a broader market rise. Now, traders are waiting for tech to tell them whether the rally in equities is justified, or merely froth:  Earnings forecasts, as compiled by Bloomberg, have stabilized and ticked up slightly in the last few weeks after a serious correction last year, but not by that much. On the face of it, the big swings for tech have been driven by valuations based on the longer term, or broader sentiment toward the market, rather than any change in expectations during the coming year:  The recent performance of the Nasdaq 100 (known by its ticker symbol NDX) shows that sentiment is on a knife-edge. The gauge in April has been trading in its tightest monthly range since 2017, which Matt Maley, chief market strategist at Miller Tabak + Co., calls the “calm before the storm.” It hasn’t traded this quietly since the inflation scare got going in earnest at the beginning of 2022. Here’s more from him:

Meanwhile, the S&P 500 Information Technology Index has jumped 19% year-to-date. This surge marks its strongest start to a year relative to the main index since 2009, according to data compiled by Bloomberg. The sector beat the broader gauge in March by the most in two decades, colleagues Elena Popina and Jessica Menton wrote. That allowed tech to recapture all its losses compared to the rest of the market since the beginning of last year. But nerves have settled in during the last few weeks as earnings season approaches:  Tech stocks in the S&P 500 currently command a lofty multiple. In terms of price to sales multiples, the sector last year topped the record set just as the dot-com bubble was about to burst in 2000. The rally to start this year has brought that metric back to levels only previously seen during those excesses and the Covid rally. That implies both confidence that revenues can be sustained, and that companies can continue to defend wide profit margins:  Another way to view valuation is with relation to the bond market. It’s standard orthodoxy of late that the tech sector is particularly sensitive to low rates, which in theory help those companies that are projected to make rising earnings well into the future. At present, the S&P 500 Information Tech is trading at almost 25 times prospective earnings, a level that will only be justifiable if the Federal Reserve cuts by at least 300 basis points, data compiled by Bloomberg Intelligence show. Cuts so deep would imply very serious problems for the economy. Despite no clear hints of rate cuts from Fed officials in recent weeks, and futures implying a 90% probability of another hike in the fed funds rate when the Federal Open Market Committee meets next week, tech bulls are still of the belief that the central bank will about-face before much longer. Swaps markets do continue to see interest rates peaking in the coming weeks before a series of cuts later in the year. (That said, leveraged investors — generally hedge funds — boosted net short positions on 10-year Treasury futures to a record this month, data from the Commodity Futures Trading Commission show. This amounts to a big bet by macro funds the market has the Fed wrong, and that rates will keep rising to deal with inflation.) The unbridled optimism was most evident during the thick of the banking turmoil last month, when tech stocks in the S&P 500 surged to their best first quarter since 1998. Year-to-date, five stocks have been largely responsible for two-thirds of the S&P 500’s advance: Apple, Microsoft, Nvidia Corp., Meta and Amazon.com. That’s another demonstration of why the market has narrowed to a tight range, with nobody wanting to take a big position ahead of earnings announcements from these companies. Here’s James Demmert, chief investment officer at Main Street Research, who does not see the tech sector as a “safe haven.” Especially not with their P/E multiples significantly exceeding their revenue growth rates:

For Tim Courtney, chief investment officer at Exencial Wealth Advisors, misses in tech earnings may jolt the eerily calm VIX Index of volatility in the S&P 500 because it could portend that “the champions are faltering.” Known as Wall Street’s “fear index,” the VIX closed at 16.89.  With the Fed in blackout period ahead of next week’s FOMC meeting, US equities traded range-bound Monday. And unless there is some resolution when it comes to monetary policy or clarity on inflation, Tom Hainlin, national investment strategist at US Bank Wealth Management, said that choppy trading will continue:

|