Uddrag fra Authers

Ever So Gone |

As was obvious even before voters went to the polls, ESG was already a decisive loser in the US. The concept of Environmental, Social and Governance investing became hopelessly entangled with the culture war agenda, failed to deliver on its promises, and went into retreat. Rather than attempt a technocratic, clean, green way of changing capitalism, America has opted for something more nationalist, even mercantilist.

ESG as a term has been demonized by politicians on the right, to the point that BlackRock’s Larry Fink said that it had been “weaponized” and should no longer be used. Because of Fink’s stand on ESG issues, BlackRock has become a lightning rod for conservative attacks lumped in with identity politics. Startlingly, the company shows up in a list of “decadent and rootless” institutions that should be burned to the ground in a new book by Kevin Roberts, the head of the Heritage Foundation, a distinction it bizarrely shares with the Boy Scouts of America and the Chinese Communist Party.

Supporters of the concept were already disillusioned that ESG had become little more than a marketing wheeze, and several big fund managers, including WisdomTree and Invesco, have faced fines in the US for “greenwashing” (claiming their products were greener than they really were). In France, BlackRock is under fire over allegations that 18 of its funds sold as sustainable are in fact investing in fossil fuels.

Regulator attitudes differ starkly across the Atlantic. In Europe, regulators have raised the ante by telling fund managers that they must reach minimum thresholds for environmental impact before they can use the ESG label — a move that makes it hard for them to keep investing in the US, where the best returns are, and requires them to become more active than is currently the case for many.

In the US, the Securities and Exchange Commision has watered down its requirements on companies to disclose ESG statistics — and the whole concept is close to unworkable unless everyone has to disclose standardized statistics. In September, it quietly disbanded its task force on ESG enforcement. Now, the Trump administration is likely to make dismantling such rules one of its first acts in office.

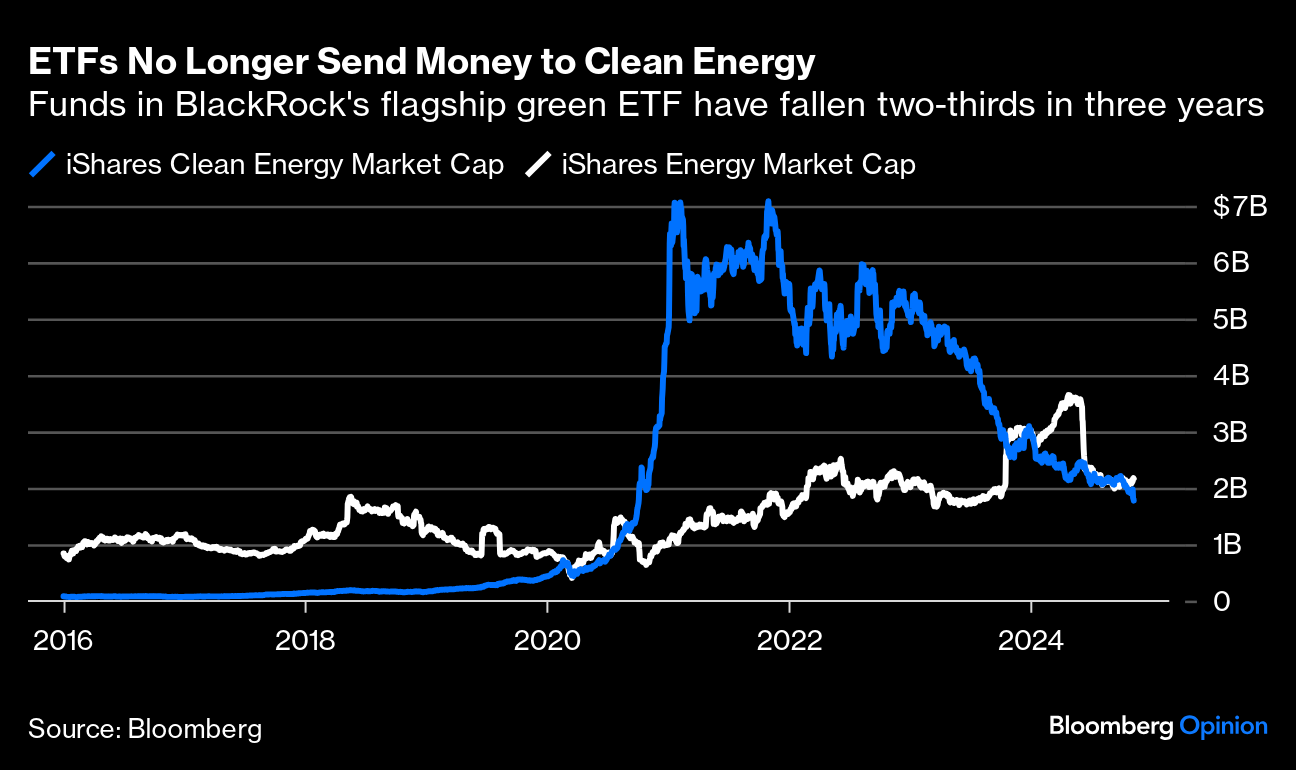

That will complete a retreat that has largely already taken place. A look at the total market cap of BlackRock’s flagship ETFs covering the global energy and clean energy sectors shows that after a boom in 2021, the clean energy fund has steadily dwindled, and is now worth slightly less than the main energy fund:

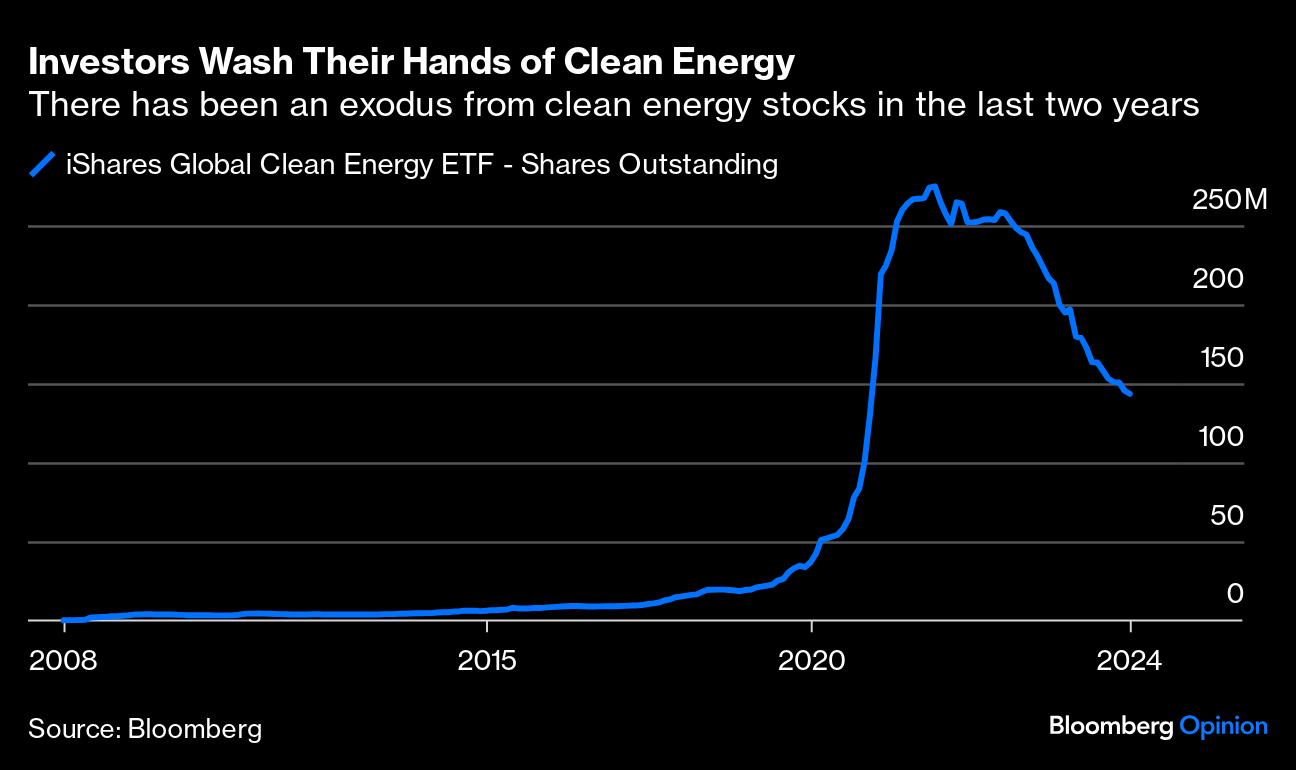

Much of this is driven by the declining share prices of clean energy stocks. However, if we look at the number of shares in the ETF, it’s clear that there were huge inflows during the pandemic, and much of that money has now been withdrawn. Investors are losing interest in the concept (and claims that ESG would reduce global warming, or starve fossil fuel groups of capital, look overblown):

Interest among the public has waned in the US — although not elsewhere. Google Trends shows that US searches for ESG and its synonyms tanked over the last two years, while continuing at much the same level elsewhere. The rest of the world still seems happy to give it a try, but America is no longer going along for the ride:

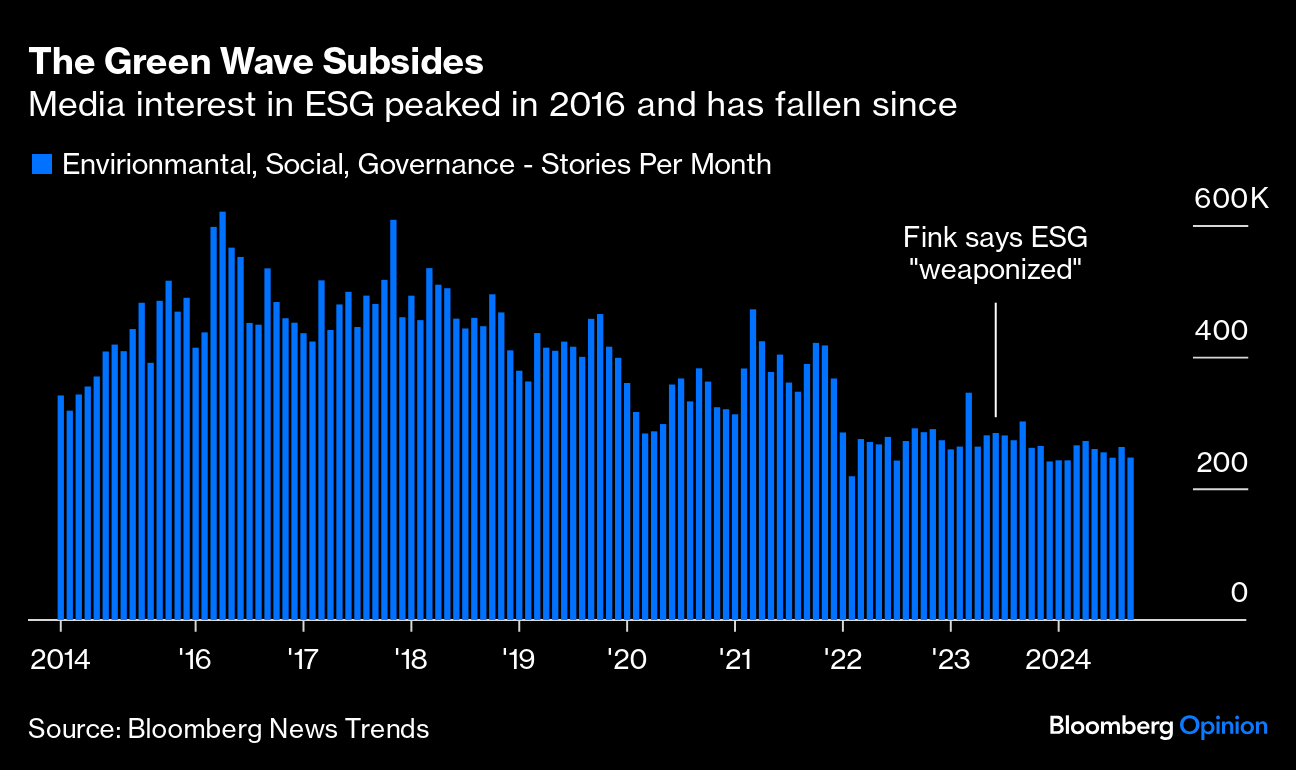

The pattern recurs in the news media. Counting stories published on the Bloomberg terminal from all sources shows interest peaking in 2016, when Donald Trump was first elected, and long before the flow of money went into reverse. By the time that Fink said ESG had been “weaponized,” interest was barely a third its 2016 level and has continued to dwindle:

Critically from the point of view of how capitalism is operating, the same pattern shows up in earnings call transcripts. Bloomberg’s Document Search function shows that executives — not just Larry Fink — no longer want to talk about it. This is our quarter-by-quarter measure of mentions of ESG and its various synonyms since 2010. Mentions exploded after the pandemic, and have tumbled since 2022. With this earning season roughly 90% over, interest from executives in ESG looks to be right back to pre-pandemic levels:

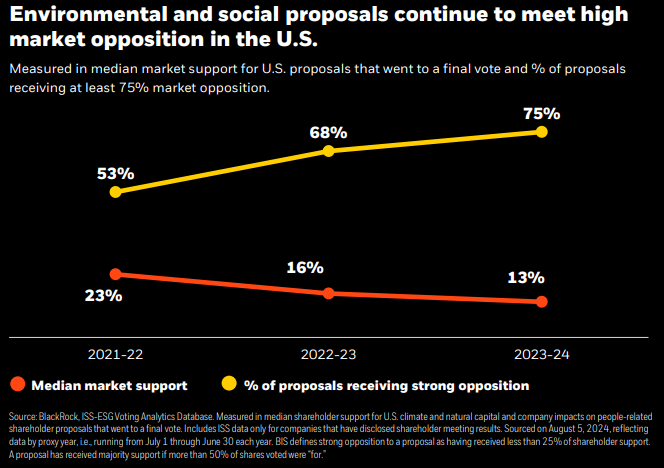

This is at least in part because fund managers are no longer forcing the issue. BlackRock is admirably transparent about the way it votes its shares, and produces regular reports; here is the latest. As this chart from the report (which is worth a read) demonstrates, the amount of support from shareholders for environmental and social proposals has declined markedly over the last three years:

BlackRock itself upped its support for corporate governance proposals, but only backed 4% of social and environmental proposals (down from 20% two years earlier). It also declined to support any of the various anti-ESG proposals that were put forward, and complained that many of them were duplicative or poorly drafted. But the notion that ESG was going to change the way companies operate seems to be in retreat.

Once Trump is back in the White House in January, we’ll learn much more about how his economic nationalism will work. Fine-tuning capitalism to make it more long-termist and take into account more than the narrowly defined interests of shareholders — the big ESG idea — has been comprehensively defeated. Now we wait to see what version of mercantilism comes in its stead.