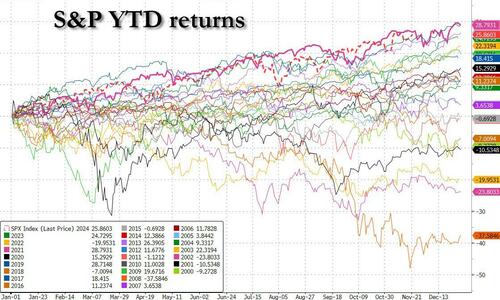

Bank of Americas flow strategi Harnett skriver i analyse, at 2024 har været et af de bedste aktieår nogensinde. S&P 500 har i 2024 opnået en år-til-dato stigning på 26 %, hvilket kun er 0,5 % lavere end 2021, det bedste aktieår i dette årtusinde. Historiske mønstre i præsidentvalgår antyder, at S&P kan slutte året med endnu flere gevinster, lyder vurderingen.

Historiske præstationer og potentielle scenarier for fremtiden

S&P 500 er steget med +20 % to år i træk, hvilket kun er sket fire gange i de sidste 150 år. Historisk set har dette resulteret i store bevægelser i de efterfølgende år, både opad og nedad. Lavere obligationsrenter kan være en nøglefaktor for at undgå de store tilbageslag, som man har set tidligere i årtier som 1929/30 og 1956/57. Samtidig står amerikanske statsobligationer over for deres tredje tab i fire år, en situation sidst set i 1950’erne.

Inflation og skiftende markedstrends

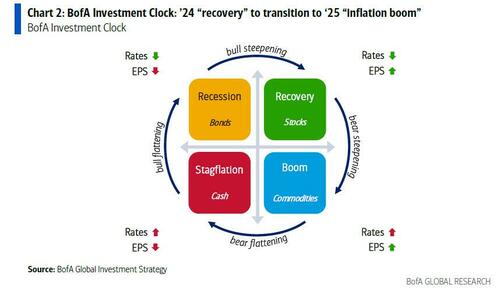

Øget inflation og stigende renter forventes at markere overgangen fra en aktievenlig “recovery”-fase til en råvarevenlig “boom”-fase i 2025. En stejlere rentekurve og højere obligationsafkast kan skabe udfordringer for aktiemarkedet.

Teknologisektorens dominans

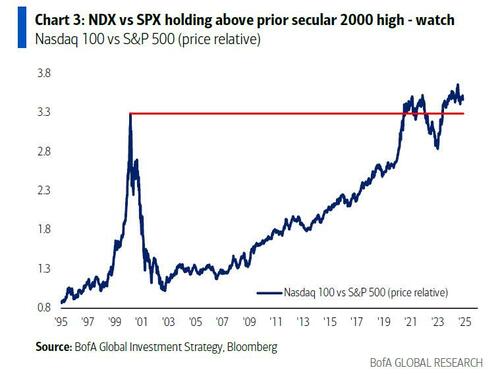

Nasdaq har fortsat en stærk position i forhold til S&P 500, understøttet af store investorindstrømme i teknologisektoren. Risikoen for en vending i denne trend ligger i, at NDX/SPX-forholdet bryder under 2000-højderne, hvilket kan føre til en rotation væk fra amerikanske teknologiaktier.

Kapitalstrømme og sektortrends

2024 har været præget af store kapitalindstrømme, herunder:

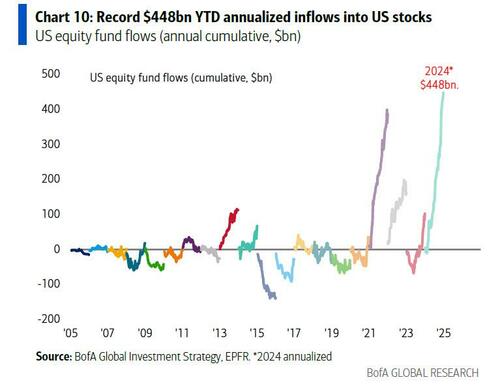

- $448 mia. til amerikanske aktier (rekordniveau).

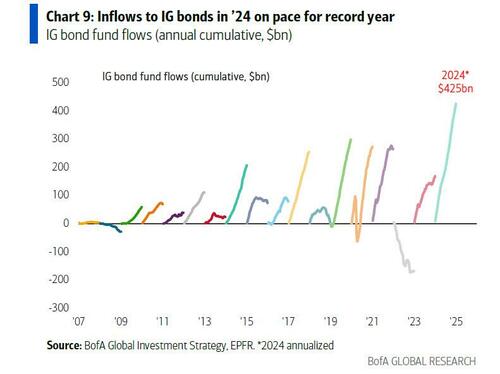

- $425 mia. til investment-grade obligationer.

- $165 mia. til emerging markets-aktier.

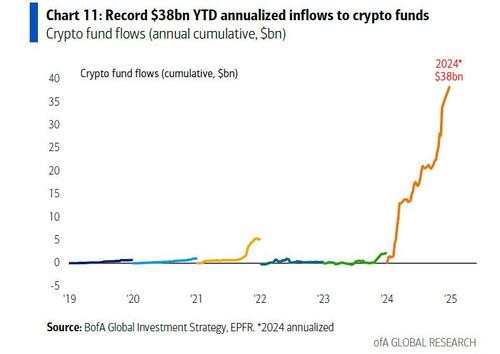

- $38 mia. til kryptovaluta.

Omvendt har der været betydelige udstrømme fra europæiske aktier og amerikanske value-aktier.

Forventninger til 2025

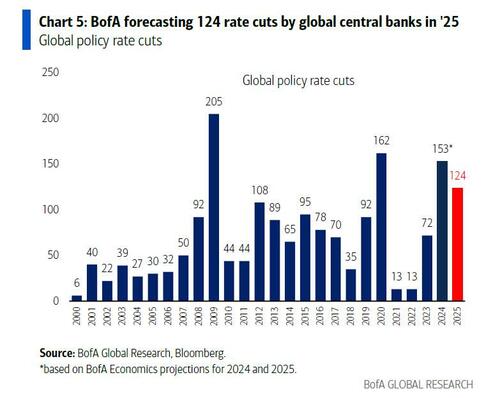

Højere inflation og et stigende budgetunderskud kan presse obligationsafkastet, men centralbankernes forventede rentenedsættelser i 2025 (BofA forudsiger 124) kan skabe et positivt momentum. Teknologisektoren forventes fortsat at være en nøgleaktør, selvom der kan komme en midlertidig top i amerikansk dominans.

Strategiske investeringsscenarier i 2024

- ABP (Anything But Populism): Politisk stabilitet og lempelig politik har ført til høje priser på Bitcoin og guld.

- ABB (Anything But Bonds): Lavere renter og faldende inflation har gjort obligationer mindre attraktive.

- AI: Investeringer er strømmet til virksomheder med stærk positionering i AI-kapløbet.

- ABC (Anywhere But China): Investorer har undgået Kina, men markedsdata fra anden halvdel af 2024 indikerer, at Kina kan blive en stærk performer i 2025.

8. Opsummering

2024 har været et stærkt år for aktier med rekordhøje indstrømme og en teknologidrevet vækst. 2025 vil dog sandsynligvis bringe udfordringer i form af højere inflation, stigende renter og en mulig rotation væk fra amerikansk teknologidominans.

————————–

Uddrag fra Bank of Amercia og Zerohedge:

It may not be the best year of the century, but it’s close. As the chart below shows, the YTD performance of the S&P is 26%, just 0.5% where the index performance was in 2021, the best year for stocks this millennium.

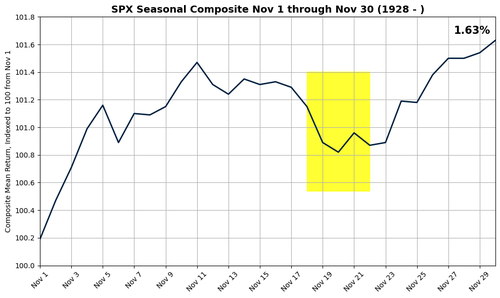

And if seasonals have anything to say about the performance of the S&P in the last 5 weeks of the presidential election year, then we are likely set for another record year.

But even if the S&P doesn’t rise another 3% in the remaining 5 weeks to push 2024 into the history books as the best year for stocks this century, the S&P is still on course for some truly remarkable stats.

Consider the following facts from the latest Flow Show (available here) by BofA’s Michael Hartnett: the S&P is up +20% in 2 consecutive years – this has happened just 4 times past 150 years (1927/28, 1935/36, 1954/55, 1995/96);

So what happens after? Well, the history lessons from returns in following 2 years are…

- SPX in ’25 will likely have another big double-digit move (although unclear if up or down);

- falling bond yields = secret sauce for SPX to avoid the huge reversals seen in 1929/30, 1937/38, 1956/57, and catalyze further big equity gains, as occurred in 1997/98.

In other words, what stocks do next year depends on bonds, and here the context is less cheerful: unlike stocks, US Treasuries are on course for 3rd loss in 4 years in 2024, the 1st time since 1955-58…

… and note that Treasury returns were again negative in 1959 as the US economy boomed and the budget deficit rose (similar to what many expect will happen in 2025), i.e. bond returns can fall in 4 out of 5 years.

And while Treasuries paint a dire overall picture, there is an even simpler reason why the stellar equity returns of recent years are set to moderate: more inflation. According to the BofA Investment Clock (shown below) the equity-bullish “recovery” phase of lower rates and higher EPS (which defined 2024) will be followed by a commodity-bullish “boom” phase of higher EPS and higher rates.

The yield curve “bear steepening” in 2025 signals transition as bonds price-in an inflation boom, and price-out rate cuts. To Hartnett, bond yield levels that cap risk assets in early ‘25 are the following:

- real rates >2.5%,

- long rates >5%,

- short rates >4.5%.

Meanwhile, within equities, the Nasdaq vs the S&P relative price is holding above the secular high in 2000 (Chart 3), keeping investors comfortably long US tech stocks & US dollar. Here Hartnett warns to watch the NDX/SPX ratio, as a crack below the 2000 high would be a catalyst for rotation from “US exceptionalism” trades into the “US humiliation” the BofA strategist discussed last week.

For now, there is little danger to the exceptionalism trade cracking: that’s because Hartnett notes that inflows to US stocks in 2024 are annualizing a stunning $448bn, well above the previous record set in 2021…

… with IG bonds looking at a blowout $425bn in inflows…

… and other record inflows include $165BN in EM stocks, $54BN in HY bonds, $38BN in crypto…

… a massive $1.1tn inflow to money market funds; in contrast, big outflows in ’24 from US value ($46bn) & Europe stock funds ($58bn), which are the unloved contrarian plays heading into ’25.

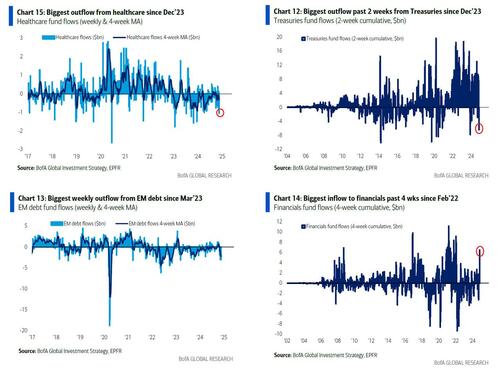

Taking a closer look at the weekly inflows, we find $14.4bn to equities, $9.1bn to bonds, $0.9bn to crypto, $0.6bn from gold, $1.3bn from cash, and the notable weekly flows are the following:

- Treasuries: $2.9bn outflow…past 2 weeks biggest outflow ($6.4bn) since Dec’23;

- EM debt: $3.0bn outflow…biggest weekly outflow since Mar’23;

- Financials: $1.1bn inflow…past 4 weeks biggest inflow ($6.0bn) since Feb’22;

- Tech: $5.4bn inflow…biggest in 6 weeks;

- Healthcare: $1.1bn outflow…biggest since Dec’23.

Looking ahead, Hartnett says that it would almost be a surprise for the equity bull which began in March 2009 at 666, to not continue melting up in the coming weeks/months, potentially rising as high as 6666, given:

- Trump admin sees rising stocks/crypto as tool to boost “animal spirits” & few believe Trump will allow a bear market

- “Boomy” global macro data coming in short-term as companies front-run tariffs (Port of Long Beach imports at record high), hoard labor ahead of immigration controls (unemployment claims tumbling),

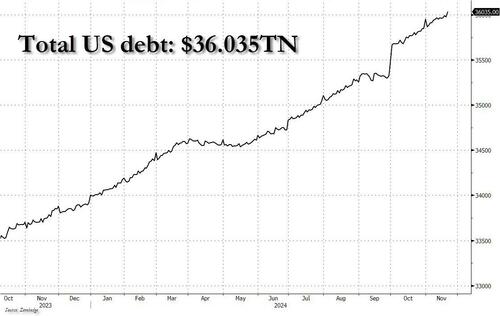

- Bond yields remain in Goldilocks range as bear catalysts of rising 3% inflation, $36tn debt, 7% of GDP deficit, offset by bull catalysts of central bank rate cuts in 2025 (BofA forecasting 124 cuts), peak geopolitical risk, and optimism that Trump (and especially his new Treasury Secretary Bessent) knows it would be political malpractice to allow 2nd wave of higher inflation in ‘25 (although that’s precisely what will happen).

And as we increasingly turn our focus to 2025, in the final days of 2024 Hartnett does one of his first annual recaps, writing that 2024 can be summarized in the following 4 trades:

- ABP “Anything but Populism”– 80% of world market cap, 60% of world GDP, 40% of global population went to the polls in ’24; in anticipation policy makers eased fiscal, monetary, energy policies to maintain full employment and in hopes of maintaining political status quo; the “ABP” easing sent Bitcoin & gold prices to all-time highs, but failed politically as electorates angered by inflation & inequality punished incumbents (80% of incumbent parties lost), and voted for populists, culminating with big Trump victory in US election; Hartnett says expectation that Trump 2.0 = US inflationary boom means bid for crypto & gold to continue

- ABB “Anything but Bonds” – inflation fell and central banks cut rates 153 times; shift from “easy fiscal-tight money” in ’23 to “easy fiscal-easy money” in ’24 caused asset prices to soar and the US economic growth to accelerate… There was no global recession, “soft landing” became the ’24 macro narrative; bond yields were range-bound as lower inflation & rate cuts were offset by ongoing rise in US government debt ($36tn, rising $1tn in 100 days in ‘24) & deficits (7% of GDP), and investors had no excuse to abandon their 2020s “Anything but Bonds” stance, and rotate away from risk assets (stocks & credit); Hartnett is a buyer of Treasuries above 5%, as that level triggers asset losses/growth slowdown

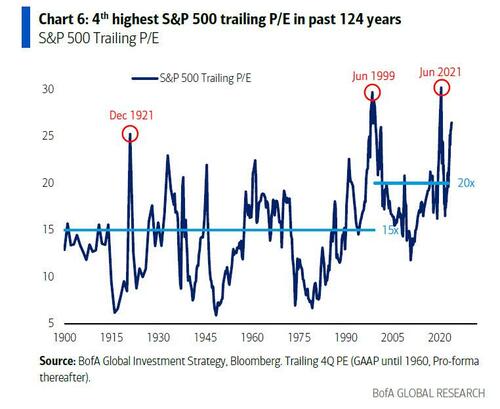

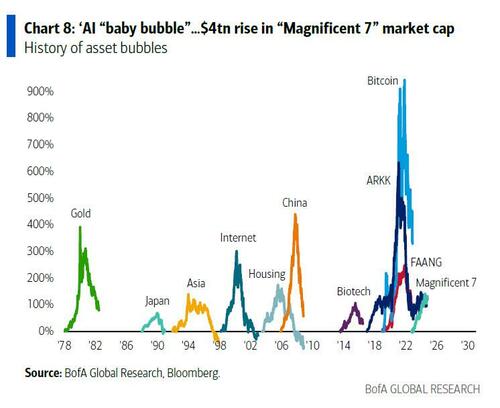

- AI “Artificial Intelligence”: can’t buy bonds, can’t buy “leverage” (e.g. small cap, China, regional banks), can’t buy “duration” (e.g. biotech); 2024 liquidity poured into high quality assets e.g. IG bonds and global companies with strong monopolistic market positions, particularly those in US driving/benefiting from AI “arms race,” conviction secular growth theme; S&P 500 trailing P/E now 26.5x (4th highest in past 125 years)…

… US stocks at 75-year highs vs. rest-of-world…

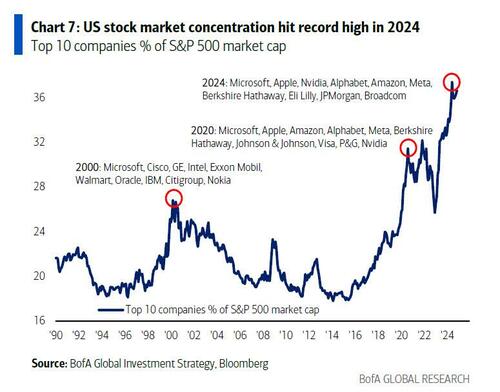

… led by a handful of tech names; record US index concentration as the top 10 stocks = 37% of market cap…

… and the market cap of the “Magnificent 7” stocks up a record $4tn in 2024, more than most countries GDP and capital markets.

In summary, US is secular AI winner, but Hartnett believes “US exceptionalism” theme cyclically peaks, allocation to International troughs in Q1, as US financial conditions tighten, and Asia & Europe ease.

- ABC “Anywhere but China”: investors in ’24 remained resolutely negative on China, and reduced portfolio sensitivity to a China economy plagued by real estate deflation, weak consumption, and geopolitics; asset deflation drove China stocks to 51-year lows vs US, and China bonds to all-time highs vs Treasuries; but the ABC trade reversed in H2’24 as China policymakers began surprise aggressive easing… China stocks rallied big, big regional equity beneficiaries of “ABC” (Japan, Mexico, India) notably peaked in H2’24, and China real estate & macro data improved; Hartnett believes China should outperform in ’25…and while China remains unloved it is notable that China tech (26% YTD) pacing US tech gains (34% YTD) in ’24, after big underperformance since 2022.