Mens markederne falder på grund af coronavirussen og skaber usikkerhed, udgør boligmarkedet i Berlin et attraktivt marked for risikovillige investorer, trods politiske forsøg på at lægge loft over boligpriserne. Det kan få betydning for boligmarkedet i alle tyske storbyer.

Uddrag fra Deutsche Bank:

Berlin housing market

Rent cap may decouple real estate cycle from economic

supercycle for a number of years

The key message: If the rent cap is constitutional, the situation for investors will change dramatically. While initially limited to five years, the shape of future political majorities may result in the regulation being extended in 2025. Riskaverse, short-term oriented investors have incentives to leave the Berlin market.

We believe Berlin remains an attractive market for long-term oriented investors. A judicial review is expected to clarify whether the rent cap is constitutional. It is generally expected that a verdict will be reached in autumn 2020. Lawyers are divided over the anticipated verdict, leading to high legal uncertainty.

Previous regulatory approaches including rent brakes, revisions to the rent

index, and a housing summit were footnotes in the German real estate boom. In view of the housing shortage, they had a slightly dampening effect on price rises at best. The realignment of housing policy in Berlin and the rent cap represents a radical attempt to sideline market-based mechanisms.

Developments in Berlin are also likely to have a major influence on housing policy across Germany. The city senate’s main concern is freezing rents across the entire private residential market for five years. To this end, a “rent cap” was resolved in late January 2020, and it became effective at the end of February. The law freezes rents with retroactive effect to their level in June 2019.

This also legally prohibits rent increases until 2021. After that point, rent

increases of 1.3% per year will be permitted. The rent cap does not tackle the

core problem, namely a shortage of residential space. Quite the contrary – it will increase demand while reducing supply. The permits already slumped heavily in the second half of 2019. The number of potential loopholes is high and could foil the senate’s efforts to create affordable housing.

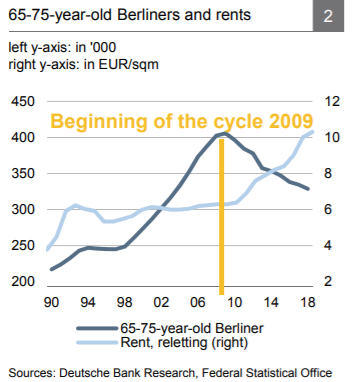

The economic supercycle in Berlin marches on undiminished. The population is

growing, the job market is booming, and real GDP has seen annual growth of

almost 4% in recent years. In addition, Berlin is shielded from global risks by its strong high-skill services sector.

The negative effects of the rent cap on the housing market are likely to emerge clearly in the long run. We therefore do not expect the scheme to be extended beyond 2030 and believe that Berlin remains an attractive location for long-term oriented investors on account of the economic supercycle.