Resume af teksten:

Den amerikanske jobvækst i september var stærkere end forventet med 119.000 nye job mod de forudsete 51.000. Alligevel steg arbejdsløsheden til 4,4% fra 4,3%, da flere arbejdere vendte tilbage til arbejdsmarkedet. Trods styrket jobrapport forudser markedet ingen rentenedsættelse ved det kommende FOMC-møde 10. december, især da ingen yderligere officielle jobdata forventes inden da. Markedet vurderer chancen for en rentenedsættelse til kun 35%. Der ses en forskel mellem forbrugerfølelser og erhvervssurveys, som maler et dystre billede af jobmarkedet. Den stigende arbejdsløshed understreger behovet for mere svaghed i dataene for at presse Federal Reserve til handling inden 2026.

Fra ING:

US jobs growth was stronger than expected in September, but unemployment also rose amid workers returning to the labour market and seeking jobs. Given the Fed’s recent hawkish shift and the lack of official data scheduled before the 10 December FOMC meeting, it is understandable that the market thinks the next move won’t come until early 2026

The jobs data isn’t weak enough to force the Fed to backtrack from recent hawkishness and cut rates in December

Jobs added in September

The September US jobs report (delayed from its 3 October scheduled release date) is firmer than the consensus predicted at +119,000 additions to non-farm payrolls versus 51,000 expected. We imagined the risks were always skewed to the upside, given the Federal Reserve had a good idea of its contents at the October FOMC when it cut rates by 25bp but adopted a more hawkish posture on future moves. This was likely one of the triggers.

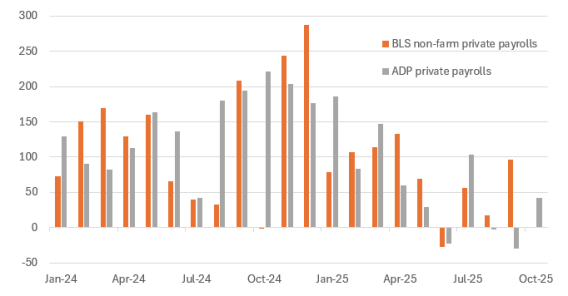

Change in private payrolls (000s)

Source: Macrobond, ING

Nonetheless, the report isn’t universally strong, with 33k downward revisions to the previous two months. The breakdown shows that it is the three usual suspects that contributed virtually all the jobs: leisure & hospitality +47k, government +22k and private education & healthcare services +59k. Remember, the federal government workers who accepted deals to leave won’t drop off until the October report, which will now be combined with the November report and released on 16 December.

Meanwhile, the unemployment rate rose to 4.4% from 4.3% and wage growth rose only 0.2% month-on-month. The unemployment rate comes from a separate survey of households. This showed a 470,000 increase in the labour force, but only 251,000 found jobs, so unemployment grew by 219,000. This survey tends to be more volatile than the establishment survey of firms that generates the non-farm payrolls number.

Consumer sentiment on jobs vs change in private payrolls

Source: Macrobond, ING

Given that we won’t receive any more official jobs data ahead of the 10 December FOMC meeting, and we aren’t confident on the inflation release schedule, it is understandable that the market is only pricing a 35% chance of a 25bp cut. That said, the probability is up from 24% at 8:00am, ahead of the release. It looks as though the market may be focusing a little more on the unemployment rate creeping higher. It is true to say that business surveys paint a gloomier picture of the jobs market, such as the ADP report and the ISM indicators, but we are going to need to see even more weakness to get the Fed to move in three weeks’ time.

Charts, such as the one above, suggest the Fed will have more work to do in 2026. Workers remain very downbeat on the jobs market, and the relationship shows that over the past 50 years, workers see and feel changes before they show up in the official data. That doesn’t bode well for upcoming jobs reports.

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.