by John Rubino via DollarCollapse.com,

The recent back-and-forth precious metals action has left a lot of people frustrated with both the metal and the “permabulls” in this space.

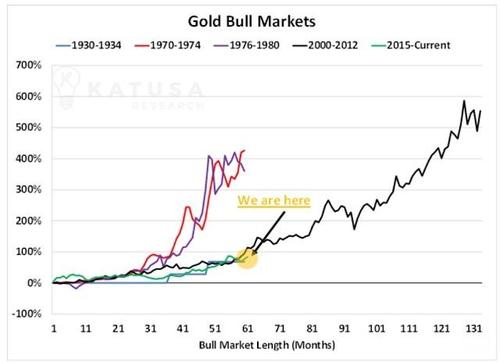

But history says that the real action is still to come. The following chart shows the past century’s gold bull markets, most of which* make the current bull market look like a virtual newborn.

*One gold bull market ended after matching today’s in both duration and appreciation. It ran from 1930 – the start of the Great Depression – to 1934 – the year in which FDR confiscated gold, made ownership of the metal illegal for individual Americans and then devalued the dollar versus gold. Unless all that happens again (possible but highly unlikely), that bull market isn’t a useful indicator.

Note that the 1970s appear as two bull markets separated by a correction in 1975. View that decade as a single bull market and you get something as long as – and much more lucrative than — the 2000-2012 bull market, with most of the gains coming towards the end of the run.

Is the 1970s gold market a good template for the the balance of the 2020s? Let’s consider the similarities:

- A bungled exit from a pointless and costly war? Check: Vietnam then, Afghanistan now.

- Rising inflation due to excessive debt and artificially easy money? Emphatic check. The current US CPI is showing a consistent 5%, while debt levels pretty much everywhere are off the charts.

- Leadership that seems less competent and trustworthy every time they speak? Check: Jimmy Carter then, Biden/Harris now.

- A rising power that threatens US military and financial hegemony – and by implication the dollar’s role as the world’s reserve currency? Double check: China and (again) Russia.

- Energy crisis? Check: Natural gas and coal prices are soaring, stockpiles are at historically low levels, and winter is coming. Gas hoarding in the UK is likely to spread to Continental Europe and beyond. See here for more detail.

Toss in the pandemic that just won’t die, a labor shortage, supply chain disruptions, immigration chaos, and a weirdly-general societal shift away from discipline and rationality, and you get an economy that’s locked into an easy-money, soaring leverage trajectory until no one in their right mind will want anything to do with traditional financial assets.

In this environment, the boring market action in gold – a form of money that has protected against financial and societal chaos for all of recorded history – looks like the calm before the storm.