Uddrag fra Bloomberg/ Zerohedge:

The latest macro outlook on 2025 comes from Bloomberg Intelligence’s Timothy Tan and Jason Lee, who penned a note titled “Geopolitical Black Swans and Macro ‘Gray Rhinos’ Abound in 2025” on Monday.

The note focuses on major risks expected in 2025, categorized into black swan events (unpredictable and rare events) and gray rhinos (highly probable but ignored risks)…

Here’s the note:

The US carry trade remains the biggest gray rhino in 2025 that could send the Fed’s monetary policy dominoes tumbling in the face of US fiscal deterioration. Black swan events in the Middle East and the South China Sea could have a higher likelihood of occurring than markets anticipate, with geopolitical risk remaining high.

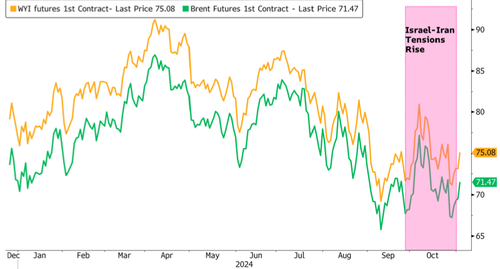

Risk of Wider Conflict in Mideast Rises in 2025

Risks of a black swan event in the form of a wider conflict grow as Middle East tensions escalate. Supply disruption from a regional war could lift oil prices significantly, as the region remains the world’s largest source of crude. Wild swings in oil prices were already evident in 2024 at the mere hint of an attack on Iran’s oil infrastructure. Yet, risks to supply extend beyond Iran, as any impediments to transit through the Strait of Hormuz would have a similar effect.

WTI & Brent Futures

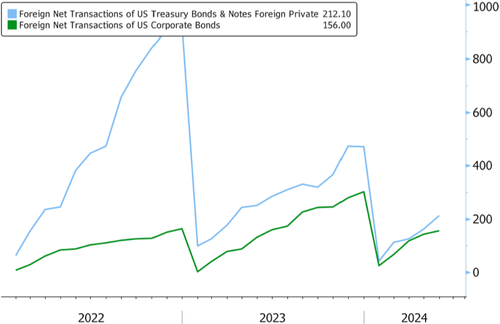

Carry Trade Unwind the First Gray Rhino Domino

The carry trade actually rose more from September 2024 rather than unwinding, as TIC data shows. As of August 2024, the combined foreign private purchases of US Treasury and corporate bonds from the start of 2022 has risen to around $2.48 trillion. This liquidity from the offshore euro-dollar market essentially adds to US domestic financial markets. The continued rise in July and August indicates a continued build, with positions likely significantly larger now.

These flows stand to reverse course if the Fed were to cut rates aggressively to contain government interest costs, leading to a liquidity crunch in US financial markets. This, in turn, would spawn market instability and a weaker dollar. Dislocation will lead to wider spreads.

Accumulated Foreign Buying of U.S. Bonds

Rising Tensions Make Taiwan, Mainland China a Flashpoint

Events in 2024 show increasing tension between China and Taiwan. The Taiwanese president’s rhetoric and approved sale of air defense missiles in October 2024 has raised the stakes. During that same month, China initiated a large-scale military exercise along the island’s perimeter, blocking marine routes. Beijing is likely to follow through with more trade restrictions on the island, while at the same time promoting opportunity for Taiwanese businesses within mainland China. A military conflict remains a potential black swan event capable of being triggered by weapons sales to the island, or a declaration of independence by the Taiwanese government. Such an event would herald further global economic bifurcation, and have negative credit connotations.

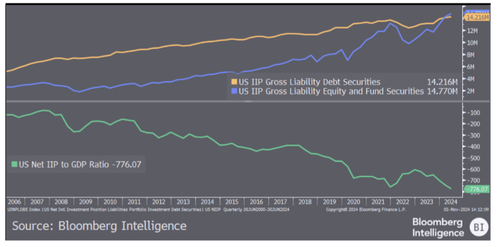

US Investment Position Third Gray Rhino

While the hot money buildup in the US since the Fed began raising rates has become a concern, a more critical element is the dramatic growth of the negative Net International Investment Position (NIIP) since 2018. The US owes the rest of the world around $22.5 trillion dollars or over 77% of its GDP. The bulk of the external liabilities are in the form of portfolio flows, i.e., trading flows into US debt and equity markets. Gross foreign portfolio holdings in debt and equity securities is around $29 trillion.

The negative NIIP is a point of vulnerability in US financial markets due to its dependence on foreign investors. If confidence in the US fiscal and monetary condition is lost, outflows may create a dislocation, or widespread asset mispricing, akin to a balance-of-payments crisis

US Net International Investment Positions

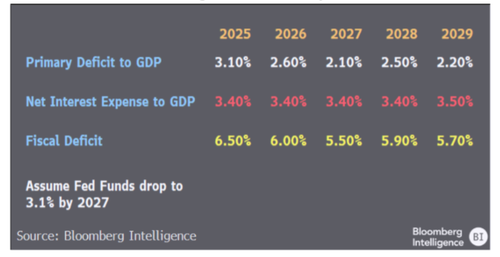

US Fiscal Deterioration May Be a Key Focal Point

The deterioration in the US government’s fiscal condition, another gray rhino, is likely to accelerate if the Federal Reserve falls short of aggressive rate cuts in 2025. This could considerably damage faith in US government bonds and the dollar, which is plagued with uncertainty from the carry trade and external shocks. As long as foreign capital continues to add to hot money, the condition of the fiscal balance may be ignored. However, any shift in the former will bring fiscal security concerns to the fore, and may force the Fed to abandon all pretense regarding inflation and cut rates, given the potential domino effect from the fed funds rate on the carry trade.

If the Fed changes its policy focus to US debt sustainability, this gray rhino could charge sooner rather than later.

US CBO Budget Forecasts, June 2024

The note underscores the interconnected nature of geopolitical and economic risks ahead for the new year in the era of Trump 2.0.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her