fra Bloomberg macro strategist,

Stocks are weakening despite signs the US economy is reaccelerating, as higher yields are beginning to degrade equity valuations. This is quite typical, with the market and the economy often operating out of synch.

It’s been a challenging few weeks for stocks, with their current drawdown now about 5%-6%. That comes as 2025 has opened with a robust set of data, with claims, ISM, PMI and employment all showing the economy is on a strong footing and whose pace could well be picking up.

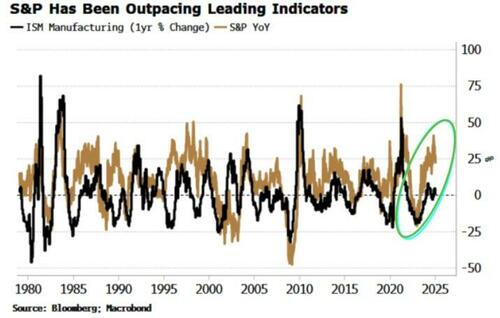

Yet the market decoupled from leading indicators since the 2022 bottom. Normally the manufacturing ISM is good coincident guide to the stock market, but for the past two years the latter has outperformed.

Whatever the reason – an overly pessimistic ISM or an AI productivity boom, or others – there is thus no reason why the ISM cannot pick up further even as equities continue to face resistance. If stocks have already unhitched from economic fundamentals, they can continue to do so.

There is an irony that it is higher yields that appear to be giving the market a bout of dyspepsia.

More so that it’s real yields, and not inflation expectations driving most of the move.

But that’s always been the case: stocks ultimately require a goldilocks’ quantum of growth to ensure that a rise in the discount rate, which has a non-linear impact on present values, does not overwhelm the linear impact of rising earnings expectations.

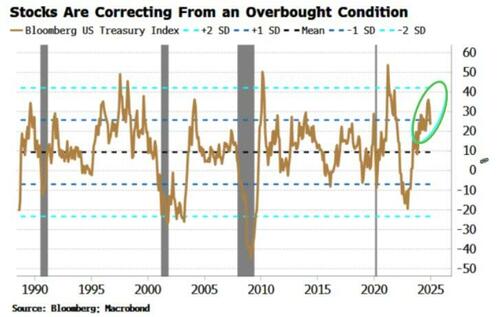

The implication of stocks becoming detached from fundamentals is that prices and mean-reversion are more consequential for their subsequent path.

The S&P is currently correcting from an overbought condition. Its annual growth was over 1.5 standard valuations rich; it has more to go if it is going to correct back to the mean (or even overshoot).

That can happen either through lower prices or the market treading water for a period.

However, many measures of breadth are already much less extreme, showing that a fair amount of the overboughtness has been worked out.

The number of S&P stocks above their 200-day moving average, the net number of new 52-week highs of NYSE stocks, the advance-decline line, and the number of stocks with an RSI of less than 30 all show that the market has taken out some of the richness.

Price and bond yields, not the economy, will continue to be the main arbiter of the stock outlook, at least, for now.