Fra Bloomberg

Bloomberg markets live reporter and strategist

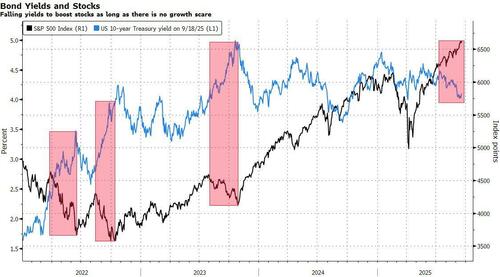

Now that the Federal Reserve has done what everyone expected, investor focus shifts to whether the economy is resilient enough for stocks to push even higher.

The Fed has resumed cutting rates and may be far from done, with three more reductions nearly priced in by next March. Chair Jerome Powell rallied a deeply divided committee of policymakers behind an interest rate-cut on Wednesday. Still, lower borrowing costs don’t always hand an immediate boost to stocks and their positive impact in the months ahead also depends on investors being convinced there’s no recession coming.

“Historically, Fed cuts have been a tailwind for global/European equities, and a catalyst for ‘broadening’ market performance,” say Citigroup strategists led by Beata Manthey. “In instances where rate cuts were not closely followed by economic recessions, equities fared even better on average.”

The strategists expect European stocks to outperform as investors broaden exposure. In cases when Fed cuts weren’t closely followed by US economic recessions — like in 1984, 1995, and 1998 — European equities tended to perform better on average, both in absolute terms and relative to the US. Cyclicals have also typically rewarded investors more than defensives in these times.

And investors, who have driven stocks to record highs, do expect a rather positive growth backdrop. Bank of America’s fund manager survey published this week showed that 67% anticipate a so-called soft landing and 18% no landing, with only 10% braced for a downturn.

Over the past 20 years, aggressive rate cuts were unleashed in response to a weakening economy, driven by the need for fast action. This time around, the economy is broadly OK, even if the US labor market has started to weaken.

“There were seven instances of the Fed resuming rate cuts after a long pause – four were followed by a recession and lower equity markets, and three were followed by continued expansion and further equity market upside,” says Barclays strategist Emmanuel Cau.“We are in the no recession camp, arguably so is the stock market.”

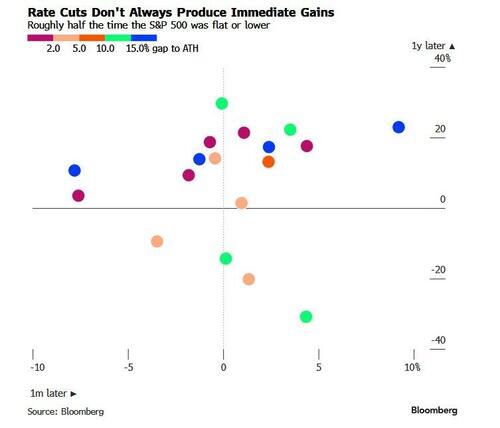

The near-term effect Fed easing will have is open to debate. Historical data for the S&P 500 shows that a rate cut that follows the previous one by at least 200 days leaves the benchmark flat or lower a month later in about half of all instances. The picture is more positive on a one-year horizon.

That pattern keeps some market participants skeptical. “I do worry about travel and arrive in relation to rate cuts,” says Goldman Sachs trader Bobby Molavi. The benefits of Fed easing have been priced in stocks since August, he notes. “What drives the next leg higher? Investors are long, CTAs long, retail is long, buybacks slowing and valuations are no longer cheap.”

Molavi says that investors continue to focus on the “haves,” such as the Magnificent Seven, mega-cap tech and AI winners, while the rest of the field seems to be treading water or losing relevance.

“History shows that a more dovish Fed clearly boosts global equities, and not just US equities,” say SocGen strategists led by Alain Bokobza. “Within equities, we continue to advocate for broadening, reflecting what we have seen in 2025: that non-US equities can do as well — or even better — than US equities in a common currency.”

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her