En britisk recession er uundgpelig, skriver Nordea i en analyse, og det kan bringe euroen og pundet på niveau.

Uddrag fra Nordea:

UK on the brink of a deep recession – could EUR/GBP go to parity?

Despite the BoE and the Government taking unprecedented measures to combat COVID-19, we see a UK recession as inevitable. The BoE asset purchases are a game-changer for GBP rates while an increasing number of risks could take EUR/GBP to parity.

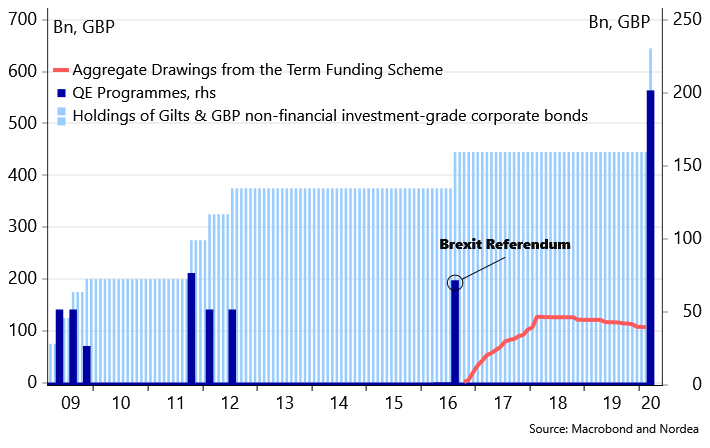

For the second time in less than a month, the Bank of England cut rates in-between meetings on Thursday. The policy rate is now at an all-time low of 0.10%, which the MPC judges to be the effective lower bound. Moreover, an unprecedented £200 billion QE programme was introduced, which is almost three times the size as former QE announcements (see chart 1).

In other words, this is a massive boost to the demand side of the economy as well as a game-changer for GBP rates and possibly also the sterling. For the latter – which has been under a massive market pressure in recent days – this in, our view, prompts the question of whether EUR/GBP could go to parity.

Chart 1. The BoE’s “corona QE” clearly surpasses programmes during the GFC and the Brexit referendum

A recession is inevitable

Before we dig into the implications on GBP rates and the sterling, let’s be clear that despite the significant monetary and fiscal measures, we think a relatively deep UK recession is inevitable. Hence, supply chains are being heavily disrupted, and the “corona lockdown” reduces labour supply, increases unemployment and creates uncertainty, which not only negatively affect the supply side of the economy, but also domestic demand. Moreover, the transmission mechanism of a lower Bank Rate to the real economy is somewhat lower than in the past, as UK households since the GFC generally have switched from variable-rate mortgages to fixed-rate (from ~45% to ~75%) while the overall share of mortgages has also declined (businesses and in particular SMEs do, however, still have are relative high share of variable rates).

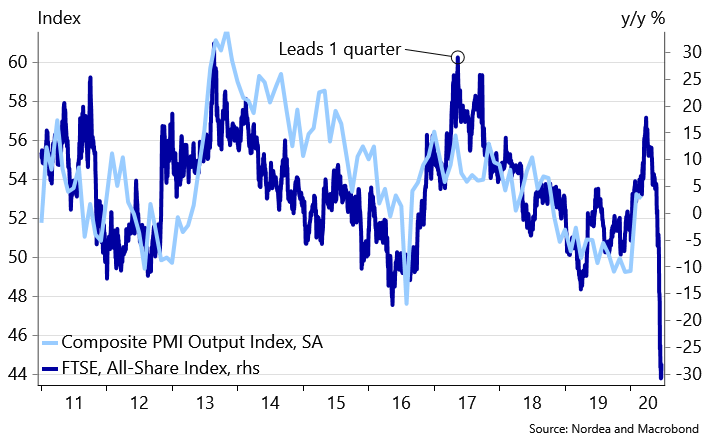

Consequently, growth in the first and second quarters should be grim, with the latter probably being as bad or even worse than what we saw during the Global Financial Crisis. The policy responses due, however, offer some hope of a more rapid recovery in the second half of the year, compared to 2008/09. Obviously, this still dependent on how quickly the coronavirus is contained.

Chart 2. UK PMIs will tank in the coming months

A game-changing easing package for the gilt market and GBP rates

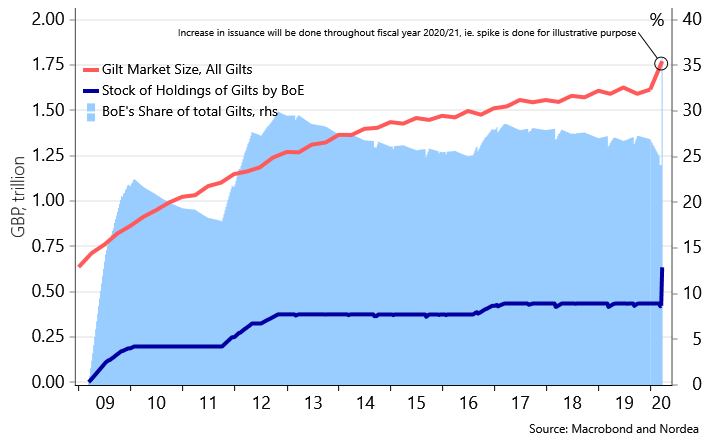

The BoE’s asset purchases as well as Chancellor Sunak’s fiscal easing packages should have a material impact on the gilt market. According to the UK Debt Management Office, £156.1bn of gilt sales will be conducted in the 2020-21 fiscal year. This is the highest since 2012-13. Combined with the BoE’s purchases of around £200bn gilts (we don’t yet know how much the corporate bond purchases represent of the total £200bn asset purchases), this effectively means that Bank of England will hold roughly 35% of the gilt market, according to our estimates (see chart below).

Chart 3. BoE’s share of the gilt market is set to increase significantly

On the rates front, Carney said in January that £120bn of gilt purchases would be equivalent to cutting the Bank Rate by about 100bp (the £120bn purchases was at the time considered a maximum without creating market distortions, but that was before the announced surge in gilt issuances). If we use that “conversion rate” as a guide for the corona QE programme, we get ~167 bp of rate cuts. Combined with the actual Bank Rate cuts of 65 bp, this totals ~232 bp of easing.

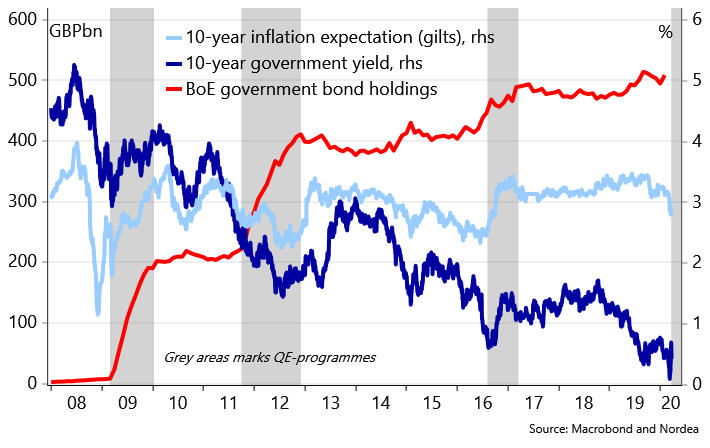

On top of this comes the new Term Funding Scheme, forward guidance, the reduction in the countercyclical capital buffer rate to 0%, fiscal stimulus, etc. Hence, this should keep a clear ceiling on GBP rates in the coming months.

Towards the end of the year where a recovery in activity and higher inflation expectations could occur (given current GBP weakness and perhaps higher oil prices), this may push longer-term rates higher. In the short-end of the curve, however, we still expect rates to be capped by the Bank of England. We expect no further policy rate changes in 2020.

Chart 4. Long-term yields and market inflation expectations to stay put in coming months

Why the sterling has been smashed over the past week

Turning to the sterling, we think there are especially three factors why it is currently disliked by investors and has traded somewhat in tandem with G10 commodity currencies (besides the obvious of an increasing number of UK corona cases and rate cuts / QE):

- the UK has a twin deficit with the biggest current account deficit (as % of GDP) in G10. A constant capital inflow is therefore needed to underpin the GBP which is challenging in the present “dash for cash situation”

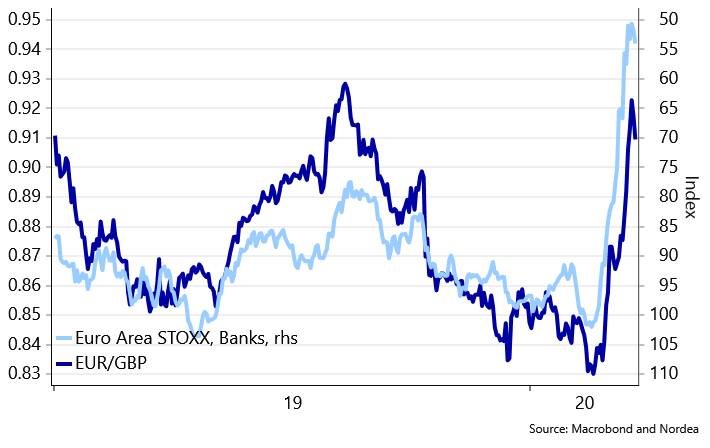

- the UK has a large and systemic important banking sector which is particular exposed in times of credit crunches and disturbances in the global funding system (containing Libor-OIS and basis swaps spreads via more USD liquidity is key)

- after years of Brexit uncertainty and low returns, the sterling has lost some of its appeal as a major reserve currency.

Chart 5. The sterling is highly exposed to the banking sector

Our fair value model indicates EUR/GBP around 0.96, but the risk of parity is high

The above-mentioned factors led EUR/GBP to peak last week at 0.949 – a level not even seen during recent years of Brexit turmoil. After some stabilisation Friday, however, the EUR/GBP is now trading around 0.92. While it therefore may seem like there is a long way up to 1.00, we would still not rule out that scenario. At least, we do not think we have seen the highs in EUR/GBP yet.

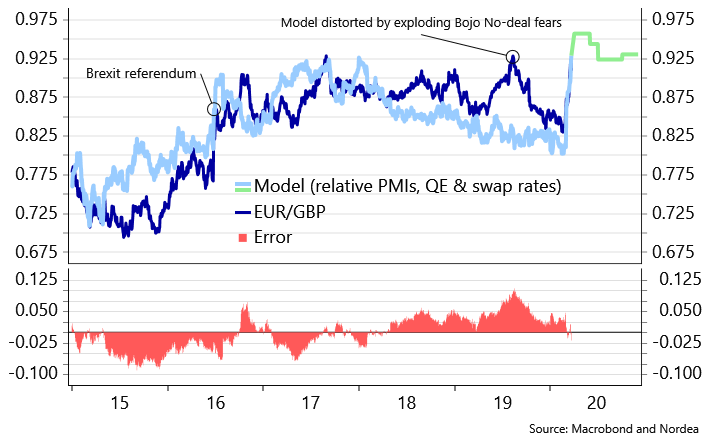

We have constructed a fair value model in which we have included relative QE programmes from the ECB and BoE, longer-term swap rates and Composite PMIs. We assume that i) the announced asset purchases are done linearly through 2020, ii) GBP swap rates are depressed around 20-25 bp more than the corresponding EUR rates, and iii) the UK economy takes a slightly harder hit in the next three months than the euro area.

Our model depicts that EUR/GBP could move to levels around 0.96 in the coming 1-3 months before seeing some stabilisation in H2 2020.

Chart 6. Our model indicates that we have not seen the peak in EUR/GBP yet

Thus, while we still see upside risks for EUR/GBP, more is “needed” for EUR/GBP to break parity. Besides the risk of an even broader global financial meltdown, we see two UK idiosyncratic factors that could “support” the parity case.

First, Brexit is for obvious reasons no longer in the forefront of markets’ attention, but the end-June deadline for extending the transition period is getting closer nonetheless. BoJo confirmed last week that the UK will leave the negotiation table in June, if a Canada+ agreement is not on the cards. It seems like the EU is some way off from accepting that (no break-through yet on fisheries, level playing field, etc.), why the risk of a No-deal 2.0 could soon come into the minds of markets again.

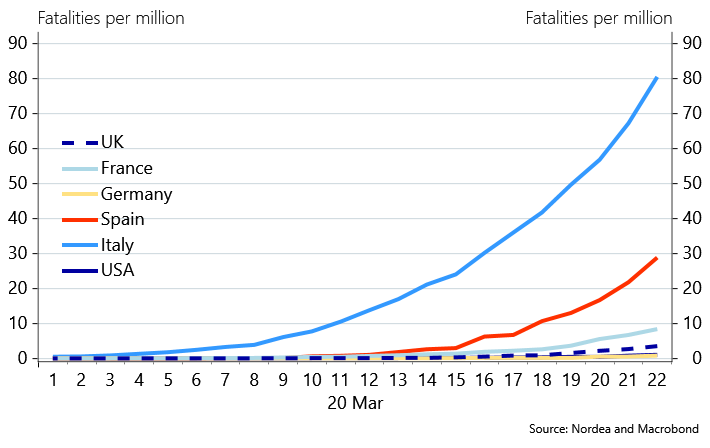

Second, a gloomy report from the well-respected Imperial College made the Government change its COVID-19 strategy last week to a so-called “suppression strategy”. Hopefully, this will soon contain the virus, but the UK still appears to be lagging other European countries in terms of new corona cases and fatalities (see chart 7). If UK follows the path of Italy or Spain (let’s hope not!), this is what, in our view, poses the biggest risk for the UK financial system and could be the final trigger for EUR/GBP breaking parity.

Overall, we therefore see the risk of EUR/GBP in parity as uncomfortably high. In terms of COVID-19 cases in the UK, we will monitor the situation closely – you can sign-up to our new Daily Corona Update here.