Der er stadig flere tegn på, at eurozonens nedtur er endt, men der er trods alt ikke tegn på, at økonomien bliver bedre i 2020.

Uddrag fra ING:

There are gradually more signs that the eurozone economy is bottoming out after a

deceleration that started in January 2018. However, survey data seems to reflect

some hope for improvement, while hard data still remains poor. Although the economy

is likely to improve, 2020 is unlikely to see much stronger growth than in 2019.

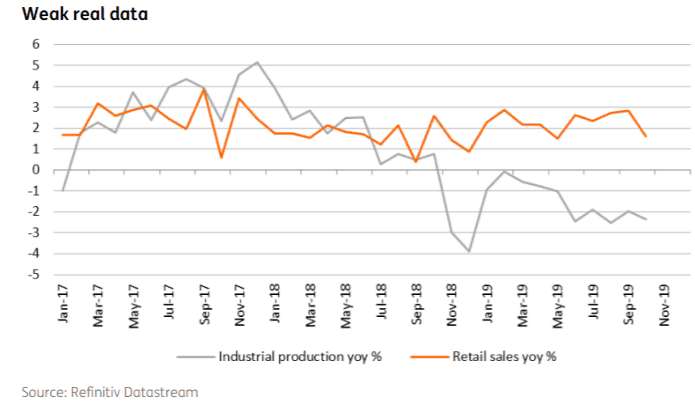

For the economy to recover, we need to see the animal spirits reviving. Although

sentiment indicators have indeed improved over the last few months, we don’t see

much progress in hard data yet.

To be sure, the German Ifo-indicator rose for the third month in a row in November,

while the European Commission’s economic sentiment indicator registered a stronger

than expected increase last month. The €-coin indicator, a real-time estimate of the

underlying growth pace, rose slightly from 0.13 in October to 0.15 in November,

although this still suggests rather weak growth. There is hope that trade could offer

some relief in 2020.

As a matter of fact, the eurozone is a far more open economy than both China and the

US, explaining why the fall in global trade on the back of the trade war provoked

significant collateral damage in Europe. Other positive news was the fact that President

Donald Trump didn’t announce higher tariffs on European cars. This would have been an

additional blow to the already battered German car industry. Finally, Boris Johnson’s

landslide victory in the UK elections offers at least the advantage that there will now be

more clarity on Brexit, although the negotiations for a new trade deal between the UK

and the EU might still prove to be laborious.

While the news flow has certainly been improving, a robust upturn is not to be expected.

The more cyclical business climate indicator even decreased to -0.23 from -0.20 in

October. This chimes with a further fall in the assessment of order books in the industrial

sector. Employment expectations declined in all sectors in November, which might have

a dampening effect on consumption. Several big German firms announced significant

lay-offs over the last month.

Admittedly, the German unemployment figures remain reassuring, but such headline

news might make consumers more cautious. Is this recovery for real?