Måske er det kun et spørgsmål om tid, inden digitale valutaer indføres. Den amerikanske centralbank erkender nu, at den studerer digitale valutaer – hvordan centralbanker kan operere med digitale valutaer. Det kan blive et nyt instrumnent for at håndtere fremtidige kriser. Også den svenske centralbank har studeret indførelsen af en digital valuta, E-Krona.

FX weekly: Brace yourself.. People’s QE is coming

The Fed is now openly admitting to studying digital central bank currencies, which could be seen as an early warning of People’s QE. There will be a (another) crisis and new instruments will be created. People’s QE would be the ultimate inflation put

If you want to receive a copy of FX weekly directly in your inbox, you can sign up via this link.

Quote of the century

“I am sure the euro will oblige us to introduce a new set of economic policy instruments. It is politically impossible to propose that now. But some day there will be a crisis and new instruments will be created.” Romano Prodi in 2002

It is no secret that we absolute love the honesty of the above quote from the former president of the European Commission, Romano Prodi. New instruments are always invented during times of turmoil, even if they should optimally be implemented during better times. This is the harsh political reality in one single quote.

The Corona-crisis has so far paved the way for i) European Union bonds in larger scale, ii) formalized EU cross-border grants, iii) Oprahnomics in the US (it is now even a word in the Urban Dictionary) and iiii) increased research on central bank digital currencies.

The latter is probably slowly but surely being prepared in time for the next crisis. If central banks run out of assets to buy or if they receive too much criticism along the way, why not just send the People a cheque directly from the printing press? After all, it almost feels a little cumbersome to have the Treasury as a middle-man in such a process.

It would almost be a gift for central bankers in search of a slightly steeper yield curve. If you practically buy all bonds, it is obviously impossible to steepen the curve in the process of doing so, but you can send endless cheques to regular people without killing the curve.

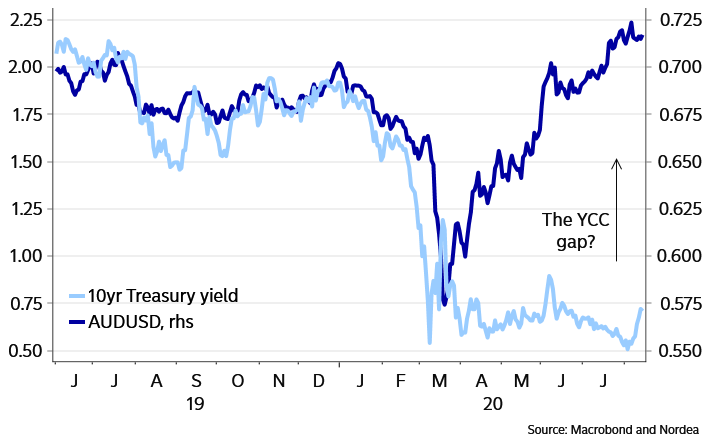

Chart 1. What if rates markets started to trade the V? The Fed is the roadblock

Our Fed favourite, Lael Brainard, gave an update on digital central bank currencies last week concluding that they “remained committed to understanding how technological advances can help the Federal Reserve carry out our core missions” and that the Fed had launched a collaboration with MIT “in a multiyear effort to build and test a hypothetical digital currency oriented to central bank uses.”

The no-bullshit translation of this speech is basically that the Fed is looking into giving each and every American an account at the Fed, which could pave the way for actual People’s QE when the next crisis makes it necessary to increase the money supply markedly in an attempt to prop up inflation while keeping unemployment down. The Swedish Riksbank is another central bank that is openly looking at digital currencies – the so-called E-Krona.