Saxo Bank har udviklet et Liquidity Dashboard. Banken tror, at ved at følge de store centralbankers likviditet får man et varsel om den globale økonomi. Indikatorerne peger på en bedre økonomisk udvikling i 2020.

Uddrag fra Saxo Bank:

This is the first edition of the Saxo Liquidity Dashboard. We believe that in the era of central bank power and USD dominance, it is of prime importance to track the evolution of central bank liquidity and USD liquidity. Our dashboard features a number of indicators that will give you some clues about the direction of the global economy and financial markets and will help you formulating your investment decisions.

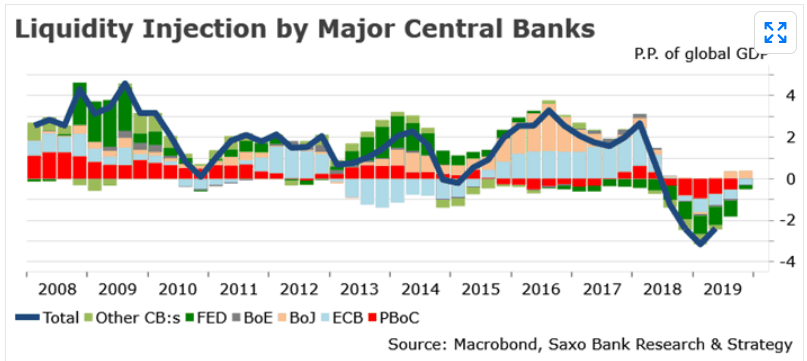

Following Powell Pivot in early 2019, global central bank liquidity has headed north. The chart below tracks the evolution of total liquidity injection by the 22 biggest global central banks. Based on preliminary data, we expect that global central bank liquidity will turn positive in Q2 2020 for the first time since mid-2018 on the back of positive impulse from the Fed, the PBoC and the BoJ. The BoJ’s liquidity injections are so far the most important contributor to global CB liquidity, representing almost 0.4 percentage point of global GDP.

We observe the same reversal trend in global USD liquidity. Our below model is based on the evolution of the monetary aggregate M2 in the 25 largest economies, converted into USD and minus the evolution of M3 in the United States. We think that this chart tell us much more than any other on what will happen in 2020 in financial markets. Since Spring 2019, our liquidity indicator has returned in positive territory after a short-lived contraction in 2018 reflecting the Fed normalization process. An improvement in global USD liquidity tends to favor risky assets over safe havens (notably USD and JPY) and is consistent with our positive narrative for the global economy in 2020.