UDDRAG FRA ZEROHEDGE.

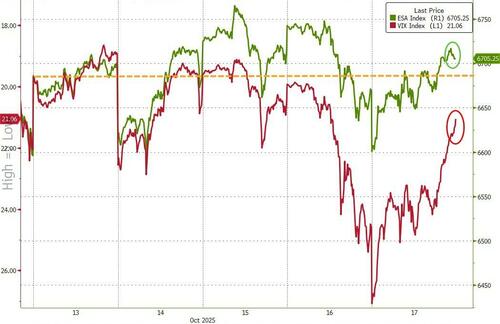

While US stocks finished higher (S&P 500 +1.7%), this week brought increased volatility as the start of Q3 earnings was met with mounting geopolitical risks and credit concerns.

Renewables, Non-Profitable Tech, and Most Short were among the themes that outperformed on the week (though all gave back some gains on Thurs/Fri), while Obesity Drugs, Defense, and Liquid Regional Banks were among the themes that underperformed.

Top Goldman Sachs trader, Brian Garrett, summarizes the week’s action below:

Prime

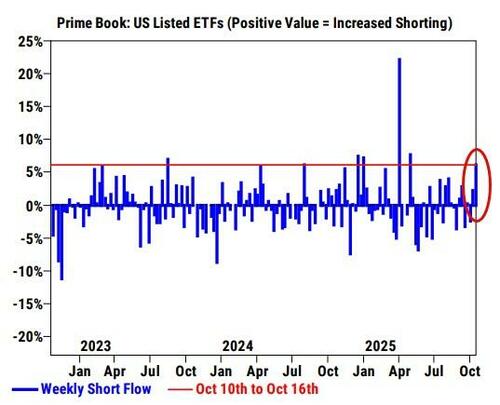

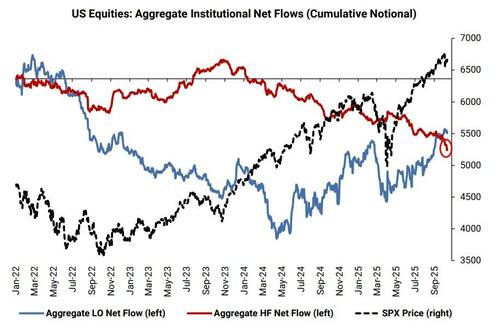

HFs net sold US equities at the fastest pace since early April, driven by short sales in Macro Products and Single Stocks.

US ETF shorts saw the largest % increase in 5+ months, and the 7-week net buying streak in Single Stocks came to a stop.

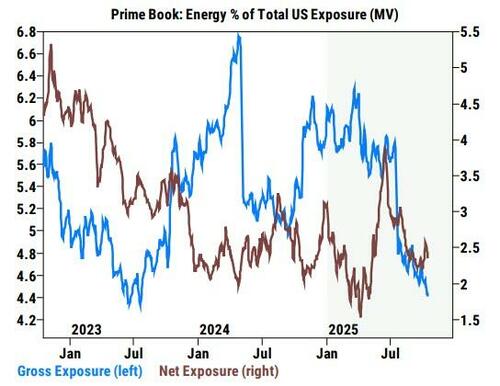

As WTI crude fell below $60 for the first time since May, Energy was the most net sold global sector and net sold across all regions.

US Financials finished modestly net sold, as managers net bought the sector thru Tues but turned sellers Wed/Thurs amid increased concerns over credit quality.

Shares

From a flow perspective, both Asset Managers and Hedge Funds finished the week better for sale at -$1.7bn and -$2.0bn, respectively.

Busier earnings next week with 18% of S&P market cap reporting.

On the macro front, market participants are expecting a delayed September CPI print on Friday.

Fed is entering blackout ahead of 10/29 decision.

S&P implied move through 10/24 is 2.31%.

Sector Specialists

Financials was a tale of two half’s this week: The first half was marked by particularly robust earnings at the Large Banks, but Jamie Dimon on the earnings call forewarned the market of more ‘cockroaches’ in the credit markets, and shortly after, ZION pre-reported a ~$50mn net charge off. Given the timing to the ‘cockroach’ comments, as well as preexisting anxiety around private and consumer credit, regional banks sold off significantly on Thursday.

Friday was much quieter, with regional bank earnings generally lacking any incremental fireworks, while consumer finance included improving auto credit (ALLY) and an acceleration in spend (AXP).

Price action within healthcare continues to reflect a re-risk in R&D/Innovation led segments but has been muted/mixed to the very early innings of the EPS season (JNJ, ABT). Updates around drug pricing deals with the administration have also seen dampened volatility. LLY weakness was in focus on the back of the Oval Office press conference, and there was intrigue around several of the selected drugs (REGN’s DB-OTO for deafness, RVMD’s RMC-6236 for pancreatic cancer, IRON’s Bitopertin for porphyria) where timelines for submissions were farther out, patient populations were likely more niche, and manufacturing requirements for some were more complex than initially anticipated.

Baskets

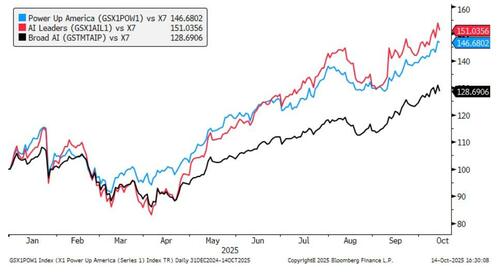

Power Up America (GSX1POW1) continues to be our favorite AI theme…

On the other hand, Low-Income Consumer Discretionary (GSXULOWD) is our favorite short theme at the moment…

…despite resilient consumer confidence, these stocks have begun to underperform the broader market amid tariff pressure, student loan payments, and inflation.

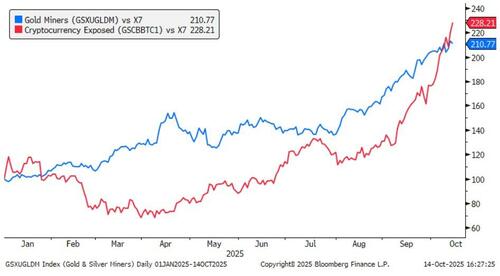

Debasement is a true theme in 2025: Gold, Silver, Bitcoin, Ethereum, and miners all doing quite well.

This is driven by the intersection of rising doubts on the Dollar trade as central banks globally buy Gold and other precious metals, the new administration’s interest in cryptocurrency and onshoring of materials it considers strategic for national security (GSXUNATL), as well as the aftermath of a significant surprise in Japan (see more details on USD/JPY impact after the LDP election).

Futures

Nasdaq’s funding premium to S&P, which traded at 93% 1-year rank just a week prior, cheapened to near parity on Oct 10th alongside renewed US-China trade tensions.

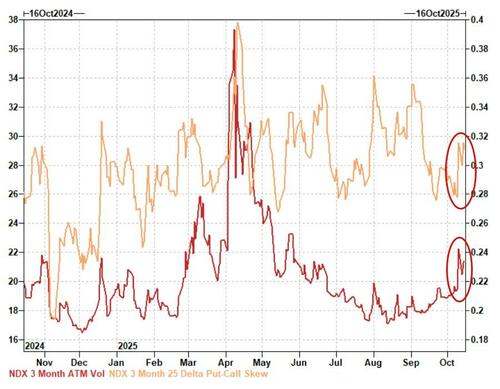

Significant futures liquidation and put demand were key drivers, as aggregate open interest shed -$5.1bn – one of the largest drops YTD excl. roll periods – and 3-month implied vol and normalized 25 delta put-call skew richened.

Price stabilized in subsequent sessions with some futures length returning.

Though the option surface still appears somewhat wary.

ETFs

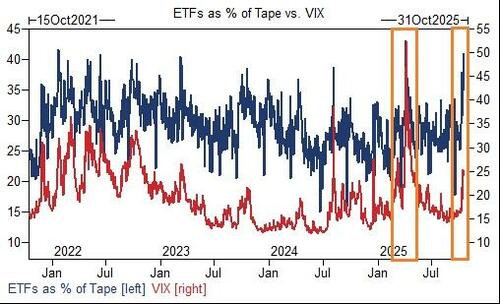

ETF volumes have exceeded 30% of the tape for 6 straight sessions, a streak which last occurred in April.

This is a key indicator that investors are rushing to macro products to quickly manage their delta or efficiently pivot their exposure.

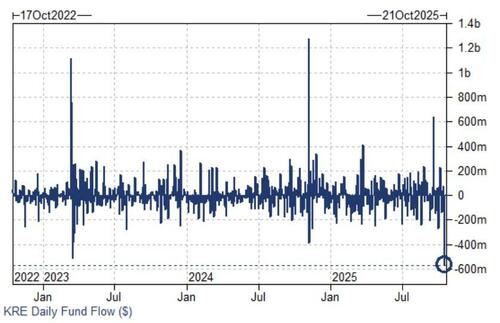

As regional banks sold off on Thurs, KRE faced over half a billion dollar in outflows – its largest redemption over the past few years that include the 2023 regional bank crisis.

Our desk flow skewed strongly better for sale in the product on Thurs followed by a retracement of supply on Fri (covers bid).

CTAs

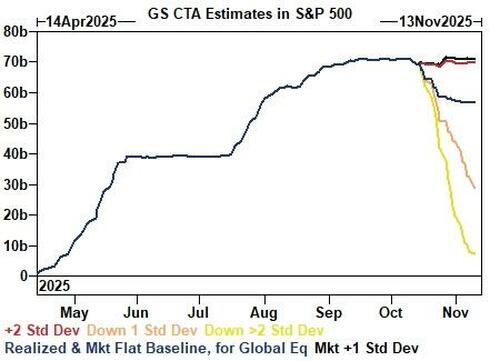

After Friday’s move, we have CTAs modeled to sell equities in every scenario over the next week and month, mostly concentrated in the US:

SPX CTA Flows:

Over the next 1 week:

- Flat tape: -$6bn to SELL (-$6.5bn out of SPX)

- Up 2 STD: -$1.5bn to SELL (-$2.3bn out of SPX)

- Down 2.5 STD: -$42bn to SELL (-$16bn out of SPX)

Over the next 1 month:

- Flat tape: -$16bn to SELL (-$14bn SPX)

- Up 2 STD: -$16bn to SELL (-$1bn SPX)

- Down 2.5 STD: -$232bn to SELL (-$64bn SPX)

Key pivot levels for SPX:

- Short term: 6579

- Med term: 6293

- Long term: 5877

Derivatives

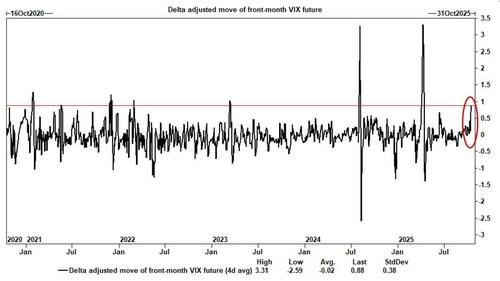

Equity vol and skew experienced a persistent, aggressive bid this week with SPX Nov fixed strike vols increasing by +3v (vs Monday’s close). On average this week leading up to Friday, the front month VIX future outperformed its beta to SPX by nearly a vol. Thursday was the standout – the front month VIX future outperformed its beta to SPX by 2.4v despite SPX closing down less than 1% – this has only occurred 4 other times in the last decade.

Client activity was less active in index and mainly focused on idiosyncratic risk this week: AI-exposed, regional bank credit concerns, healthcare headlines were the most active themes that drove options activity.

Call skew remains inverted in many names with AI-exposure, making 1×1 call spreads or ratios look attractive.

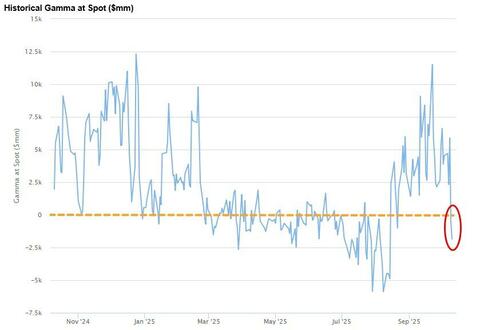

A record $3.4 trillion in options notional expired on Friday, which is expected to result in a lighter dealer gamma profile into next week.

And given that we went into the week with negative gamma…

Goldman estimates that dealers will get shorter on selloffs and longer on rallies near-term.