Tech vs. non profitable tech has crashed. Starting to look tempting…

Source: GS/Bloomberg

vs NDX

Big tech vs. NDX has also corrected over the past weeks. Can earnings come to rescue?

Source: GS/Bloomberg

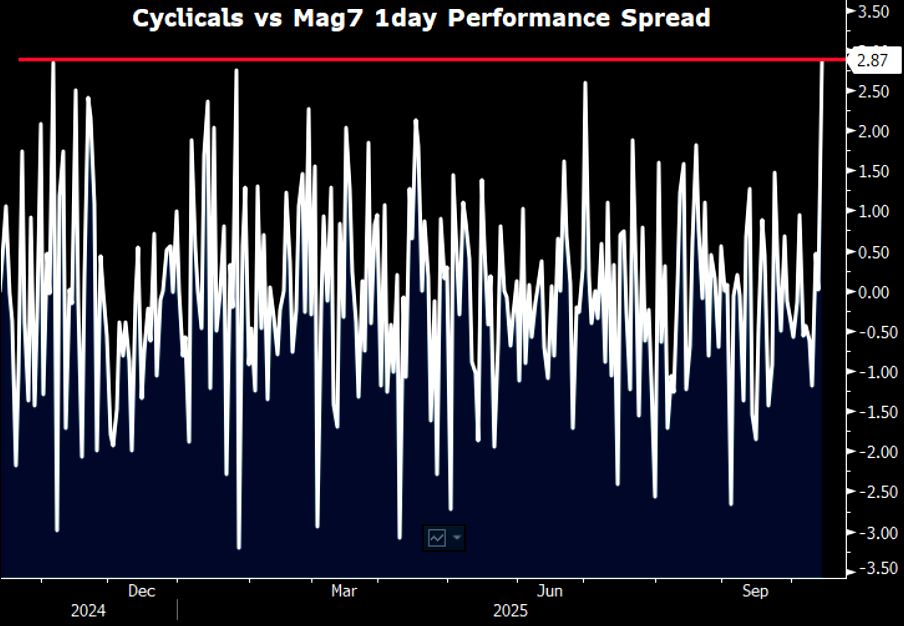

Cyclicals

Cyclicals vs. Mag 7 just had the best day in 2025.

Source: GS

The Charts

MSFT

MSFT continues trading inside the range that has been in place since July. Max boring. Note the 100 day comes in slightly lower.

Source: LSEG Workspace

Apple

Apple not far from the 50 day and the lower part of the channel. Big resistance at 260.

Source: LSEG Workspace

AMZN

King of boring. AMZN has been stuck in the same range since late May. Note we are down to the 200 day, but this is a stock stuck in non trend.

Source: LSEG Workspace

Google momentum remains strong. The steep trend line is slightly lower. 50 day comes in just below the $230 area. Resistance ATHs.

Source: LSEG Workspace

META

Basically at range lows, close to the bigger trend line as well as the 200 day coming in slightly lower. Big supports closing in for a rather boring name.

Source: LSEG Workspace

NVDA

King of stocks has basically done nothing since mid July. The bigger trend line as well as the 50 day come in right around these levels.

Source: LSEG Workspace

TSLA

TSLA has done little over the past month, basically trading without a short term trend, in the middle of the big trend channel. 50 day is lower.

Source: LSEG Workspace

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her