Commerzbank har analyseret genrejsningen af den kinesiske økonomi, og der er sket en hurtig forbedring. Der er store forskelle på, hvordan sektorer er blevet ramt. IT-sektoren og fødevaresektoren har ligefrem haft gavn af krisen. Boligmarkedet og industriproduktionen er kommet stærkt igen. Men generelt tager det tid, før økonomin er normaliseret.

Uddrag fra Commerzbank:

How virus hit the economy? A China’s case study

How would the Covid-19 hit the economy? A case study in China might shed more lights on

how different economic sectors could be influenced. After all, the services sector seems to

be hit harder and longer. All told, the recovery process is slow and fragile.

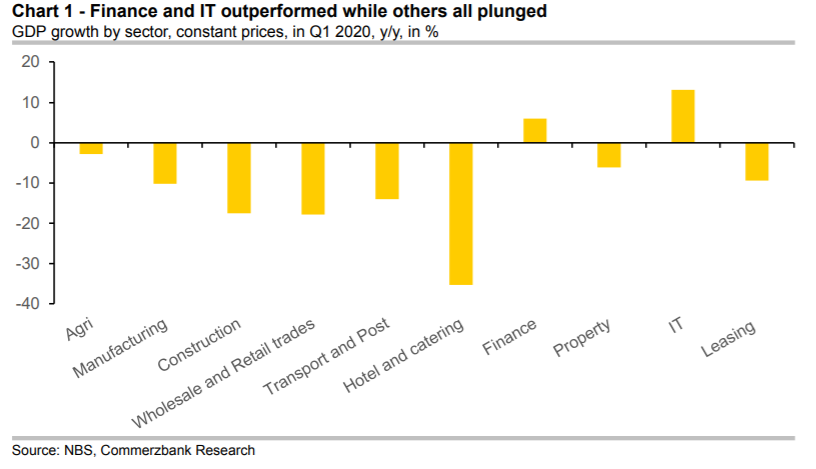

In the first place, let’s take a look at China’s Q1 GDP report by sector: There is clear spilt that while most sectors saw a plunge particularly in the “hotel and catering”, the finance and IT sector reported a positive annual growth in Q1 2020 (Chart 1).

The outperformance of IT is clearly due to the surge of online shopping and huge demand for cloud services as many people need to work from home.

Chart 1 – Finance and IT outperformed while others all plunged

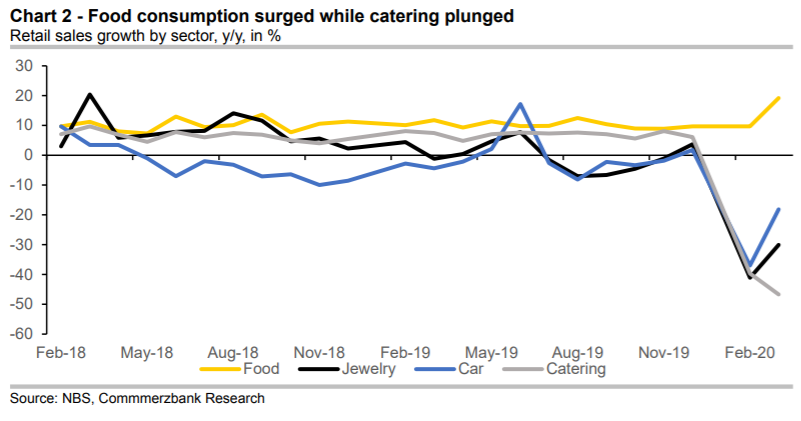

Then let’s dig a bit further into the consumption, which accounts for almost 60% of China’s economy. Notably, the food consumption grew sharply during the virus outbreak.

Comparably, the discretionary consumption, including cars, jewelry and catering, also reported at least 30% drop in the first three months of 2020 (Chart 2).

Following this logic, the developed regions, where the discretionary

consumption have taken a bigger part, should be hit harder by the Covid-19.

Chart 2 – Food consumption surged while catering plunged

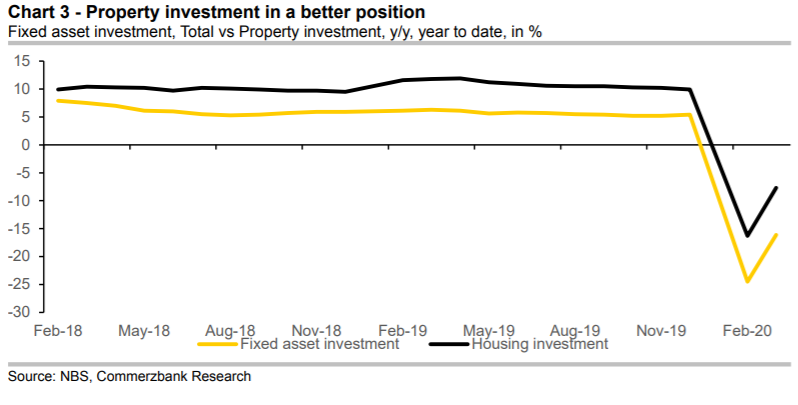

Property slowdown unlikely

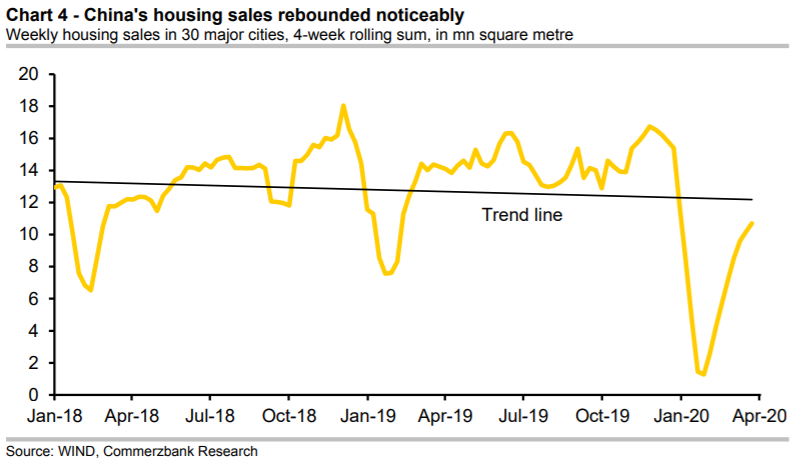

In the investment profile, property investment continues to outperform compared with the overall fixed asset investment (Chart 3), which suggests that the property demand is still holding up, as most of the housing investment is conducted by the non-state companies. In fact, the housing sales in China in early mid-April have more or less recovered (Chart 4, only slightly below the trend line), which also looks counterintuitive as the long-term investment (such as housing) should recover later.

This at least suggests that a property slowdown, as feared by many, is not an immediate risk for the already fragile economy.

Chart 3 – Property investment in a better position

Chart 4 – China’s housing sales rebounded noticeably

Manufacturing recovers faster

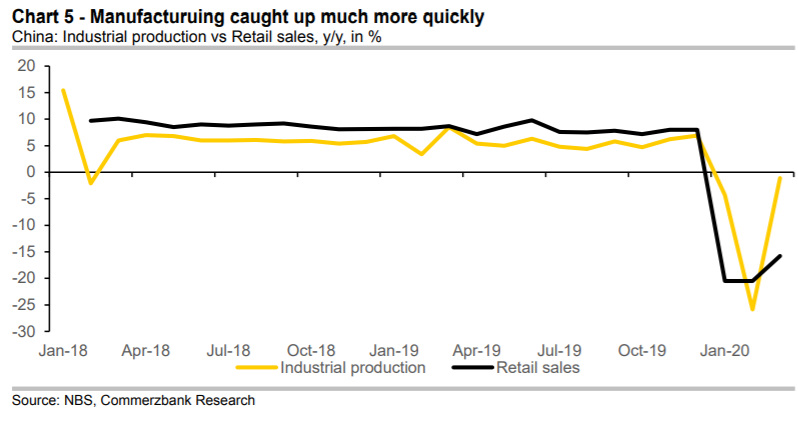

As China is gradually resumed economic operations after lifting the travel restrictions, the pace of activity recovery varies in different sectors. Manufacturing sector recovered much more rapidly than certain services industries, as the industrial production illustrates a V-shaped rebound while retail sales significantly lags behind (Chart 5).

On a seasonally adjusted basis, the industrial production climbed by 32% m/m in March, while retail sales only gained by 0.24% in the month.

Chart 5 – Manufacturing caught up much more quickly

Private sector lags behind

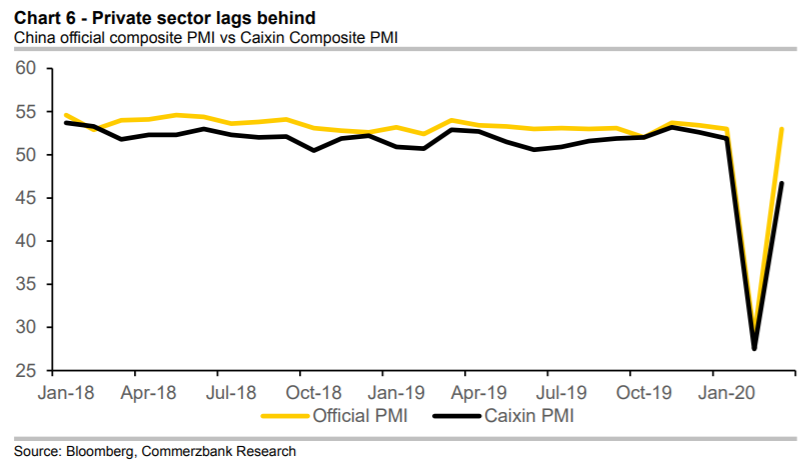

Last but not least, almost every indicator, including PMIs, industrial production and fixed asset investment, points to a much slower recovery path in the private companies compared with state firms. For instance, the official composite PMI climbed to the expansionary territory in March, but the Caixin PMI, a reflection of private sector performance, was still below 50 and 6.3 pts lower than the official PMI figure (Chart 6).

Chart 6 – Private sector lags behind

A full recovery still distant

These findings suggest that the Chinese economy has not fully recovered, with consumption, services and private sector still distant from a normal level. That said, the economy is unlikely to return to a normal track before Q3 2020.