Uddrag fra Zerohedge:

Where did the surprises come from? Well, developments in food and energy prices came with few surprises. Energy prices fell 5.0% M/M…

… with gasoline prices down 10.5%, and food prices rose 0.8%. Both numbers were in line with expectation.

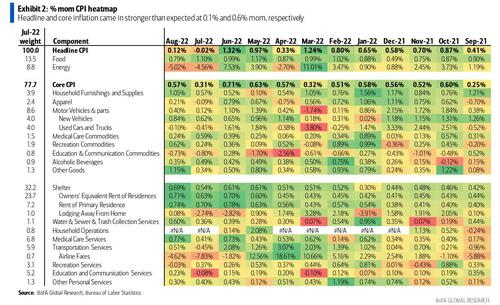

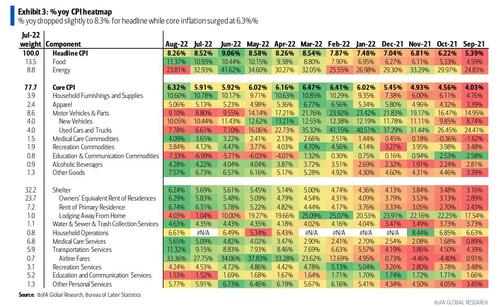

The prints for both core goods and core services were stronger than anticipated, however: core CPI rose 0.6% mom versus consensus expectation of a 0.3% rise, and the yoy rate rose to 6.3% from 5.9% previously, as consumers seemingly shifted purchases away from cheaper staples (lower gas prices) to discretionary goods, lifting prices in the process.

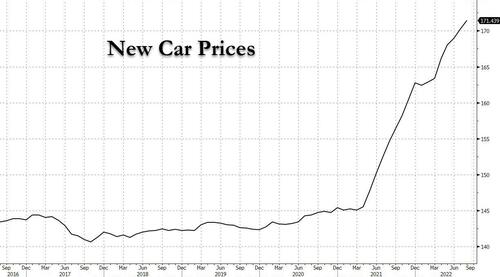

Core commodities prices surged 0.5% on gains in a number of categories including apparel (0.2%), new vehicles (0.8%), medical care commodities (0.2%), and alcoholic beverages (0.4%); most on Wall Street had expected a small decline in apparel and a smaller increase in new car prices which unexpectedly increased sharply.

At the same time, used car prices fell 0.1% on the month, though this decline was less than what most had forecasted, based on the large declines observed in wholesale prices recently.

Discussing the inflation report, BofA said that its “outlook for inflation includes moderation in the rate of increase in core goods prices through year-end and stable goods prices in 2023. This month, however, strength in core goods prices came as a surprise and suggests that further easing of supply chain pressures and inventory rebuilding, particularly in autos, is needed before good price pressures can moderate.”

Meanwhile core services also came in hotter than expected, at 0.6%: the surprise came in transportation services, which rose 0.5% against (vs an outlook for a 0.5% decline). An while airline fares did drop 4.6%, other transportation costs surprised to the high side.

Elsewhere, medical care services rose 0.8% on a 0.7% gain in hospital services,while health insurance soared by a whopping 24.3% Y/Y (and up 2.4% on the month) making some wonder “rhetorically” if Obamacare wasn’t quietly and retroactively renamed to the Unaffordable Care Act.

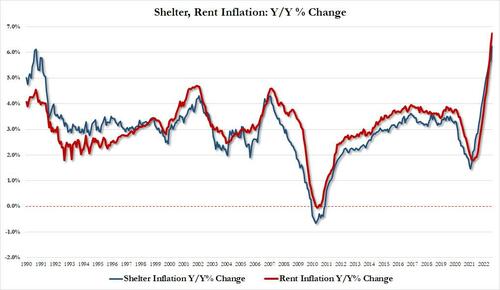

Elsewhere, shelter inflation rose another red hot 0.7%, while Rents (0.7%) and OER (0.7%) came roughly in line with expectations, and there is no sign this trendline is slowing any time soon (as we warned last year, once housing prices start going higher, very little can stop them).

Here are heatmaps for CPI on a M/M basis…

…. and Y/Y:

As BofA’s Michael Gapen writes, altogether the “solid” reading on core CPI and core goods prices, in particular, “suggests that underlying price pressures remain firm and suggests the Fed’s work is only just beginning. We continue to expect a 75bp rate hike in September and for a terminal funds rate of 4.0-4.25% early next year.” He adds that “solid employment gains alongside firm core inflation readings, in our view, point to additional monetary policy tightening and hard landing risks” and concludes that his “outlook for the US economy includes a mild downturn in 1H 2023 and a restoration of price stability in 2024.”

What about other Wall Street strategists? Below is a snapshot of kneejerk reactions across various Wall Street strategists and analysts courtesy of BBG:

Rob Dent, Nomura:

“We saw this tug of war between goods moderating and services remaining strong. This is not a tug of war. They both moved up. .. Right now I think the Fed is going to be looking at this with a lot of concern. There is no good news across this report.”

Guillermo Hernandez Sampere, head of trading at asset manager MPPM GmbH:

“It’s been a reality check. Markets were, again, ahead of themselves. The Federal Reserve will not step on the brakes before year end, so we can expect more rates hikes.”

James Athey, investment director at Abrdn:

“The recent bounce in equities looked incredibly ill-judged and premature. That CPI number is very strong relative to consensus and will not be what the Fed wanted to see at all. The chance of the pace of hikes slowing after September has receded somewhat as a result of this data but of course the reality is that what happens in Q1 2023 is still very much an open question.”

Sebastien Galy, senior macro strategist at Nordea Asset Management:

“The US equity market was simply overly optimistic, whereas European equity markets are far far cheaper which gives them some resilience faced with this type of shock.”

Mark Hamrick, senior economic analyst at Bankrate:

“The prices for necessities continue to fuel this fire, including shelter, food, and medical care. The substantial decline in gasoline prices is noteworthy but doesn’t address the overall problem with inflation.”

Ipek Ozkardeskaya, senior analyst at Swissquote Bank:

“Good news is, inflation in the US gives signs of easing. Bad news is, inflation in the US doesn’t ease as much as investors would like it to, and core inflation accelerated stronger than expected. Today’s figures are read as a guarantee of a 75bp hike next week, and probably 50bp or plus the month after.”

Danni Hewson, financial analyst at AJ Bell:

“Prices that have been bubbling over take time to cool and markets have been a little over enthusiastic in the last few days about the prospect of less aggressive rate hikes from the Fed in the near future. The reality is that whilst most things seem to be going in the right direction, there are still significant headwinds when it comes to things like electricity and gas supplies and simply keeping a roof over people’s heads. Realistically, there’s nothing in today’s figures to convince central bankers to switch tack and looking at rate hike probabilities 86% still expect a 75 basis point hike in the coming days.”

Esty Dwek, CIO at Flowbank SA:

“This probably comforts the Fed in hiking 75bp, but we are still nearing the end of its tightening cycle. However, they will stay higher for longer, so no pivot is coming. For markets, this is not as good as expected, but in any case, there was still a long way to go before markets & the Fed can feel that inflation will continue to fall.”