Præsident Donald Trump erkender, at USA ikke kan begynde at genåbne det nedlukkede erhvervsliv til påske. Det har været et urealistisk håb, skriver Nordea i en analyse af coronavirussen. Men væksten i nye tilfælde er begyndt at aftage.

Uddrag fra Nordea:

Daily corona update: Trump’s easter wishes are likely (too) optimistic

US cases are still doubling every 3-4 days, which is why a re-opening of the economy already by Easter looks a tad optimistic, even though Trump strongly advocates for it. Europe seems to be ahead of US on that curve.

Trump continues to advocate for a reopening of the US economy by Easter (social distancing warning has been prolonged until late April) and accuses the «lame-stream media» of exaggerating the Corona crisis. We still find such an Easter outlook too optimistic, even though Trumps hopes have been a part of fueling equity markets recently.

The best thing that could happen to markets and the economy, is if some sort of credible rule-based exit plan was announced both in US and Europe. At least some politicians have started talking about when, how and if the economies can reopen, even though it is not just around the corner. UKs top advisor currently projects a curfew lasting until the end of June for example.

One probably can’t “turn the economy back on” until there is i) enough protective gear for health workers, as well as enough of resources such as respirators, ii) masks for healthy/asymptomatic people to be able to safely go out in public and/or iii) gazillions of disinfectant.

It doesn’t matter if you want to turn on the economy before then – you will fail. The US is probably not quite there yet, at least if you listen to Governor Cuomo from New York. Remember that governors will decide when to reopen, not Donald Trump.

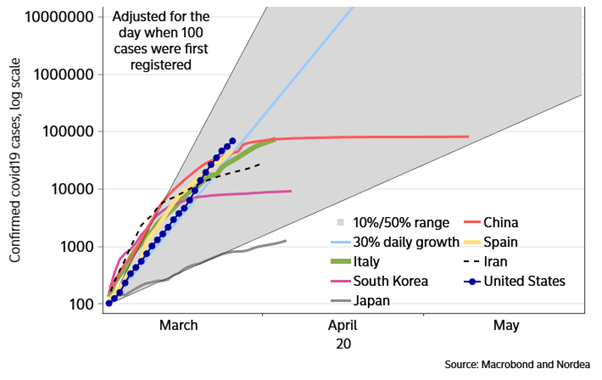

US cases are still doubling every 3-4 days, even though we will likely soon get a de-acceleration of cases, simply just due to logistical reasons (not tests enough). With a 30% daily growth the US will hit 1 mio cases already in the first half of April based on this model from Friday. The growth rate has already slowed a tad over the weekend.

Chart 1: US cases to hit 1 mio in the first half of April unless the curve fades

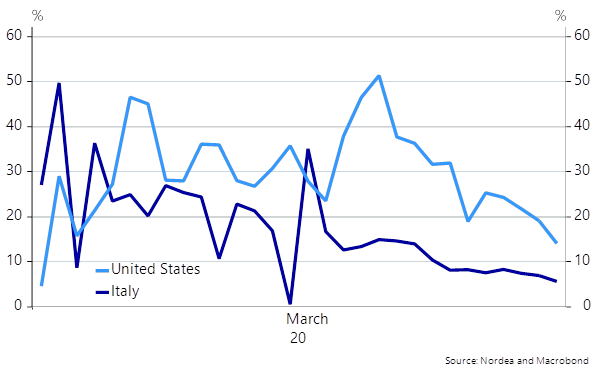

Daily US growth rates of new cases are now running sub 20%, which are the lowest numbers since early March. Italian growth rates are also slowly but surely edging towards 0%. The Italian virus spread is past its peak in momentum terms and other European countries will follow over the coming 7-10 days. That is good news.

Chart 2: Italian growth rates in cases are closing in on 0%, while US case growth rates are still high

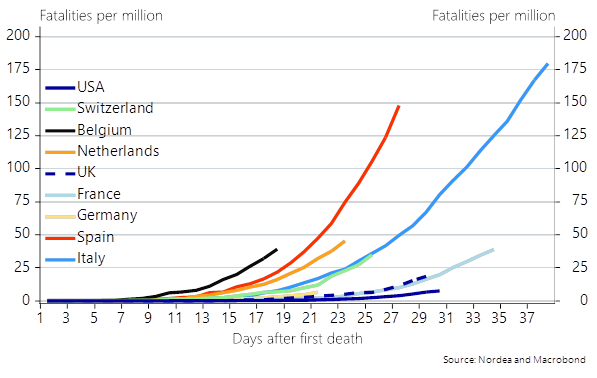

This also provides a glimse of hope for Spain, as growth rates in daily cases have also started to wane across Spain. The fatality data is though still sad reading and Spain is on a worse trajectory than Italy. So is Belgium and the Netherlands.

Chart 3: Spain, Belgium and the Netherlands on a worse trajectory than Italy

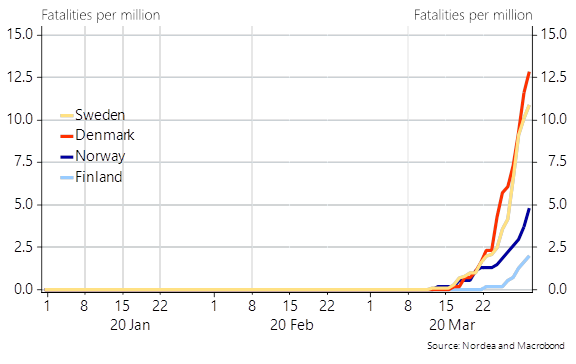

In Scandinavia, Denmark is still the country with most fatal outcomes per 1 million citizens, while Norways test-strategy (Norway has tested more than South Korea) seems to have been enough to dampen the curve already. It is still hard to tell the difference between Denmark and Sweden on fatality data, even though the two countries have taken very different approaches to the Corona virus. Swedish case data started to show some signs of acceleration late last week and into the weekend, which was not the case in the same way in Danish data.

Chart 4: Hard to tell the difference between Denmark and Sweden on fatality data

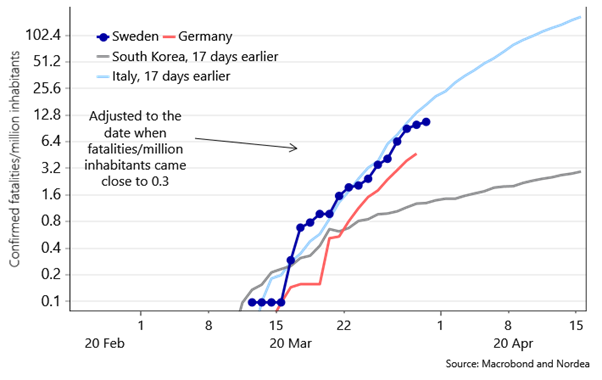

It is still too early to tell whether the fatality curves in e.g. Sweden and Denmark will wane (much) faster than for example the Italian one. There are already signs that the curves in Scandinavia will be more benign, but it is still a little too early to tell. So far there are no capacity issues in the Scandinavian health system, which bodes well ahead of the coming week or two.

Chart 5: Sweden almost on same path as Italy, but the trend has thankfully started to wane

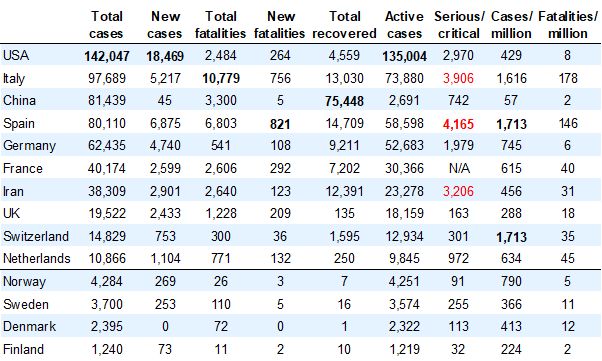

Here is the total overview of corona cases. The amount of critical cases in Spain have now surpassed the amount of cases in Italy, while e.g. Denmarks 113 critical cases are only accounting for roughly 10% of the total capacity of ICUs in Denmark.