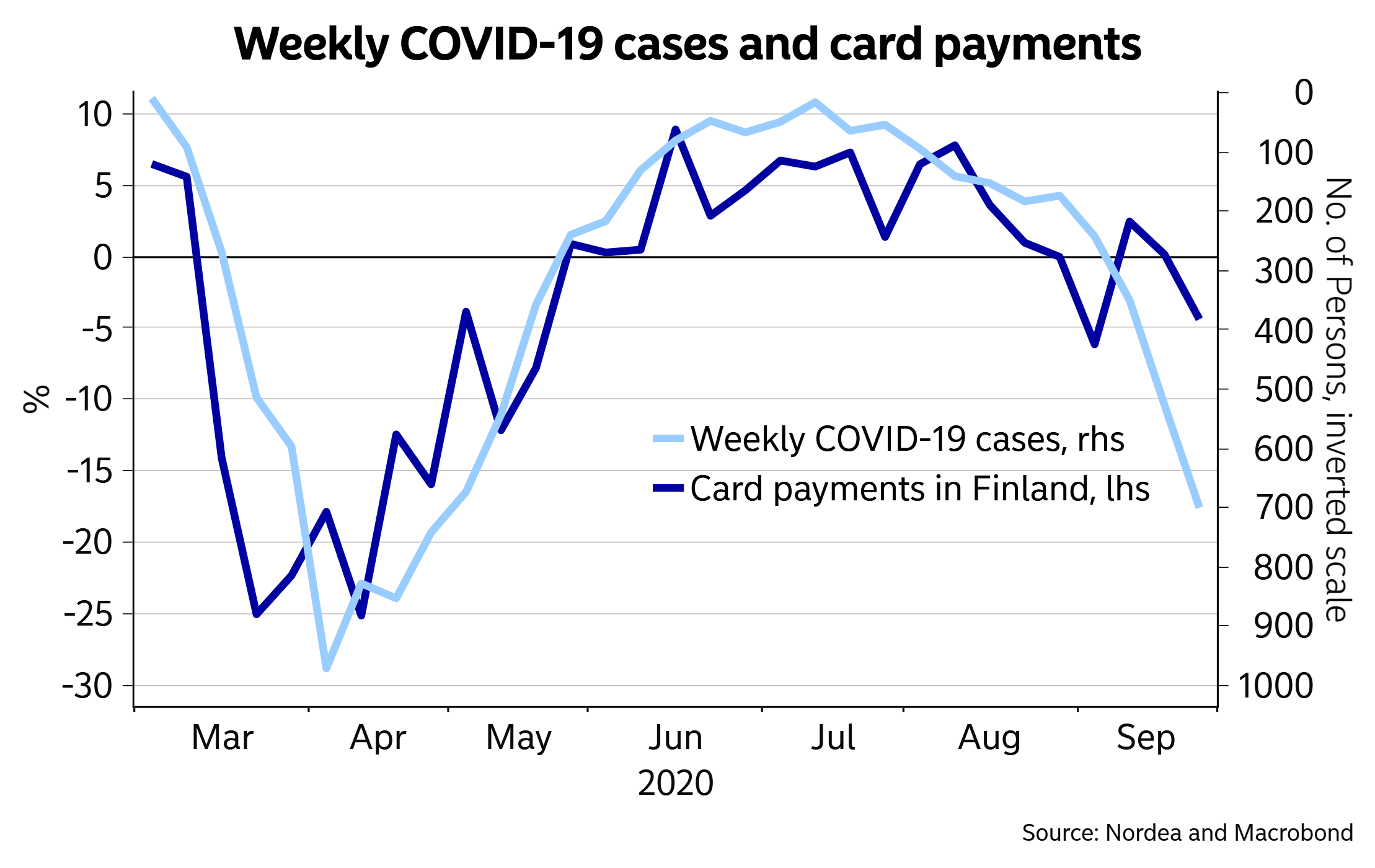

Nordeas corona-barometer for Finland viser, at forbrugersektorer ligger stabilt trods en stigning i corona-tilfældene, mens servicesektoren, f.eks. transport og underholdning, viser en markant nedgang på 20 pct. Barometret registrerer kortbetalingerne og giver dermed et tidligt og sikkert billede på service- og forbrugersektoren under coronakrisen.

Corona Barometer for Finland: A slight downturn in payment activity

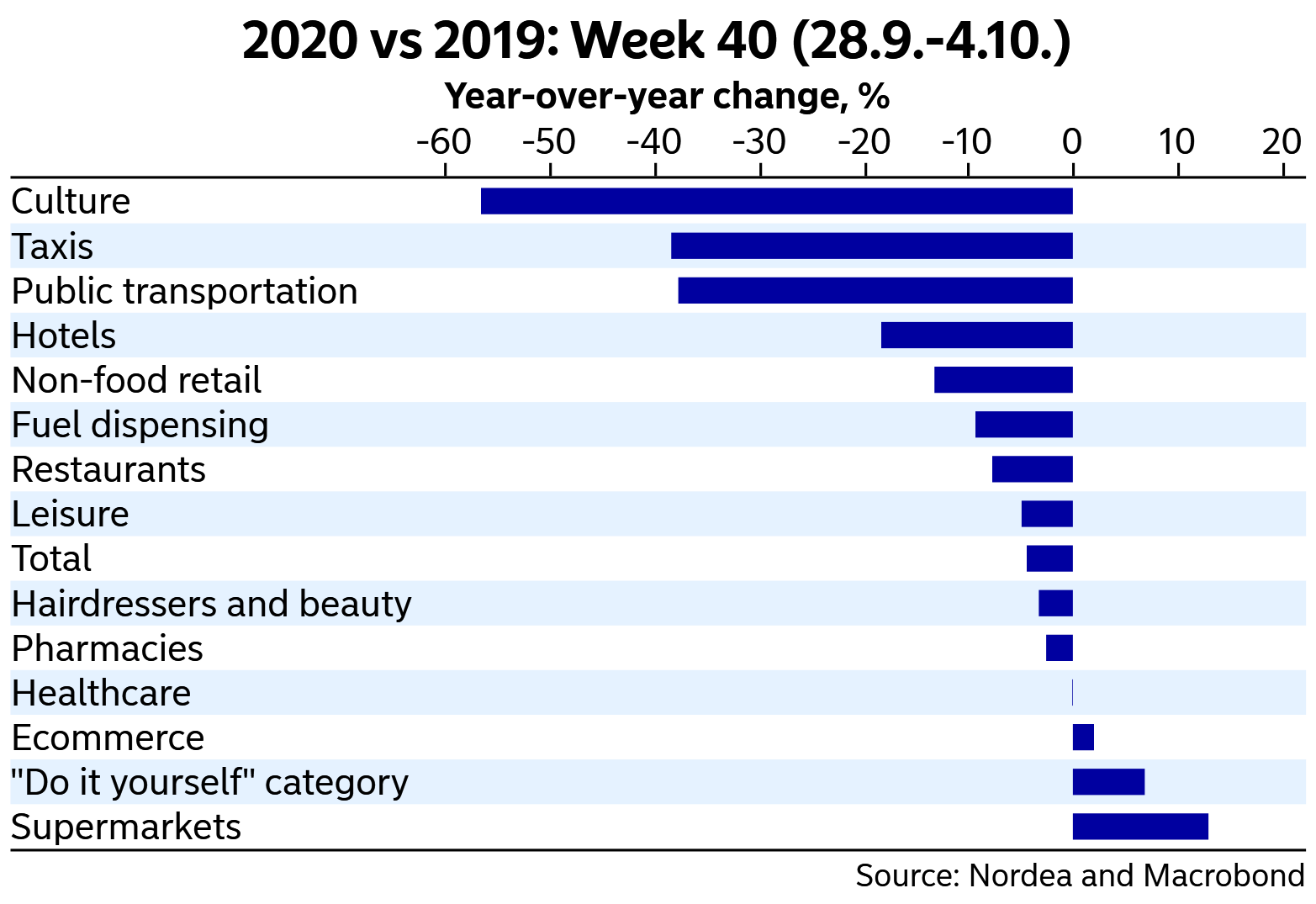

Total card payment volumes are slightly below last year’s levels. Service sector card payments are around 20% lower compared to the previous year. Goods sector activity stayed steady and close to last year’s levels.

In contrast to previous crises, consumers are at the forefront of the corona crisis. The negative shocks emanating from the virus have spread quickest to the service sector and consumption side and not on investments and manufacturing.

Therefore, in order to support policy makers and effectively analyse the real-time effects of the coronavirus on economic activity, it is essential to have on-demand data that gives an accurate representation of the consumption side of economic developments. Nordea’s card statistics are exceptional in allowing for this.

The main findings of this week’s Corona Barometer are: