Taiwan er et af de lande, der med størst succes har bekæmpet corona-virussen – med indgreb seks uger tidligere end Europa og USA – og det belønnes nu i økonomien. Eksporten steg i juli med 0,4 pct., og det var elektronikken, som drev udviklingen. Det hjemlige forbrug er dog lavt som følge af den forsigtighed, som coronakrisen medførte.

Taiwan exports start growing again

Taiwan’s exports grew by 0.4% year-on-year in July, breaking the negative year-on-year contraction since March, but the pattern of trade hasn’t changed.

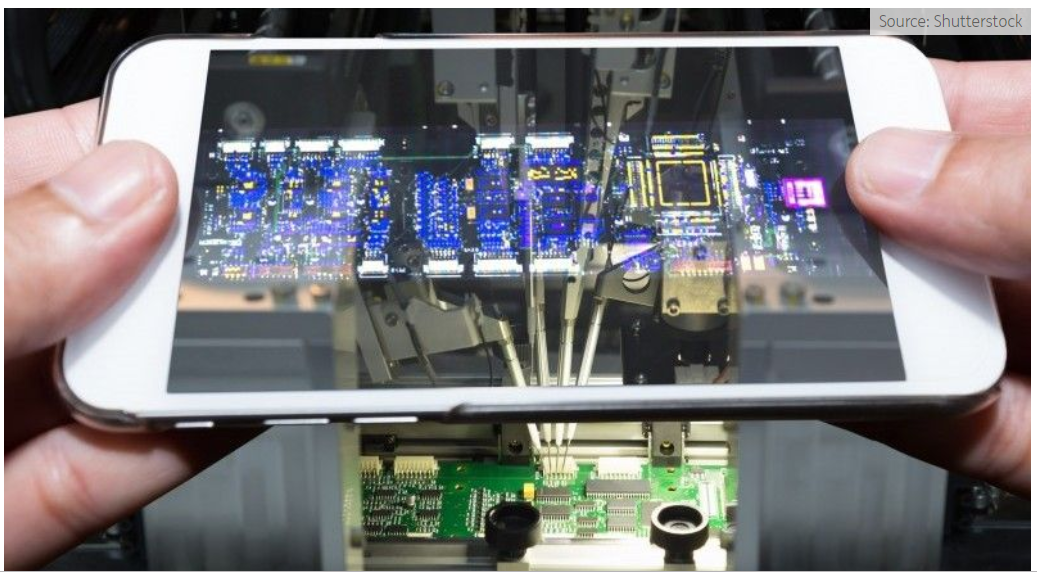

Taiwan still relies on electronics for export growth. Exports of electronic parts grew by 15.5%YoY and telecommunication products rose by 18.5%YoY while other items continued to contract. In particular, machinery exports shrank by 14.1%YoY.

This clearly shows that Taiwan’s exports have a narrow focus and will only see an overall improvement if the global economy continues to recover. But this may not be possible anytime soon given the emerging Covid-19 clusters as national lockdowns are relaxed.

Imports suggest weak domestic demand

On the flip side, Taiwan’s imports continue to shrink. Headline imports contracted by 6.8%YoY while consumer goods imports declined by 7.3%YoY and, notably, mobile handsets fell by a whopping 33.0%YoY.

The data reflects weak domestic demand and a partial recovery of the export sector. Only electronic producers have benefited from the recovery, but other manufacturers and exporters continue to suffer from the economic fallout of Covid-19.

Big trade surplus may not offset weak consumption factor in GDP

Taiwan’s trade surplus rose to US$5.37 bn, which was the highest since August 2019. Softer import growth compared to export growth will continue to contribute to a bigger trade surplus, which will support GDP growth slightly, but overall, we expect consumption growth to be too weak to be entirely offset by the increase in net exports in 3Q20.

Our GDP forecasts are -1.0%YoY and -1.5%YoY for 3Q20 and 4Q20, respectively, which will bring the full-year GDP forecast to -0.4%, after -0.7%YoY growth in 2Q20.