Corona-krisen synes at have toppet. Det viser statistikken over nye virus-tilfælde. Men der er også risikozoner, for i Japan og Singapore er antallet af virusramte steget kraftigt, omend fra et lavt niveau. Den udvikling har betydning for, hvordan landene vil genstarte økonomien.

Uddrag fra Nordea:

Daily Corona update: Global curve flattening but some potential new epicentres are emerging

The global case curve has flattened markedly, and the market has taken it as a conciliatory signal. Some new epicenters are potentially emerging, here amongst in Moscow. Furthermore, no one is yet able to explain how to open the borders again.

If you want to receive a copy of the Daily Corona update directly in your inbox, you can sign up via this link.

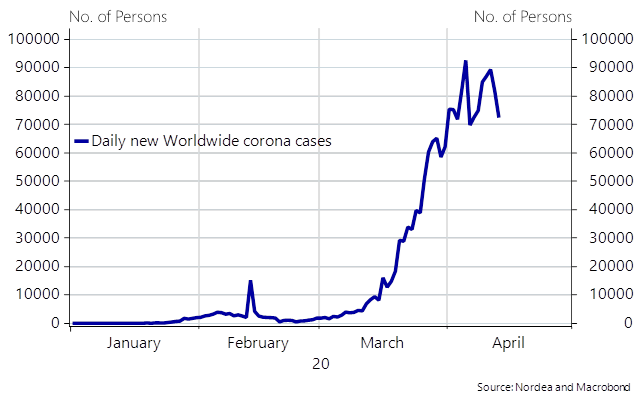

The global daily case curve has flattened, and it seems like we have peaked (at least for wave 1) already during Easter. This is a good sign and one of the reasons why markets have been in a better mood recently.

Chart 1: The global daily case curve has flattened. The peak is likely in already.

The big IF is still how to re-open economies without re-accelerating the case curve in a chaotic manner. Some countries including South Korea and Norway don’t even want any acceleration of the case curve at all (R0 to remain below 1). Good luck opening the borders to those two countries – it is simply impossible without 14 days of forced quarantine for everyone arriving.

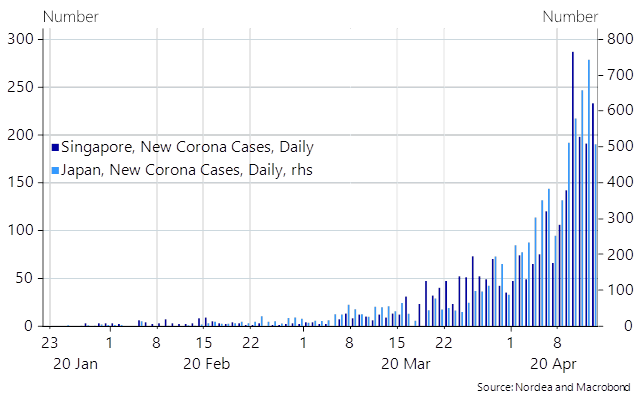

Over the past week authorities in eg Japan and Singapore have re-tightened the stance on Corona as a new case spike was seen. Singaporean authorities weren’t fully able to explain why, which means that case growth likely stems from people entering Singapore from the outside. This is a template of what other economies could be faced with, also here in the West. Case growth may start accelerating swiftly again, if the economies are not opened very carefully only. And the Singaporean case also reveals that it is unlikely that freedom of movement will be normalised (to 2019 levels) across borders the next couple of quarters. Borders will be closed for long. Another example is China, where imported cases have started to rise again.

Several media reports mentioned 51 imported Corona cases on a single Russia-Shanghai flight. If true, Russia seems to have a pretty nasty virus spread going. Russia is hence one to watch in the coming week given the stories of queuing ambulances outside of Moscow hospitals. Is a Lombardy-like scenario brewing (or even worse) in Russia?

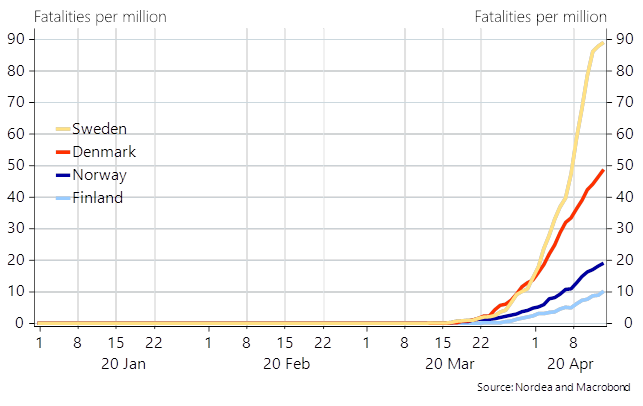

Chart 2: Case acceleration (imported cases mostly) seen in Singapore and Japan

It is hard to judge whether the Swedish “odd-one-out” strategy in the Corona fight has been a positive or a negative for Swedish markets. Over the past week, Sweden has received both bad and good press coverage internationally and it seems like the market remains undecided. On one hand the less draconian measures can remain in place for longer than measures seen in other countries (and the second wave may prove smaller than in comparable countries), as they come with a relatively lower cost (a SEK positive), but on the other hand the market will also have to price in a risk premium, if Sweden is eventually forced in to a very harsh lockdown as seen in Italy and Spain (SEK negative). Models from Imperial College London suggest that daily fatalities will accelerate further during this week in Sweden. Remember that weekend data is of almost no use in Sweden due to lagged reporting. So, don’t take comfort in the data seen Saturday and Sunday. Watch the data today and tomorrow instead.

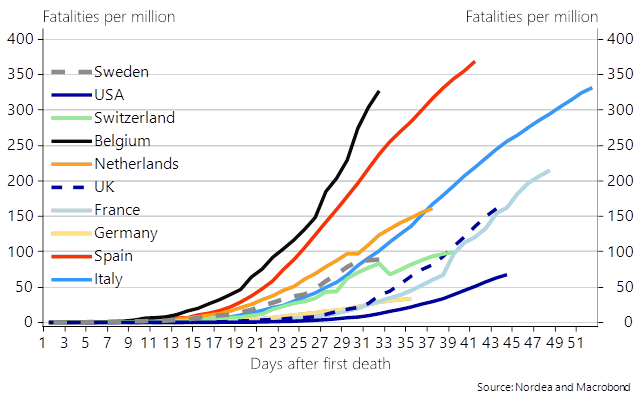

Chart 3: Sweden is (deliberately) on a more fatal path than surrounding countries

Sweden is still doing OK in a more international comparison, being placed right about in the middle of the park on European fatality numbers per capita. The Swedish curve is a little better than the Italian, but a little worse than Swiss currently. Denmark, Norway and Finland would rank among the absolute lowest on the below chart. Belgium is sadly turning into the worst Corona case globally (at least on official figures).

Chart 4: Fatalities per million in selected countries (one could argue to have deaths per capita on the x-axis as well)

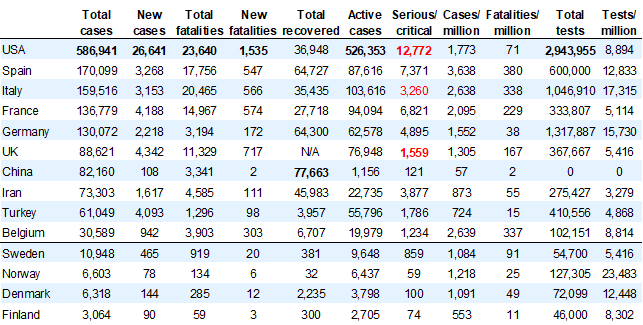

The US became the biggest global corona case on right about all measures during the Easter, but that is to be expected given the size of the population. The total corona overview is found below.