En Ifo-undersøgelse viser en stærk vækst i zombie-selskaber i Tyskland, ligesom der er sket et fald på næsten 10 pct. i konkurser under coronakrisen, fordi regeringen holder hånden under erhvervslivet under coronakrisen. En rundspørge blandt 120 økonomer viser, at 86 pct. venter en stigning i zombie-selskaber. Det er navnet på selskaber, som kun er i stand til at overleve, fordi de får statshjælp under coronakrisen, og fordi de nyder gavn af nul-renterne. Når krisen og hjælpepakkerne er overstået, ventes en dramatisk stigning i konkurser. 96 pct. af økonomerne venter flere konkurser.

Uddrag fra Ifo:

An Undesirable Side Effect of Coronavirus Measures: Zombies?

The German government has adopted far-reaching economic policy measures to mitigate the consequences of the coronavirus crisis. These appear to be working: in the second quarter of 2020, there were 8.86 percent fewer corporate insolvencies than in the same period last year despite the crisis (German Federal Statistical Office, 2020).

At the same time, however, the instruments adopted might help to artificially prolong the life of companies with unsustainable business models. These zombie companies cannot cover their current interest costs with their income in the medium term. The 31st Economists Panel addresses the emergence of zombie companies as a possible side effect of economic policy measures. A total of 120 economists took part in the survey.

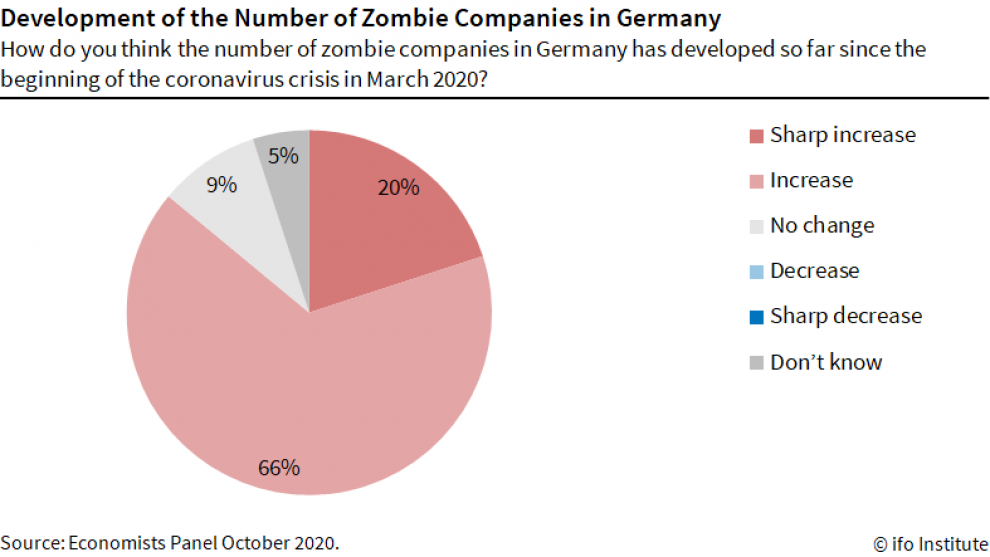

Economists See a Rise in Zombie Companies Since the Beginning of the Coronavirus Crisis

Of the participating economists, 86 percent think the number of zombie companies in Germany has risen since the beginning of the coronavirus crisis in March 2020, while 9 percent see no change from pre-crisis levels. None of the respondents assume that the number of zombie companies has declined since the beginning of the coronavirus crisis.

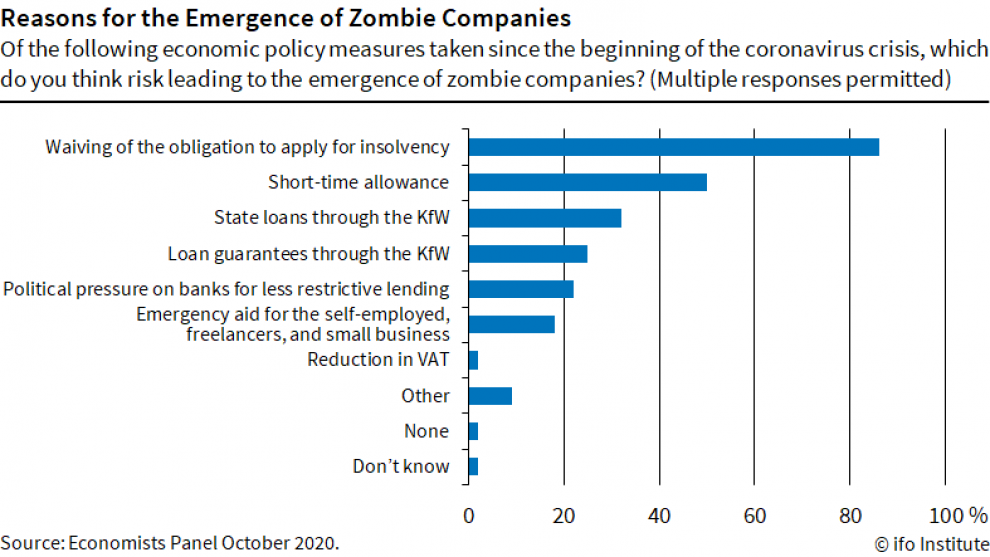

Waiving of the Obligation to Apply for Insolvency Could Be Responsible for the Emergence of Zombie Companies

Why do zombie companies emerge? The vast majority of economists (86 percent) share the opinion that the waiving of the obligation to file for insolvency is one reason.

Meanwhile, 50 percent think it is due to the recent extension of the short-time work allowance until the end of 2021. This is followed by state loans (32 percent) and guarantees (25 percent) from KfW as possible causes.

Some economists (22 percent) believe political pressure on banks for less restrictive lending also risks promoting the emergence of zombie companies. The same applies to emergency aid for the self-employed, freelancers, and small business (18 percent).

According to some of the participating economists, the ECB’s low interest rate policy is also responsible. In contrast, only a few respondents cited the reduction in VAT (2 percent) or economic policy measures (2 percent) as the cause of zombie companies.

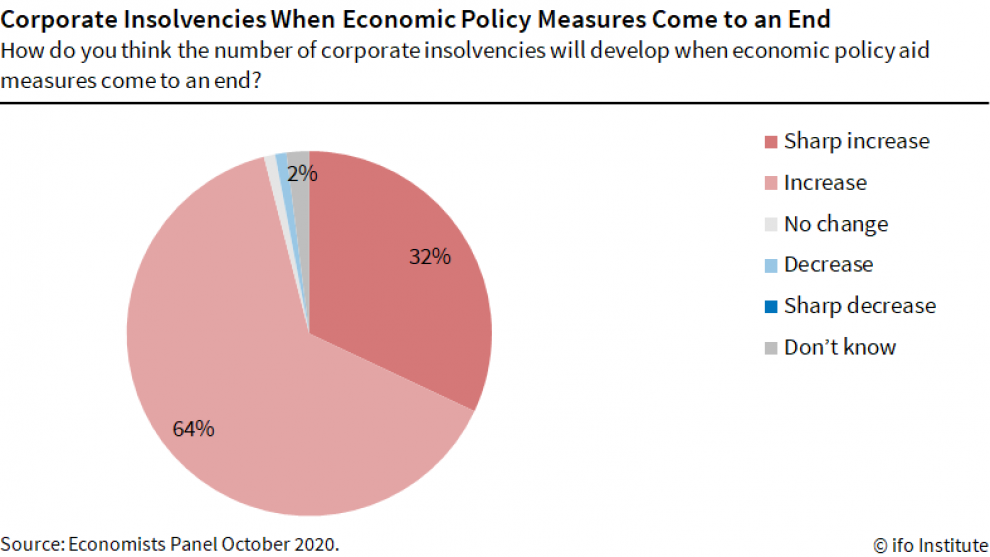

Economists Expect More Corporate Insolvencies in the Future

While the number of corporate insolvencies in Germany has in fact fallen since the beginning of the coronavirus crisis in March 2020, this trend will be reversed when economic policy aid measures come to an end.

This is the opinion of the overwhelming majority of the participating economists (96 percent); 32 percent even expect a sharp rise in corporate insolvencies once the aid measures end.