Uddrag fra Zerohedge

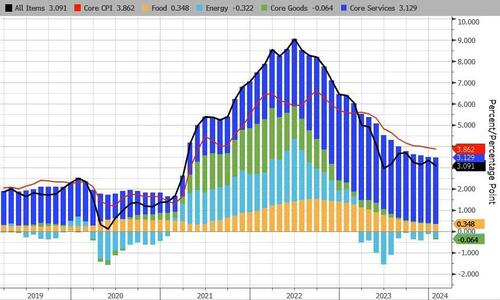

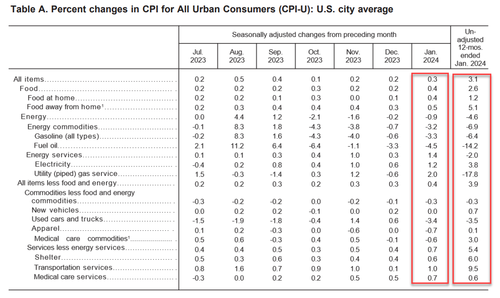

Expectations were for a big drop in the YoY consumer price index (from +3.4% to +2.9%) but instead it surprised to the upside (just as we warned) with a +3.1% YoY print for headline CPI (spoiling the sub-3% partiers). Consumer prices rose 0.3% MoM (more than the 0.2% exp) but the headline did decline from +3.4% to +3.1% YoY…

Source: Bloomberg

The 3-month annualized rate ticked up to 4% from 3.3%. The 6-month annualized rate was 3.7% (vs 3.2%). Not pretty.

Core CPI fell below 4.00% YoY for the first time since May 2021, but the +3.86% YoY print was hotter than the 3.7% exp (with prices rising 0.4% MoM – the biggest jump since April 2023)…

Source: Bloomberg

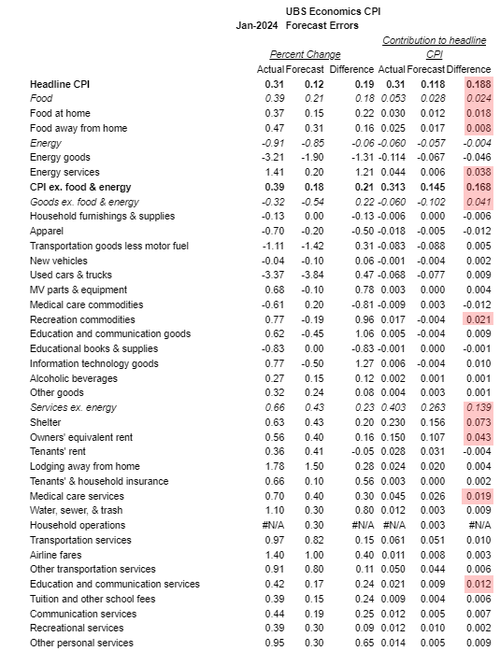

CPI Core: The index for all items less food and energy rose 0.4 percent in January.

- The shelter index increased 0.6 percent in January, and was the largest factor in the monthly increase in the index for all items less food and energy.

- The index for owners’ equivalent rent rose 0.6 percent over the month, while the index for rent increased 0.4 percent.

- The lodging away from home index increased 1.8 percent in January.

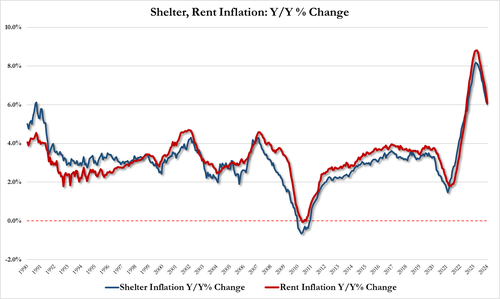

Shelter disinflation slowed…

- Rent inflation +6.09% YoY in Jan vs 6.47% in Dec

- Shelter Inflation +6.04% YoY in Jan vs 6.15% in Dec

- The motor vehicle insurance index increased 1.4 percent in January, and the recreation index rose 0.5 percent in January.

- Among other indexes that rose in January were communication, personal care, airline fares, and education.

- The medical care index rose 0.5 percent in January.

- The index for hospital services increased 1.6 percent over the month and the index for physicians’ services increased 0.6 percent.

- The prescription drugs index fell 0.8 percent in January.

- The index for used cars and trucks fell 3.4 percent in January.

- The index for new vehicles was unchanged in January.

- The apparel index also decreased, falling 0.7 percent over the month.

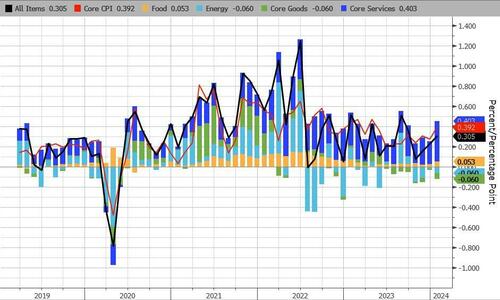

Core Service inflation picked up MoM…

..and accelerated YoY

Source: Bloomberg

Under the hood, food and Energy services costs jumped MoM along with transportation services…

Here’s the biggest component upside surprises…

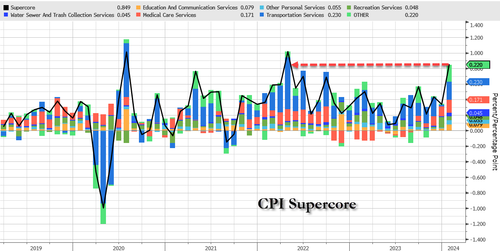

And one step deeper – the so-called SuperCore: Core CPI Services Ex-Shelter index – soared 0.7% MoM (the biggest jump since Sept 2022…

… driving the YoY change up to +4.4% – the hottest since May 2023….

Source: Bloomberg

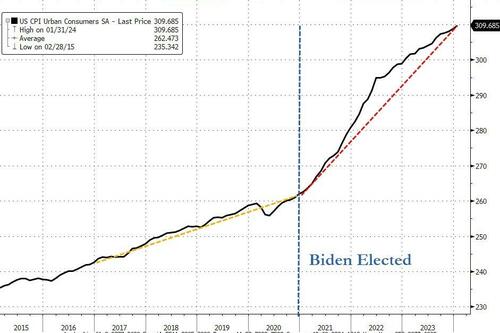

Finally, as a reminder, lower inflation does not mean lower prices.

Source: Bloomberg

The actual index of consumer prices hit a new record high this month – and is up over 18% since President Biden’s term began (it was up 8% over President Trump’s full four year term).

And it gets worse…

Source: Bloomberg