For at klare de stærkt stigende offentlige udgifter til bekæmpelsen af coronavirussen, lægger Nationalbanken op til en fordobling af udstedelsen af statsobligationer.

Uddrag fra Nordea:

Denmark: Higher government spending requires more funding

The Danish government Debt Management Office has decided to revise its strategy for 2020 in light of the coronavirus. More government bonds will be issued and the T-bill program will be expanded to fund higher government spending.

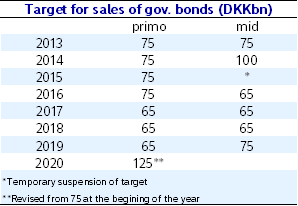

According to the announcement the Danish central bank will increase the target for government bond issuance by DKK 50bn to DKK 125bn. The decision is made “in light of the recent initiatives taken by the Danish Government to mitigate the consequences of COVID-19”. As a direct consequence of the increased issuance the opening of the new 30-year nominal bond is brought forward to 1 April, from the previously announced 5 May 2020. The revised target for sales of government bonds in 2020 is the highest in many years.

In addition the T-bill program will be expanded with two new T-bills. These T-bills will be added to the programme on 30 March 2020 with redemption 1 December 2020 and 1 March 2021. In the announcement from the Debt Management Office the previous target for outstanding T-bills at year-end has been removed. The reason for this is most likely that the T-bill programme mainly will be used to accommodate the temporary increase in liquidity requirements that follows the government’s decision to postpone VAT payments and payments of corporate tax.

Large increase in issuance

In our view the decision to increase the issuance of government bonds comes as a natural consequence of the recent initiatives taken by the Danish government in an attempt to minimize the adverse effects of the coronavirus. However, the magnitude of the increase in government bond issuance is noteworthy. According to the Danish Ministry of Finance the actions taken so far will increase government expenditures by DKK 5.3bn. In light of this, the decision to increase government funding by DKK 50bn indicates that the total expenditures could be much higher already this year. Some of these additional public expenditures will most like come from higher expenses to unemployment benefits and some will be caused by less tax revenues from both households and companies.

Strong public finances

According to our forecast made before the outbreak of coronavirus Danish public balances would end 2020 with a small surplus. However if revenue shrinks and expenditure increases by a total of DKK 50bn this would “only” imply a EMU-deficit of around 2.1% of GDP – well within the Maastricht criteria. Therefore, the strong public finances provides the Danish government with a high degree of freedom to fight the adverse effects of the coronavirus. For now the main focus have been on supporting companies with liquidity but if the downturn continues, this could soon be turned in to a broader fiscal easing.