Det danske finansieringsbehov er steget med 200 mia. kr., vurderer Nordea, og det har fået Nationalbanken til at ændre sin finansieringsstrategi. Nationalbanken har på forhånd sikret tilstrækkelig finansiering.

Uddrag fra Nordea:

Denmark: Financing requirements swell – but so do funding sources

New estimates points to an increase in financing requirement of more than DKK 200bn in just five months. However, the target for Danish government bond issuance will most likely be kept unchanged as the central bank has been prefunding.

Government finances in Denmark have been hit by the “perfect storm”. The outbreak of the coronavirus and the ensuing lockdown have sharply reduced government revenues while the extensive government aid packages and the strong rise in unemployment benefit payouts have increased government expenditure.

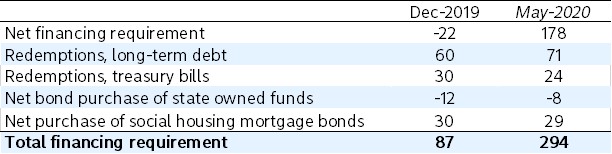

In total this has according to new estimates from the Danish Ministry of Finance caused net financing requirements to increase by DKK 200bn compared to the estimates at the beginning of the year.

Table 1: Total financing requirement for 2020 (DKKbn)

Danish central bank gets funding from abroad

The massive increase in the net financing requirement has already forced the Danish central bank to change its funding strategy markedly. On 15 April the central bank made public that it has started to use issuance in foreign currency as an actual funding source. Previously foreign currency loans were only used to adjust the size of the foreign currency reserves. According to recent statistics, the central bank raised more than DKK 80bn in April alone through issuance in the commercial paper programme.

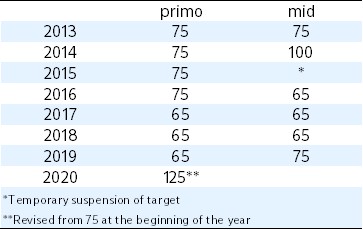

In addition to the funding from abroad the central bank has increased the target for Danish government bond issuance by DKK 50bn to DKK 125bn and the previous target for outstanding T-bills at year-end has been removed.

Table 2: Target for sales of gov. bonds (DKKbn)

The central bank has been prefunding

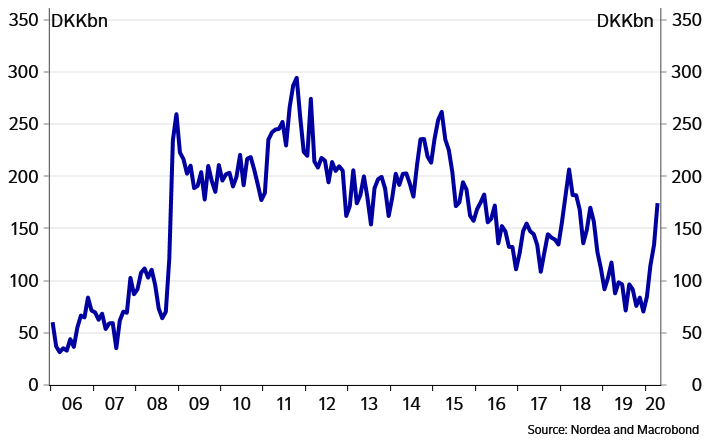

In our view these unprecedented steps has helped to restore confidence in the Danish central bank’s ability to provide the necessary funding. At end-April the governments account at the central bank stood at DKK 174bn, which is the highest deposit in almost two years. Part of this sharp increase in the government’s account is most likely caused by delays in the disbursement of subsidies to companies.

However, in our view, the increase in the deposit is also a way for the Danish central bank to underpin their credibility in obtaining the necessary funding in a period where governments all over the world are dealing with huge public deficits.

Chart 1: Government deposit

Therefore, despite the sharp increase in the total financing requirement we do not expect the Danish central bank to further increase the target for issuance of government bonds in the upcoming strategy review.