Danske Bank har offentliggjort sin årlige FX Top Trades. Banken vurderer, at selv om der bliver økonomisk fremgang i 2021, så kommer væksten ned i gear, og det skyldes også, at Kina ikke bliver så stor en drivkraft som hidtil. Det får indvirkning på valutaerne.

FX Top Trades for 2021

It is that time of year again… and we present our FX Top Trades for 2021.

As a foundation for all trades, we present five themes, which we think will set the agenda for the FX market in the year to come (Table 1).

These themes in turn serve to motivate the individual trades we adopt. We include both spot/forward and option strategies with the latter allowing us to express longer-term views if/when e.g. short-term risks may be in the opposite direction.

While the macro outlook is still fragile in Europe and the US over the winter due to a high

number of COVID-19 cases and restrictions, we think the global macro outlook for 2021

is brighter, as the vaccination process is set to start, probably in the second half of this

month.

We expect restrictions to be eased in spring aided by the seasonal weather and a

vaccine means that restrictions will not need to be re-imposed next autumn. The Chinese

economy has recovered strongly from the COVID-19 crisis, as stimulus, catch-up from lost

production and a lift to exports boosted demand.

We project growth will shift down a gear in 2021 towards cruising speed and that China will thus be less of a global growth booster in 2021. For more details see The Big Picture: Darkest before dawn, 1 December.

In an FX context, we find it essential to distinguish strategic and tactical trends based on

the general investment environment, see (Theme #1).

Strategic drifts are inherently more long term in nature and often driven by risk-adjusted real interest rates, unit labour costs and/or terms of trade, as well as net international investment positions.

Meanwhile, a range of more FX-relevant cycles are worth considering.

Oil prices are not yet in for a structural slump even if the focus on renewables increases ((Theme #2).

The USD cycle has yet to turn (Theme #3).

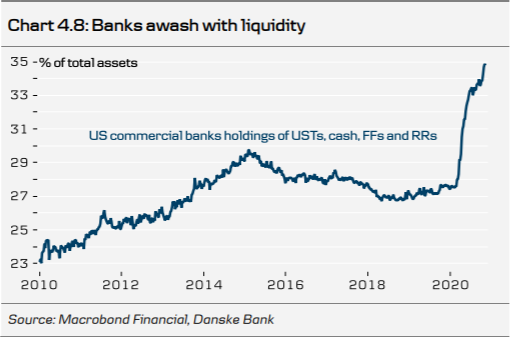

The USD money-market lull may come to an end in 2021 as the demand for USD liquidity remains even if crisis measures run off (Theme #4).

Finally, the Chinese cycle may peak in H1 as the structural need for deleveraging manifests itself yet again (Theme #5).

We distinguish between tactical Q1 2021 views (e.g. bullish NOK and GBP)

and more structural 3M+ views to play out later in 2021 (e.g. EUR/USD, USD/SEK and

EUR/HUF). Further, our baseline scenario aside, we stress that a key wildcard is whether

global reflation will finally arrive next year – Happy FX trading 2021!