Italien er kommet i centrum i corona-epidemien, og det er så alvorligt for italiensk økonomi, at det er nødvendigt med hjælp fra EU, vurderer Danske Bank.

Uddrag fra Danske Bank:

11.3.2020

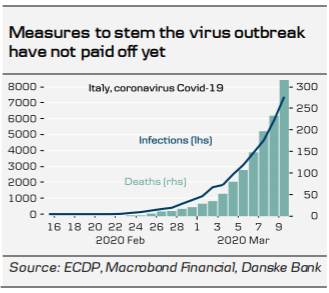

Yet again Italy has found itself at the epicentre of a crisis, battling with the most severe outbreak of coronavirus globally after China. Since the first COVID-19 infections where registered on 22 February, measures to contain the virus have been successively stepped up by the authorities and culminated in nationwide school closures and travel bans on 10 March. With the movements of some 60 million people severely restricted for an unknown period of time and companies, both public and private, encouraged to put their staff on leave, Italy’s coronavirus crisis is rapidly turning from a humanitarian one into an economic one as well. We expect Italian growth to see a big hit in H1 that risks pushing the debt to GDP ratio above 140% by the end of the year.

We think that the EU will be ready to assist Italy to overcome the dire humanitarian and economic situation in the country through leniency with budget and state aid rules. An ESM programme also remains an option of last resort.

The Italian banking sector is likely to be impacted by the COVID-19 crisis in a number of ways, including loan loss provisioning and lower profitability.

We have already seen a significant spread widening between Italy and core-EU and debt sustainability concerns have returned to the markets. However, we do not expect Italy to run into major funding problems even if the budget deficit is increased, as long as this does not lead to a downgrade of the Italian rating.